Stock up! A surge of 24%! Resin, modified plastics, and chemical products have all collectively risen in price!

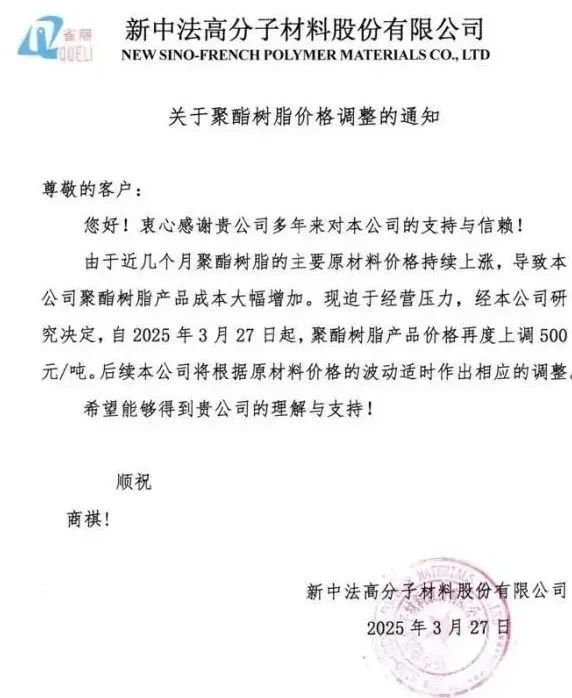

Previously, Allnex Resin announced at the end of February that starting from March 1st, the price of polyester resin would increase by 500 yuan per ton including tax. This means that within just one month, the products of this leading company have risen by 1,000 yuan per ton. At the same time, another polyester resin manufacturer—Sino-French Polymer Materials—also issued a price increase notice, stating that the prices of major raw materials have continued to rise in recent months, leading to a significant increase in costs. After careful consideration, it has been decided to raise the price of polyester resin products by another 500 yuan per ton starting from March 27th.

In addition to neopentyl glycol, many direct or indirect raw materials upstream of the plastic chemical industry have also faced similar situations recently. The imbalance between supply and demand is pushing up product prices, which is gradually affecting the stability of the coatings industry chain.

In the titanium dioxide sector, producers in the Southwest and East China regions have reduced production or halted operations due to the enforcement of environmental policies, coupled with a tight supply of raw materials such as sulfuric acid, leading to a significant decline in the operating rates of titanium dioxide plants. Additionally, the price of iron sulfate upstream has increased by 31% year-on-year, further driving up the production costs of titanium dioxide. Currently, the operating rate of titanium dioxide plants is only around 70%. A number of domestic titanium dioxide manufacturers have launched the third price increase this year, with a cumulative domestic increase of 1,300 yuan/ton and an international cumulative increase of 130 dollars/ton.

In the barium sulfate industry, there is an异常紧张supply shortage of barite ore, and the market price of precipitated barium by-products has fallen sharply, providing no additional profit margin. As a result, many producers are on the brink of loss, forcing the barium sulfate companies to increase their prices. Domestic prices have been rising continuously for a year, and by March, the domestic precipitated barium sulfate price had exceeded 4,000 yuan per ton, with the current increase reaching 1,000 yuan per ton, representing a 42% increase. Companies such as Jimei Fine Chemicals, Hubei Qiba New Materials, Guizhou Red Star Development Import and Export Co., Ltd., Shaanxi Fuhua Chemical, Guangxi Lianzhuang Technology, Shenzhou Jiaxin Chemical, Pingli Ande Li New Materials, and Guizhou Yufulong Technology have all announced price hikes for their products.

In the epichlorohydrin (ECH) sector, a major domestic player has suddenly experienced a safety incident and entered a shutdown maintenance phase. A portion of the facilities remain idle for an extended period, resulting in an overall operating rate of around 50-60% within the ECH industry. Zhejiang Haobang temporarily halted operations from March 18-20 due to facility issues; Hubei Minteng's 60,000-ton/year facility ceased production on March 14, with the restart date to be determined later. Jiangsu Ruixiang's 150,000-ton/year glycerine process plant shut down on March 20, planning to remain offline until the end of the month. These events have led to price increases in both ECH and its downstream epoxy products.

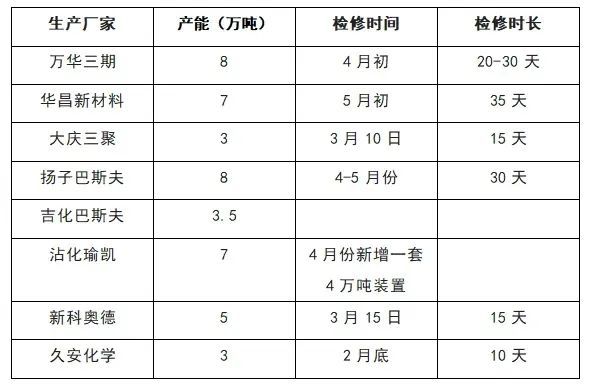

The PTA market is currently experiencing fluctuating increases in international crude oil prices due to repeated geopolitical tensions. The PX maintenance season is gradually beginning, and the supply and demand situation for PTA is entering a destocking phase. In March, the scale of PTA plant maintenance expanded, with companies such as Hengli Petrochemical's Line 3, Yizheng Chemical Fiber, and Hailun Petrochemical halting operations for maintenance. Yishengda Chemical's 3.75 million-ton unit has been shut down for a month, and Sanfangxiang's 1.2 million-ton unit has delayed restart, resulting in an operating rate dropping to around 70%.

In the MDI market, in March, Henkel in Europe's Rotterdam (470,000 tons/year), Covestro in Japan (70,000 tons/year), BASF in the United States (400,000 tons/year), and Henkel (500,000 tons/year) carried out centralized maintenance on their MDI facilities for 1-2 months. Global MDI supply contracted, leading to an increase in the price of domestic polymer MDI to 16,000 yuan per ton.

In addition to the上涨 in these chemical products, in the modified plastics sector, the significant increase in the cost of flame-retardant raw materials has led to a stronger intention for price increases in the plastic market. Given this situation, BASF and Kanghui have successively issued price increase notices. It seems like there is a part missing in the original Chinese text ("在除了这些化工品上涨之外"), which I've translated as "In addition to the上涨 in these chemical products," assuming it was meant to continue or elaborate on the context about rising costs in the chemical industry. Please provide the full sentence if there's a specific term intended by "上涨" in this context, such as "上涨" chemical prices.

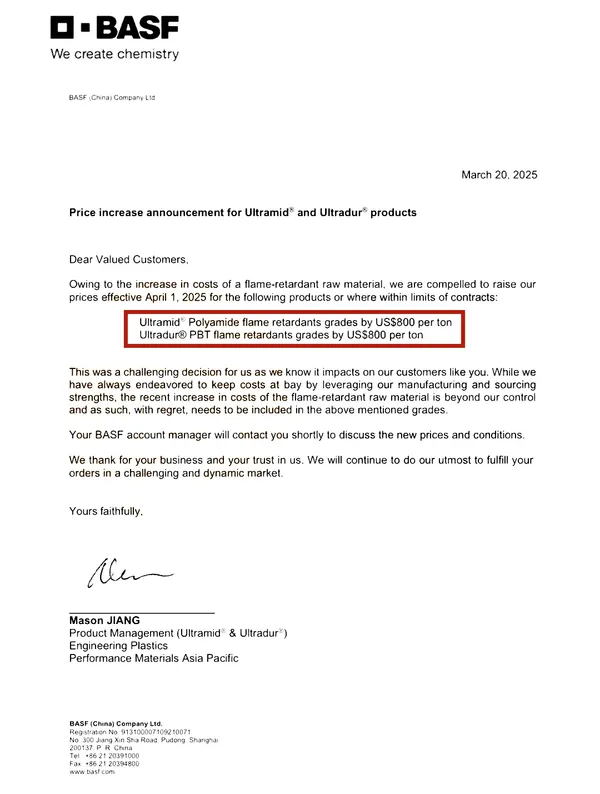

On March 20, 2025, BASF issued an important price increase notice, stating that due to the continuous rise in the cost of flame retardant raw materials, prices for certain products or products within the scope of contracts will be increased starting from April 1, 2025.

