Supply and Demand Boost: LDPE Market Rises Amid Fluctuations

[Introduction] Recently, with the major maintenance of LDPE at Guoneng Xinjiang, supply has decreased and prices have risen. In September, LDPE import volume is expected to continue its downward trend, while the peak demand season approaches and downstream operating rates increase significantly. With both supply and demand improving, domestic LDPE prices are expected to continue fluctuating upward in September. 。

1 Supply benefits support price base upward shift

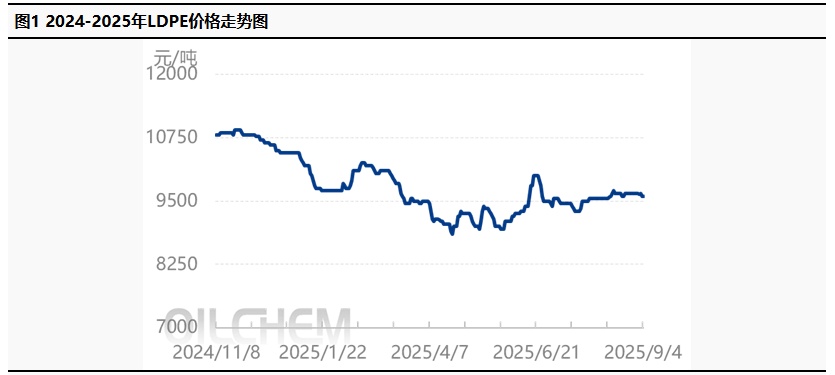

From the trend chart, starting in August, the LDPE price base shifted upward, with the monthly average price increasing by 1.29% month-on-month. In August, the Guoneng Xinjiang plant underwent a major maintenance, leading to tight supply of high-pressure film-grade material and a month-on-month decline in supply. On the demand side, the operating rates of agricultural film and packaging film gradually increased, procurement activities grew, and downstream raw material inventories rose. From a macro perspective, news of capacity reduction and other factors boosted market sentiment, keeping LDPE prices at a high level.

2 Imports and inventories both decline, strengthening price support.

2025 In August, China's LDPE import volume is expected to be around 250,100 tons, a month-on-month decrease of 2.5%. In September 2025, China's LDPE import volume is expected to be around 236,000 tons, a month-on-month decrease of 5.64%. The main basis for this judgment is that the previous overseas market offer prices were relatively high, market confidence in the future is insufficient, the number of buyers has decreased, and coupled with fewer shipping delays in August, imports are expected to mainly decline.

8 In the domestic LDPE market this month, circulating supply is relatively tight, and overall supply pressure is not significant. Operating rates in downstream industries have slightly increased, with replenishment mainly driven by rigid demand, leading to a downward trend in social inventory. In August, the social inventory of LDPE was 187,100 tons, a month-on-month decrease of 3.71%. In September, the social inventory of LDPE is expected to be 175,000 tons, a month-on-month decrease of 6.47%.

3. The peak demand season is approaching, and downstream operations are gradually increasing.

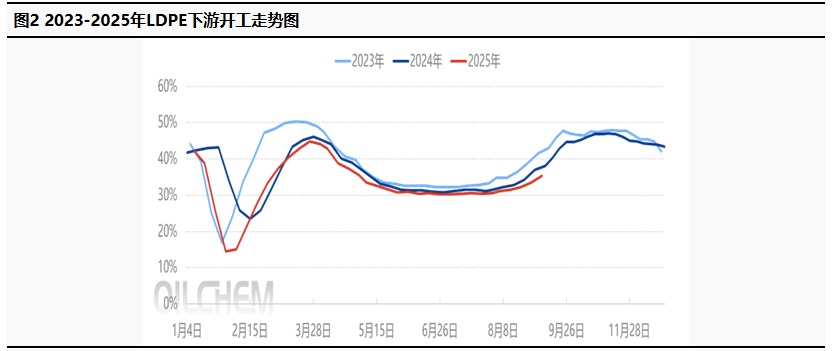

8 The monthly average operating rate of the PE packaging film industry is 49.4%, an increase of 1% compared to the previous month. The improvement in operating rates at terminal enterprises is mainly due to the consumption of accumulated orders from earlier periods, leading to a phase-based increase in production concentration. The monthly average operating rate for agricultural film is 14.7%, up by 2.2% month-on-month. In the greenhouse film market, only a few large-scale enterprises in the northern region have seen slight order follow-up, while most companies continue to focus on phased production.

9 The average monthly operating rate of the packaging film is expected to be 52.8%, an increase of 3.4% month-on-month. With the arrival of the "Golden September," market sentiment is expected to improve significantly, and the Mid-Autumn Festival and National Day holidays will drive terminal consumption. Large-scale enterprises are following up with new long-term agreements, leading to improved transactions. The average monthly operating rate of agricultural film is expected to be 33%, an increase of 18.3% month-on-month. The demand for greenhouse film in the northern regions is expected to increase significantly, and orders for large-scale enterprises are likely to rise sharply, which will drive the operating rate higher.

4 Dual Support from Supply and Demand Drives LDPE Market to Fluctuate Upward

Overall, on the supply side: the import volume in September is expected to decrease by 5.64% month-on-month, so the overall supply-side pressure is not significant. In terms of inventory, the social inventory of LDPE in September is expected to decrease by 6.47% month-on-month. On the demand side, with the arrival of peak demand season, downstream operating rates have risen significantly, with agricultural film operating rates up 18.3% month-on-month and packaging film operating rates up 3.4% month-on-month. In summary, with both supply and demand providing support, domestic LDPE prices are expected to continue to fluctuate upward in September.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics