Takeout Market "Three-Way Battle": Thin-Wall Injection Molding Rides the Wind to Rise

As of June, the total daily order volume of the three major platforms Meituan, Ele.me, and JD.com has exceeded 250 million orders, more than tripling compared to pre-war levels. The rapid development of the food delivery market has led to a swift increase in demand for thin-wall injection molding of polypropylene food container materials and milk tea cup materials.

In 2025, China's food delivery market sees fierce competition among the three major platforms—JD.com, Meituan, and Ele.me—centered on market share, user subsidies, and rider rights. Price wars, subsidy battles, and service competitions are taking place one after another. After several consecutive months of intense rivalry, China's food delivery market is experiencing explosive growth.

Data Source: Publicly available social information

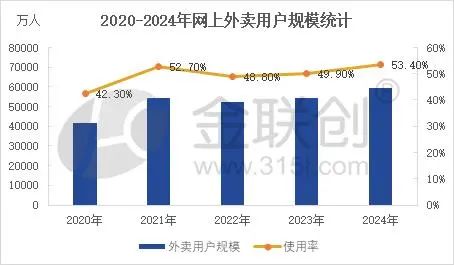

Currently, China's food delivery market is demonstrating robust growth momentum and vast market prospects. By 2024, the number of online food delivery users in China has reached 592 million, with a usage rate rising to 53.40%. The market size of China's food delivery industry has reached 1.5 trillion yuan. In February 2025, a significant change occurred in the industry as the e-commerce giant JD.com officially announced its entry into the food delivery market. By June, the total number of orders from the three major platforms—Meituan, Ele.me, and JD.com—exceeded 250 million orders per day, expanding over two times compared to before the competition. The rapid development of the food delivery market has led to a swift increase in the demand for thin-wall injection molding of polypropylene meal box materials and milk tea cup materials.

Data Source: JLC Network Technology

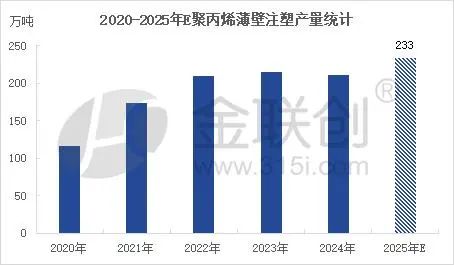

Polypropylene, as a demand-oriented product, has seen its thin-walled injection molding production rapidly increase, driven by market demand. As shown in the figure, the compound growth rate of thin-walled injection molding supply reached as high as 22% from 2020 to 2022, quickly rising from 1.16 million tons in 2020 to 2.1 million tons. After 2022, as the food delivery market entered a stable phase, the production of thin-walled injection molding products remained at a high level, fluctuating. Since 2025, the food delivery market has entered another explosive growth phase, with thin-walled injection molding production reaching 1.17 million tons in the first half of the year. It is expected that the annual production of thin-walled injection molding will exceed 2.3 million tons, with a double-digit growth rate within the year.

Data source: Jinlianchuang

Supported by strong demand and a phase of tightened supply, the thin-wall injection molding market has performed impressively. In July, the domestic polypropylene market as a whole showed a fluctuating downward trend. Although there was a slight rebound at the end of the month driven by "anti-involution" market sentiment, trading in the general-purpose material market remained weak. In contrast, thin-wall injection molding demonstrated strong resistance to price declines. On one hand, there was robust rigid demand for summer items such as high-temperature milk tea cups and lunch boxes. Additionally, the "business war" among food delivery platforms generated more orders, further boosting the summer thin-wall injection molding market. On the other hand, during this period, maintenance shutdowns at Yuheng Energy Phase I and Hengli Petrochemical’s STPP units led to reduced domestic supply of thin-wall injection molding materials. This short-term supply-demand mismatch supported the high prices in the thin-wall injection molding market. As of July 29, mainstream domestic raffia prices were at 7,000-7,200 yuan/ton, while mainstream thin-wall injection molding prices were at 7,300-7,450 yuan/ton, with the price spread maintaining around 350 yuan/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track