Summary and Forecast of the PVC Paste Resin Market in Q1 2025

1. Review of PVC糊 resin market in the first quarter

In March, the domestic PVC paste resin market showed a fluctuating downward trend, with the price center falling by 100-200 yuan/ton compared to the previous month, and the market movement exhibited phased characteristics:

Early-month prices remained stable: At the beginning of the month, companies maintained firm quotations, with major suppliers showing little willingness to adjust prices, and the market focused on steady pricing for shipments. Prices for products made using the micro-suspension process slightly softened, while prices for products made using the seed emulsion method saw a RMB 100-200/tonne correction due to weakened cost support.

Mid-month pressure to decline: The expectation of shrinking orders for downstream glove and toy export-oriented enterprises is increasing due to the escalation of US tariff hikes on Chinese PVC products. The market frequently sees price-cutting promotions, with sluggish transactions for high-priced goods and low-priced resources becoming mainstream. Some traders are increasing their discounts to recover funds.

By the end of the month, the decline in prices narrowed, with signs of stabilization in some areas. However, demand remained sluggish, with downstream buyers continuing a "buy-as-needed" strategy and weak growth in new orders. Low-priced imported goods continued to enter the market, intensifying domestic competition. Glove manufacturers largely maintained rigid procurement practices and shortened inventory cycles.

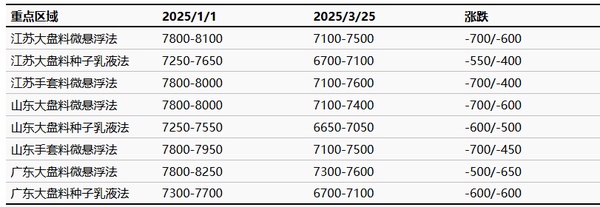

Table 1 Domestic PVC Paste Resin Market Price List (Unit: Yuan/Ton)

Currently, the industrial sector is experiencing a supply-demand mismatch. Upstream companies still maintain profit margins, with no immediate plans for concentrated maintenance shutdowns. Downstream end-users are constrained by shrinking exports and insufficient domestic demand, leading to slow inventory digestion. Market participants are adopting a cautious stance, and short-term prices may continue to fluctuate within a narrow range. However, attention should be paid to potential cost-side impacts from changes in export policies and fluctuations in the price of raw material calcium carbide. As of today, the Jiangsu PVC paste resin glove material market is primarily driven by on-demand purchasing. The delivered price for glove material produced by the microsuspension method ranges from 7,100 to 7,600 RMB/ton. Lower-priced transactions for microsuspension-grade materials are seeing better activity. For general-purpose PVC paste resin, the delivered price for microsuspension-grade material is 7,100–7,500 RMB/ton, while seed emulsion-grade material is priced at 6,700–7,100 RMB/ton, with actual prices subject to negotiation.

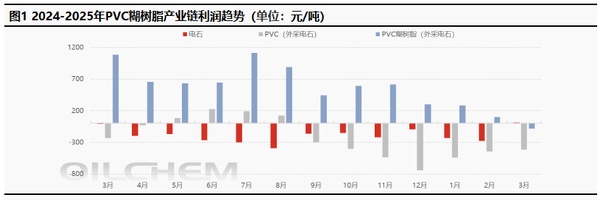

II. Profit Data Analysis of the PVC Paste Resin Industry Chain

Calcium carbide aspect:The price of raw material blue coke has dropped rapidly, with the ex-factory price of Shenmu medium material falling to 580 yuan/ton, indicating a significant decrease on the cost side. However, the domestic calcium carbide market has recently seen an increase, with the mainstream trade price in the Wuhai region currently at 2700 yuan/ton, and the profit margin in the calcium carbide industry at 10 yuan/ton (average data from the period of March 14-20).

PVC aspect:The domestic PVC industry is highly dependent on traditional sectors such as real estate and infrastructure, with demand closely linked to the real estate cycle. Since 2022, the slowdown in real estate activities has directly led to a contraction in demand for PVC pipes, profiles, and other major consumption areas. Meanwhile, PVC production capacity has shown an increasing trend, resulting in a supply-demand imbalance. Consequently, PVC prices have continued to decline, plunging the entire industry into losses. Within the year, PVC market prices dropped to a low of 4,850 yuan/ton, with the average gross profit of calcium carbide-based PVC producers nationwide at -753 yuan/ton (average data for the period from March 14 to 20).

PVC paste resin:The price of raw material calcium carbide has reached a periodic high, with the external procurement price of calcium carbide in Hebei region at 3040 yuan per ton. The cost pressure on external procurement enterprises is significant, and currently, the price of paste resin continues to decline, narrowing the profit margin. As of March 20, 2025, external procurement calcium carbide enterprises have started to incur losses, with a theoretical profit of -128 yuan per ton (average data for the period from March 14 to 20).

Currently, the profit in the industrial chain is gradually shifting to upstream products. The profit margin for PVC has significantly narrowed, resulting in noticeable losses. Under the trend of continuously rising raw material costs, PVC paste resin also faces the risk of losses.

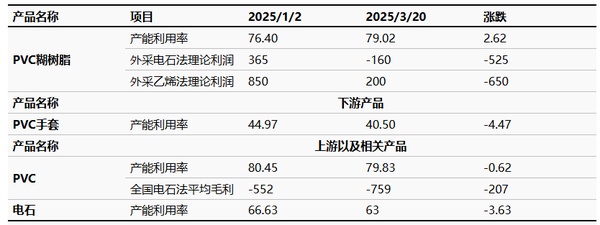

Table 2: Data Sheet of Domestic PVC Paste Resin Industry Chain (Unit: Yuan/Ton, %)

PVC Paste ResinThe capacity utilization rate shows an upward trend. On the one hand, in the first quarter, Shenyang Chemical expanded its capacity by 20,000 tons, bringing the total capacity of the manufacturer to 220,000 tons, driving up the industry's capacity utilization rate and output. On the other hand, there were fewer maintenance activities for PVC糊树脂, and manufacturers actively produced under profitable conditions, leading to a higher operating level in the first quarter.

Downstream PVC glovesThe trend of production line operation is declining. Currently, the production of PVC gloves is mainly concentrated in large factories, which have certain price and financial advantages. However, after the United States imposed additional tariffs, the domestic market has become severely competitive, leading to continuous price declines and insufficient new orders, which in turn affects the profit margins of some companies. Glove factories are constantly adjusting their operating loads to cope with the trend of price reductions.

CurrentlyPVCThe mainstream production process is still dominated by the calcium carbide method, which is mostly integrated with chlor-alkali facilities. Enterprises primarily consider the comprehensive profit of chlor-alkali, and the profit of the single product PVC has little impact on the operation of the facilities. Additionally, with fewer maintenance shutdowns from January to March, the PVC capacity utilization rate in the first quarter of 2025 is relatively high, essentially reaching the highest level for the entire year. From the perspective of the extent of losses and enterprise operations, there is no clear correlation between capacity utilization and profit fluctuations throughout the year.

Recently, the impact of power restrictions in the Inner Mongolia region is gradually dissipating.Calcium carbideAs enterprise production gradually increases, facilities that were previously under maintenance have also resumed operations, leading to a significant rise in overall supply. The profit conditions for some producers have been quite favorable, further boosting their enthusiasm for production activities. Affected by power restrictions in the first half of the month, the operating rate was low. In the second half of the month, to make up for the production shortfall, some enterprises actively engaged in追赶生产 (chasing production).

Currently, the profits in the industrial chain are gradually shifting towards upstream products. The profit margin for PVC has significantly narrowed, with noticeable losses. PVC paste resin is facing losses due to the continuous rise in raw material costs, and the downstream PVC glove market is underperforming, with a declining trend in production.

III. Forecast for the Future Market of PVC Paste Resin

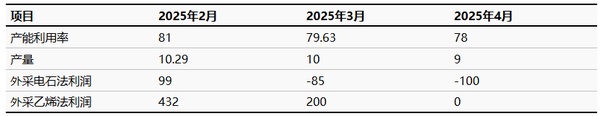

Table 3 Domestic PVC Paste Resin Market Data Forecast Form (Unit: %, 10,000 tons, Yuan/ton)

Cost aspect:The price of raw vinyl chloride continues to be under pressure, and the cost support logic of the ethylene method is weakening at the margins; meanwhile, the calcium carbide method maintains strong cost rigidity under the support of high raw material prices. Despite the divergence in cost transmission between the two process routes, the industry still maintains a positive profit zone, with the focus of profits showing a downward trend.

Table 4 2025PVCGluing resin production expansion plan (unit: ten thousand tons/year)

Supply Side:In 2025, it is expected that one new PVC糊树脂 production line with a capacity of 120,000 tons/year will be constructed in Tianjin Bohua Chemical Industry Development Co., Ltd., scheduled for production in October 2025. This project will also include an upstream vinyl chloride monomer (VCM) facility. It is anticipated that its output will increase the national export volume of PVC糊树脂 by 100,000 to 120,000 tons per year, effectively boosting the supply of PVC糊树脂 across the country. Additionally, in Northwest China's Inner Mongolia Zhongyan Chemical, there is a plan to construct an upstream calcium carbide facility. The company’s existing PVC糊树脂 capacity is 100,000 tons/year, and an expansion by an additional 20,000 tons/year is planned, bringing the total capacity to 120,000 tons/year, with production expected to start in November 2025.

Demand side:The U.S. tariff policy on China continues to escalate, with both buyers and sellers still in a stalemate over the 20% tariffs. Downstream markets are struggling with sluggish growth in new orders, and PVC glove export prices continue to decline. Glove factories are facing profit concerns, and with insufficient orders, they remain reluctant to replenish inventories. With raw material stocks still adequate, their enthusiasm for stockpiling remains low.

From a comprehensive perspective:It is anticipated that Jining Zhongyin will have a parking plan in the near future, while other companies have no plans for additional maintenance in April. The capacity utilization rate of the supply side is expected to remain high in April, with the demand side focusing on the operational status of downstream PVC glove factories. Currently, PVC glove export prices continue to decline, with some companies facing losses and reduced production loads. The market inventory pressure for PVC paste resin remains unchanged, and it is expected that the market will operate weakly in April, with the possibility of further declines.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track