Surge by 5600 RMB! Led by BASF and Kingfa! These products hit historical highs

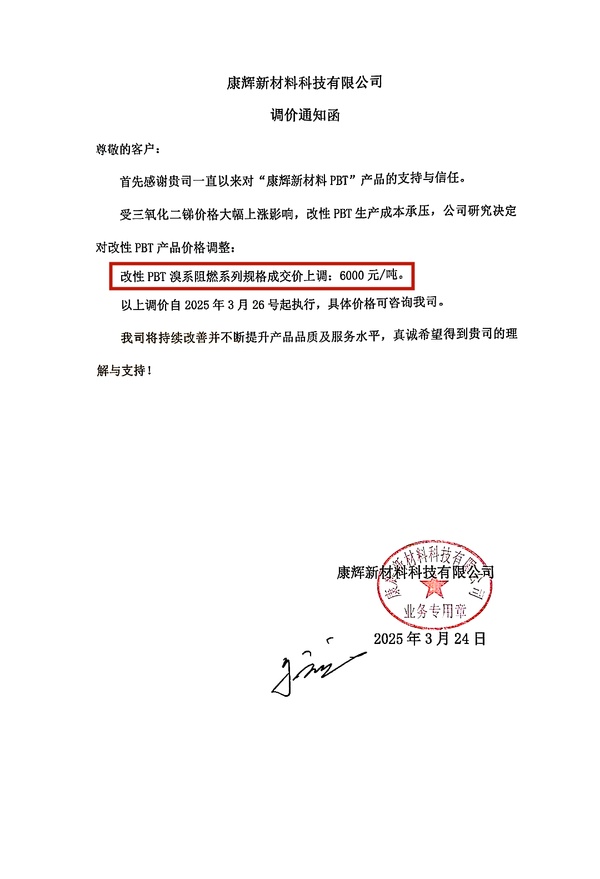

March 24th,domestic giant Kanghui has initiated a price increase mode. Kanghui announces the modificationThe transaction price of the PBT bromine-based flame retardant series specifications has been increased by 6000 yuan/ton. Kanghui also mentioned in the price increase notice that the significant rise in raw material costs is the main reason for this price hike.

Since 2025, the plastic industry has ushered in a new round of price increases, with many giant companies issuing price increase notices, involving various types of plastics and related raw material products.Below, Special Plastics View takes everyone to review the recent price increase events.

oneplastic industry price hike wave approaching

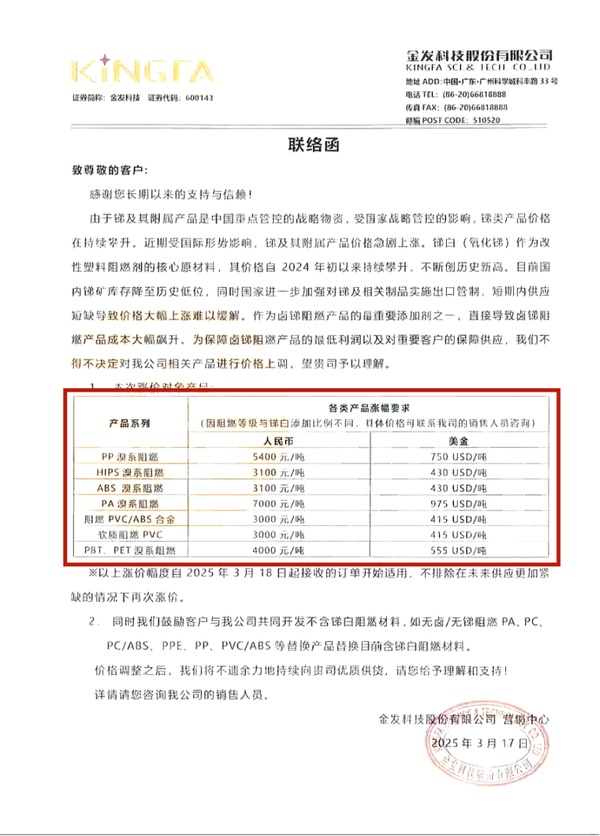

March 17th,Golden Technologyannounce price increaseThe company stated that due to the impact of the international situation, the prices of antimony and its related products have sharply increased, with domestic antimony ore inventories falling to historically low levels. At the same time, the country has further strengthened export controls on antimony and related products. Due to the difficulty in alleviating the supply shortage, Kingfa Sci. & Tech. Co. has decided to increase the prices of its related products, with the price increase幅度自 It appears there was a part at the end ("涨价幅度自") that wasn't fully provided in the original text. If you could provide the complete sentence, I'd be happy to translate it.Orders received starting from March 18 will be subject to this, and the possibility of further price increases in the future is not ruled out.

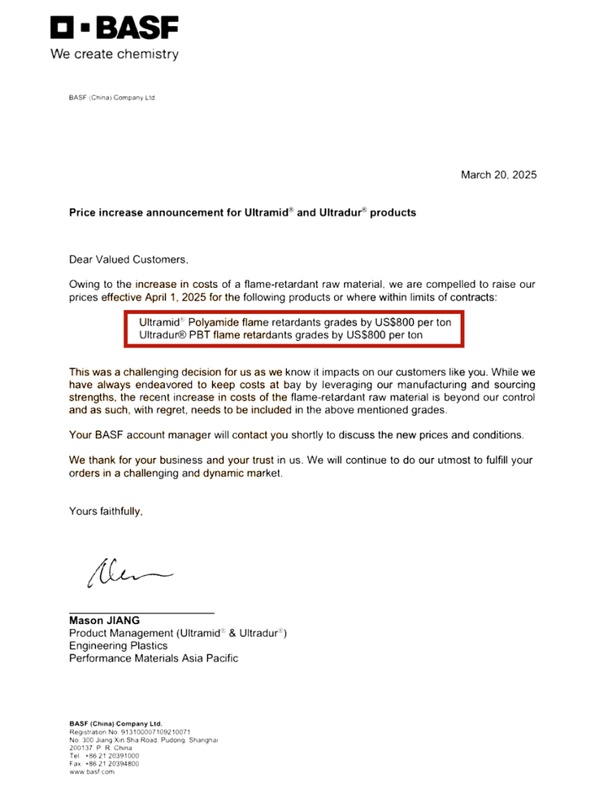

March 20th,BASF issues significant price increase noticeDue to the continuous rise in the cost of flame-retardant raw materials, BASF announces that as ofStarting from April 1, the prices of some products or products within the scope of contracts will be increased, with the price of PBT flame-retardant grade products being raised by $800 per ton (approximately equal to RMB 5799/ton). This is the second price increase notice issued by BASF within a month, with previous increases for products such as PA and PBT reaching up to RMB 5600/ton. The price hike is mainly due to the rapid increase in the cost of flame-retardant raw materials.

Multiple titanium dioxide companies announce price increases, with the leading titanium dioxide company Longbai Group issuing its third price increase notice of the year.

