Supply Flood Peak Under ABS Winter: Prices Hit Bottom, Where To Go From Here?

Since September 2025, the domestic ABS resin market has deviated from the usual "golden September and silver October" peak season expectations, falling into a deep adjustment led by the supply side. With the concentrated release of new production capacity, persistently high inventory levels, collapsing cost support, and weak demand, market prices have been on a downward trajectory, and the industry is undergoing a severe test. This article will delve into the core contradictions in the current market and explore possible future development paths.

I. Supply Flood Peak: Historical Highs and Core Contradictions Under Capacity Expansion

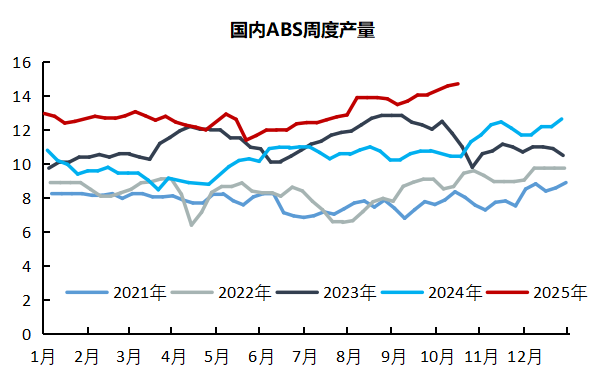

The core contradiction in the current ABS market undoubtedly points to the rapid expansion of supply. Since the beginning of the third quarter of 2025, a wave of concentrated new capacity has swept the market. The commissioning of two sets of 600,000 tons of equipment by Shandong Yulong, a 200,000-ton facility by Daqing Petrochemical, and a 225,000-ton facility by Shandong Yike has pushed the total domestic ABS production capacity to exceed 10 million tons, reaching 10.49 million tons. The swift conversion of this massive new capacity into output has driven weekly production to break through the historic threshold of 140,000 tons, with market estimates predicting that total production in October will exceed 600,000 tons, also setting a new historical high.

Despite routine maintenance being carried out on some old units during this period, the overall supply has increased rather than decreased due to the high-load operation of new units and the strategy of mainstream producers to maintain high operating rates to capture market share. This capital-driven capacity race has directly led to a complete reversal of the market supply-demand balance, with oversupply becoming the "Sword of Damocles" that suppresses the market, and this pressure is expected to further intensify in the future.

II. High Inventory: A Direct Reflection of Supply and Demand Imbalance and a Vicious Cycle

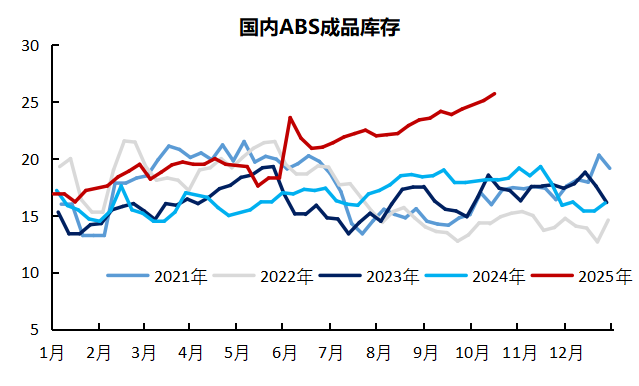

Accompanying the peak supply surge is the continuous rise and high accumulation of inventory. Since mid-June, ABS social inventory has begun an upward trajectory. Although there have been brief fluctuations during this period, the overall inventory level has remained significantly higher than the same period in history. As of after the National Day holiday, the total inventory has exceeded 250,000 tons, consistently staying above the high level of 200,000 tons for an extended period.

High inventory is not only a direct reflection of a serious imbalance between supply and demand but also profoundly affects the mindset and behavior of market participants. In the face of significant inventory pressure, manufacturers and traders commonly adopt price-cutting promotional strategies to alleviate capital occupation and storage costs in order to accelerate sales. However, this individual rational behavior forms a negative cycle at the collective level: "price reduction—intensified market bearish sentiment—downstream wait-and-see, demand postponement—inventory destocking difficulties—further price reductions," which continuously suppresses market prices, making the process of finding the bottom for prices exceptionally challenging.