The PBT flame retardant level increase is $800 per ton (approximately 5799 RMB per ton).

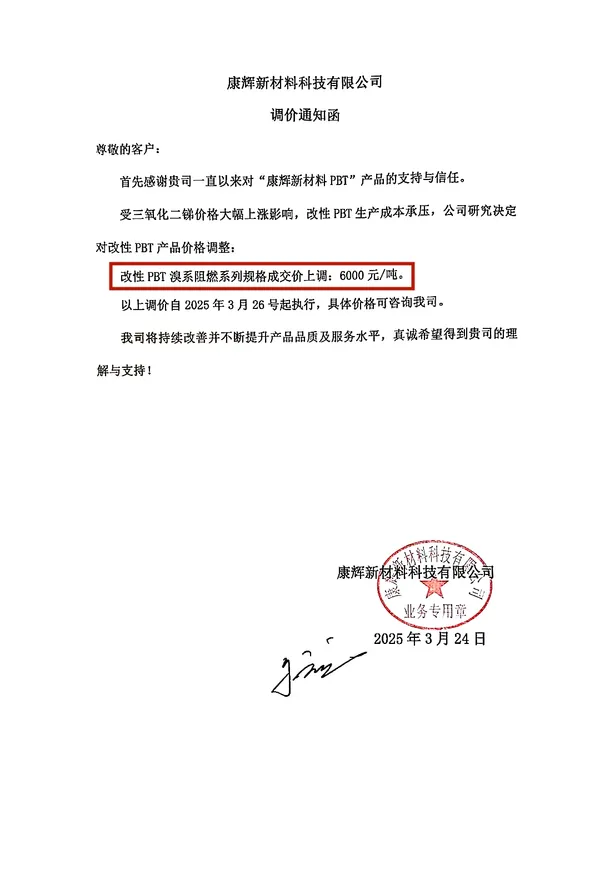

On March 24, 2025, Kanghui, a major domestic manufacturer, announced price adjustments for the following products:

The transaction price of modified PBT brominated flame retardant series specifications has been increased by 6000 yuan/ton.

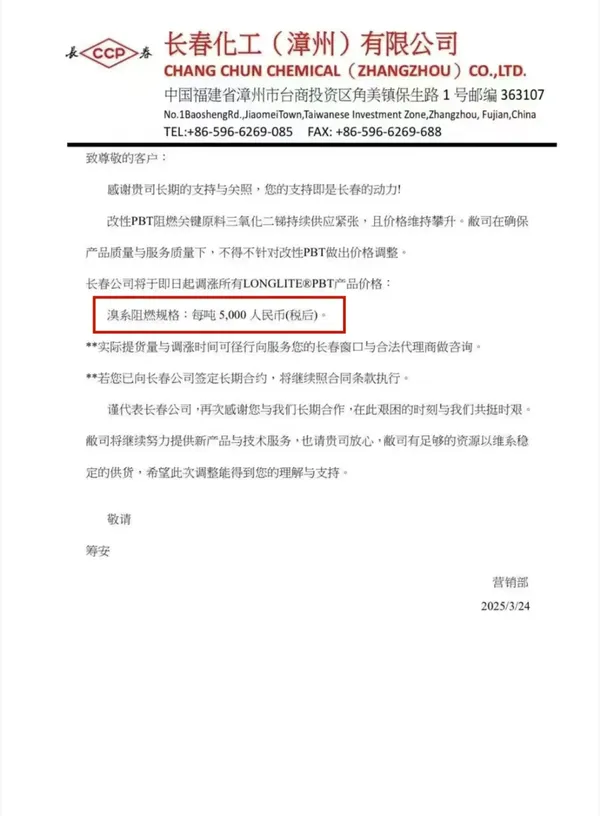

On March 24, 2025, Changchun Chemical, a major domestic manufacturer, announced price adjustments for the following products:

The transaction price of the modified PBT brominated flame retardant series has been increased by 5000 yuan/ton.

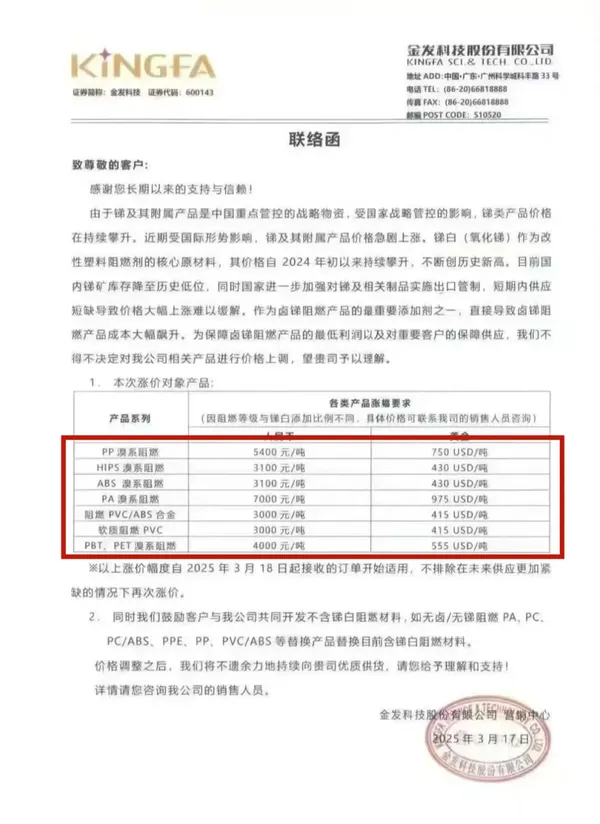

On March 17, 2025, domestic leading company Kingfa Technology announced a price adjustment for the following products:

The transaction price of the modified PP brominated flame retardant series specifications has been increased by 5400 yuan/ton.

The transaction price of modified HIPS brominated flame retardant series specifications has been increased by 3,100 yuan per ton.

The transaction price of the modified ABS bromine-based flame retardant series specification has increased by 3100 yuan/ton.

The transaction price of the modified PA bromine-based flame retardant series specifications has been increased by 7,000 yuan/ton.

The transaction price of the flame-retardant PVC/ABS alloy series specifications has been increased by 3000 yuan/ton.

The transaction price of the soft flame-retardant PVC series specifications has been increased by 3,000 yuan per ton.

The transaction price of PBT and PET series brominated flame retardant specifications has been increased by 4000 yuan/ton.

BASF, Kanghui, Changchun Chemical, and Kingfa Sci. & Tech. all reluctantly indicated in their respective price increase notices that due to the rapid increase in the cost of flame-retardant raw materials recently, they have been forced to issue these price increase notifications.

The recent price increase of modified flame retardant materials is primarily due to the rising cost of antimony trioxide. The typical addition ratio of antimony trioxide in plastics is usually between 3 to 8 parts. In plastics such as ABS, PC/ABS, and PBT, antimony trioxide is often used as a synergistic flame retardant. When used in conjunction with halogenated flame retardants (such as decabromodiphenyl ether), the ratio of antimony trioxide to halogens can reach 1:3 to 1:4, accounting for 15% to 20% of the formulation. With such a large proportion, it's hard not to raise prices!

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track