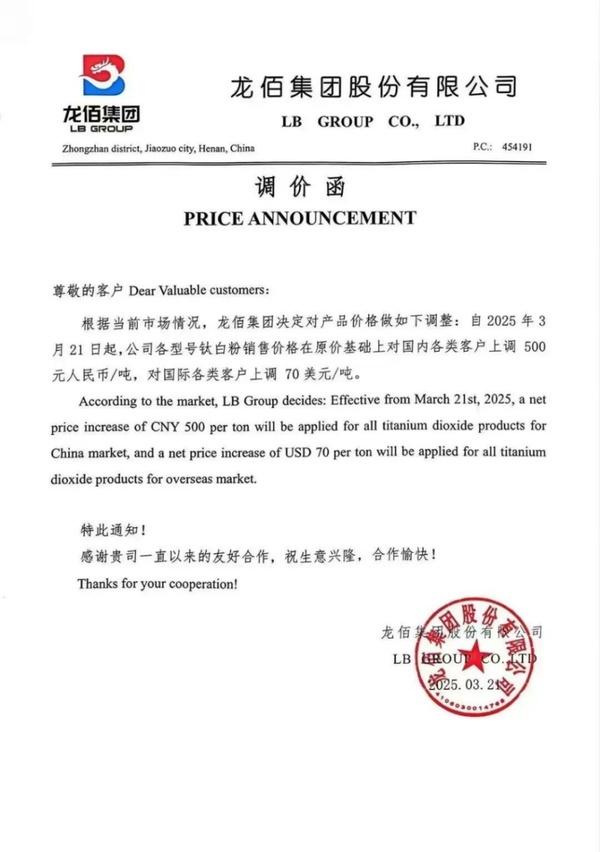

On March 21, Lomon Billions Group Co., Ltd. issued a price adjustment notice stating that, based on the current market situation, Lomon Billions Group has decided to make the following adjustments to product prices: Starting from March 21, 2025, the sales price of all types of titanium dioxide will be increased by 500 RMB/ton for all domestic customers and by 70 USD/ton for all international customers, based on the original price.

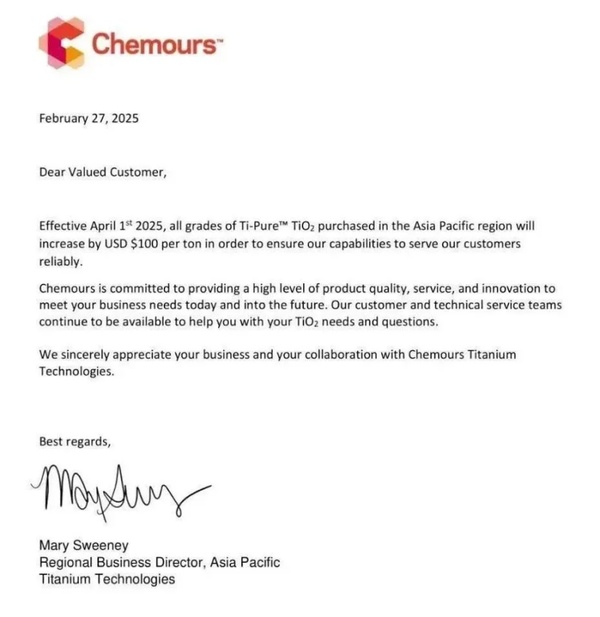

March 24thtitanium dioxide giantChemours also joins the price increase ranks. Chemours announces thatStarting from April 1, the prices of all grades of Ti-Pure™ titanium dioxide products sold in the Asia-Pacific region will be increased by 100 USD/ton (approximately equivalent to 725 CNY/ton).。

Previously, two other titanium dioxide companies announced price increases.March 17th,Ningbo Xinfu Titanium Dioxide Co., Ltd. issues price adjustment noticestated, according to the current market situation, after company research and decision, for rutile titanium dioxideOn March 17, 2025, the original price will be increased by 500 yuan per ton domestically and by 70 US dollars per ton for exports.

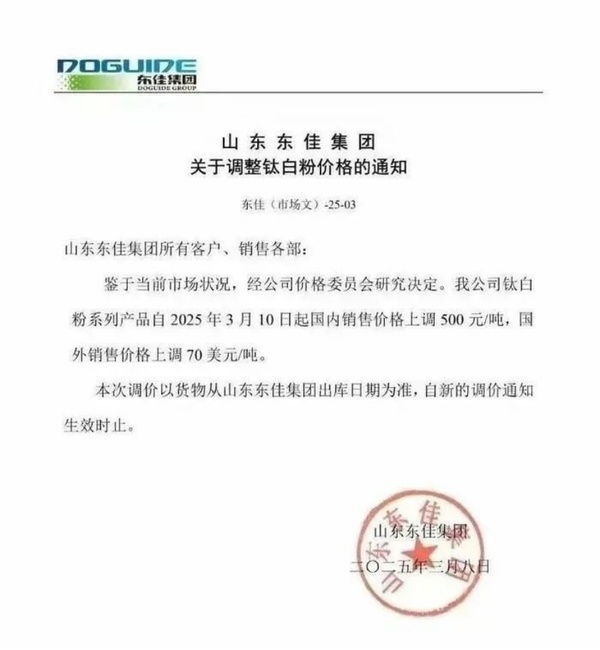

Shandong Dongjia Group announcestitanium dioxide series products sinceStarting from March 10, 2025, the domestic price will be increased by 500 yuan per ton, and the overseas sales price will be increased by 70 US dollars per ton.