III. Cost Collapse: Downward Linkage of the Raw Material Chain and Weakening Support

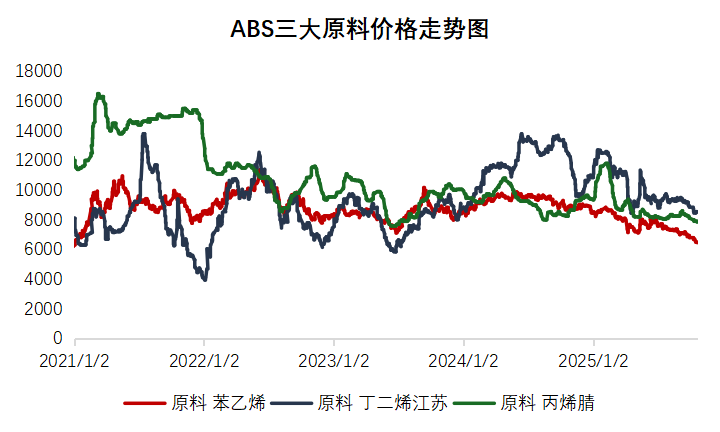

The cost support for ABS mainly comes from the three major raw materials: styrene, acrylonitrile, and butadiene. Unfortunately, during the "golden September and silver October" period, this raw material chain also performed weakly, resulting in a "collapsing" drag on the cost side.

Among these, the weakness in styrene is particularly prominent. Its futures prices have been declining continuously since the end of September, hitting a nearly five-year low on October 16th. This is due to the significant drop in international crude oil prices (as geopolitical risk premiums dissipate and concerns about global oversupply rise) and the weak fundamentals of styrene itself—port inventories have climbed to a five-year high of nearly 200,000 tons. As an upstream product, the demand for pure benzene is also increasingly expected to peak. The butadiene and acrylonitrile markets are similarly facing considerable supply pressure. Overall, the bearish factors on the cost side are abundant, significantly weakening the support for the ABS market and even becoming a major force driving its prices downward.

Weak Demand: A Double Blow from Policy Withdrawal and External Constraints

The demand side's inability to absorb the massive supply is another key factor in the market's downturn. Weak demand stems from a combination of internal and external factors.

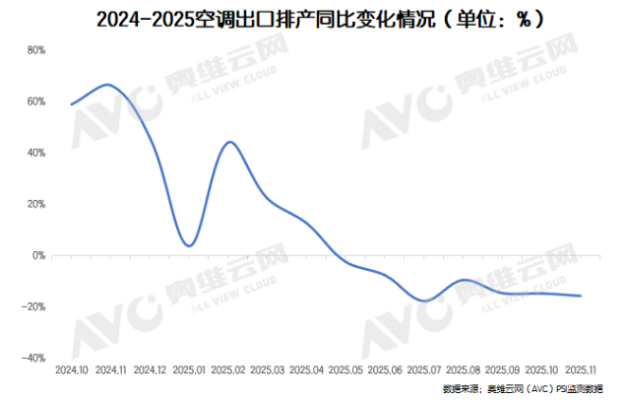

Excessive domestic demand and weakened policy effects.The national subsidy policy from the fourth quarter of 2024 to the first half of 2025, along with the "export rush" trend, had prematurely tapped into the demand in downstream sectors such as home appliances. By 2025, the subsidy policy shifted to a "phased release and flow control" approach, significantly weakening its stimulating effect. Market data clearly reflects this change: according to data from AVC, online retail sales of home appliances in September dropped by 16.0% year-on-year, while offline sales plummeted by 23.5%, with all seven major categories, including color TVs and air conditioners, underperforming. On the production side, caution prevailed, as industry online data showed that the total production volume of air conditioners, refrigerators, and washing machines in October decreased by 9.9% year-on-year.

External demand faces the threat of high tariffs.Regarding exports, the United States plans to impose a 100% tariff on some Chinese goods starting November 1. Although this has not been fully implemented yet, the uncertainty has already severely disrupted the export rhythm. From September to November, the scheduled production for air conditioner exports decreased by 7.89% to 16.69% year-on-year. Meanwhile, overseas markets are also in a period of digesting high inventory levels, and importers' willingness to restock is low.

5. Conclusion

Looking ahead, it is extremely difficult for the ABS market to achieve a turnaround in the short term.

Short-term weakness is unlikely to change: On the supply side, the inertia of new capacity releases and high operating rates will maintain a high supply level, making the destocking process inevitably long and painful. On the demand side, domestic demand is constrained by policy rollbacks and a sluggish real estate market, while external demand is suppressed by trade frictions and a high base, making a strong rebound unlikely. Although raw materials such as styrene may experience temporary rebounds due to temporary reductions in operating rates, the expectation of inventory buildup in the medium term will continue to suppress their price space. Therefore, ABS prices are expected to remain weak in the next one to two quarters, with bottom oscillation being the main theme.

Author: Zhao Hongyan, Expert in Market Research at Zhuangsu Shijie

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track