Two,chain reaction under cost pressure

This wave of price increases is mainly the result of a combination of factors, including a significant rise in raw material costs, changes in the international situation, and shifts in market supply and demand relationships.

In the field of flame-retardant materials, the price trend of antimony can be described as crazy.Golden Tech indicates,Currently, domestic antimony ore inventory has dropped to a historical low, and the country has further strengthened export controls on antimony and related products. The short-term supply shortage has led to a significant price increase that is difficult to alleviate.。

In mid-March, the benchmark price of antimony (1#) was 169,500 yuan/ton, an increase of 13% compared to the beginning of the month, and a rise of over 100% compared to the prices in the 3rd quarter of last year, reaching a historical high. In addition, metals such as tin, cobalt, and bismuth have also started to see price increases.,Global strategic metals have generally seen a round of price increases。

titanium dioxide aspect,international chemical giant Chemours (Chemours announced a price increase plan in April, becoming the key external factor driving domestic companies to make adjustments in advance. A price resonance has formed in the global titanium dioxide market, with the FOB price of Chinese products breaking through the $2,800 per ton mark. Due to the continuous rise in the prices of raw materials such as titanium dioxide, coating companies have also collectively raised their prices to survive.

The reasons for the rise in raw material prices can partly be attributed to the complex changes in the international situation. Currently,The situation in the Middle East is at an impasse, the US intensifies sanctions on a certain country in the Middle East, concerns over oil supply provide continuous support to oil prices, crude oil prices continuemultiple days of increaseThese factors collectively contributed to the rise in prices of plastics and related raw materials.

The rise in prices is not an isolated incident, but a common issue faced by the entire industry. The cost of raw materials accounts for a high proportion of the production costs of plastic products. The increase in the prices of metal materials, crude oil, and other commodities has led to a rapid rise in the production costs for plastic manufacturing enterprises. This not only affects the market prices of plastic products but also puts greater cost pressures on downstream companies when purchasing plastic raw materials.

For plastic chemical enterprises, production costs have significantly increased. For some small and medium-sized enterprises, the increase in costs may exceed their capacity to bear, thus facing operational difficulties. Secondly, the rise in product prices may lead to a decline in market demand, especially in some price-sensitive downstream industries such as construction and home appliances.

rise in raw material pricesLike the first domino being pushed over,input formattriggered a series of chain reactions, not only affecting the prices of plastic products, but also bringing profound impacts on the development of the industry and the stability of the entire industrial chain.

III. What is the Impact on the Plastics Industry?

From an industry perspective, under cost pressure, some less competitive companies may be eliminated, while large enterprises can further consolidate their market position by leveraging their scale advantages and cost control capabilities. This could lead to an increase in industry concentration, with large enterprises gaining more say.

On the other hand, the rise in raw material costs has also spurred companies to accelerate the pace of technological innovation and transformation and upgrading. Companies are more motivated to improve production efficiency and reduce production costs through technological innovation, while also developing products with higher added value.

In addition, the rise in raw material costs will also affect the industry's supply chain layout. For example, some companies may consider expanding into the upstream raw materials sector to ensure the supply of raw materials and reduce costs; while downstream companies may accelerate the search for alternative materials, reducing their dependence on traditional plastic materials.

Globally, upstream raw material suppliers have gained more profits from price increases, but they also face the risks of supply shortages and price fluctuations. Midstream plastic manufacturing enterprises are under enormous cost pressure and need to optimize and adjust in areas such as raw material procurement, production processing, and product sales. Downstream application enterprises, such as those in the construction, automotive, and home appliance industries, have also been affected by the rise in raw material prices.

At the same time, the rise in raw material costs may also trigger international trade frictions. Some countries may adopt trade protectionist measures, restricting the import or export of raw materials, thereby affecting the industrial chain layout and trade pattern of the global plastic chemical industry.

conclusion:

in summary,The surge in prices in the plastics industry since March 2025 is the result of a complex interplay of various factors. From a significant increase in raw material costs to the uncertainty of the international situation, from fluctuations in the profits of upstream suppliers to cost pressures on downstream application enterprises, the entire industrial chain has been hit as never before. This wave of price increases is not only a severe test for plastic chemical companies but also a profound baptism for the entire industry.

Editor: Carrie

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track