Stock prices plummet! Where will the billion-dollar olefin giant head in the future?

On March 27, Baofeng Energy quickly hit the daily limit down after opening, with its market value evaporating by about 12.914 billion yuan compared to 129.214 billion yuan on March 26.

According to Xinhua News Agency, the 34th Chairman's Meeting of the 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC) was held in Beijing on March 26. The meeting reviewed and approved the decision to revoke the qualifications of Tang Yong, Dang Yanbao, and Li Minji as members of the 14th National Committee of the CPPCC, and proposed to seek confirmation from the 12th meeting of the Standing Committee of the 14th CPPCC.

The person whose qualifications as a member of the National Committee of the Chinese People's Political Consultative Conference have been revoked, Party Yanbao, is the chairman and actual controller of Baofeng Energy.

On March 7, 2025, the China Securities Regulatory Commission announced that Dang Yanbao, the chairman of Ningxia Baofeng Energy Group, has been formally investigated for suspected violations of information disclosure. Following the announcement, the company's stock price plummeted 5.3% at the opening.

The flow of funds is in question. According to a report from Caizhong News, Baofeng Energy has a highly concentrated shareholding. As of the end of 2024, Dang Yanbao directly holds 7.53%, while his controlled companies, Ningxia Baofeng Group Co., Ltd. and Dongyi International Group Co., Ltd., hold 35.65% and 27.27% respectively, totaling a shareholding ratio of 70.45%. This means that over 70% of this dividend will flow to the actual controller and his controlled enterprises.

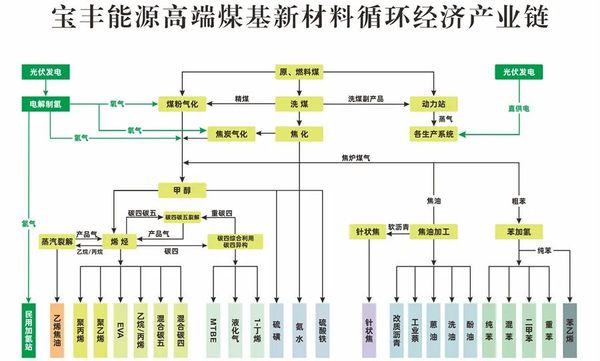

In 2014, Dan Yanbao entered the coal-to-olefins field, producing products such as polyethylene and polypropylene. The company's revenue rose from 3.449 billion yuan in 2014 to 28.43 billion yuan in 2022. His personal wealth has skyrocketed, and he has repeatedly been named the richest person in Ningxia, becoming a regular on Forbes' lists.

According to a report by 21st Century Business Review, on September 11, 2023, in a response to the Shanghai Stock Exchange's inquiry, Baofeng Energy stated that there is a capacity gap in polyethylene and polypropylene. It predicts that in the next five years, the apparent consumption of polyethylene and polypropylene in China will increase by a total of 26.4 million tons; there will be a gap of over 10 million tons between production and apparent consumption, which will need to be supplemented by imports.

The first phase of the project involves an investment of 47.8 billion yuan, with an annual production capacity of 7.42 million tons of methanol, 3 million tons of polyolefins, 1.5 million tons of polyethylene, and 1.5 million tons of polypropylene. The project adopts a production process that integrates green hydrogen with modern coal chemical technology, achieving a total olefin production capacity of 3 million tons per year. It is currently the largest coal-to-olefins project in the world in terms of single plant scale and is also the only project globally that replaces fossil energy with green hydrogen on a large scale to produce olefins.

On March 26, an investor asked Baofeng Energy on the interactive platform: According to industry data, the price of olefins is expected to rise slightly overall in 2024, but based on the company's annual report, why is the single-ton income calculated using the olefin segment's revenue/sales volume expected to decrease by more than 1,000 yuan/ton in 2024 compared to 2023?

The company's response stated: According to the company's operating data announcement, the sales prices of polyolefin products are as follows: the average annual selling price of polyethylene products is 7,089 yuan/ton, an increase of 0.1% year-on-year; the average annual selling price of polypropylene products is 6,697 yuan/ton, a decrease of 0.9%. Overall, the prices of polyolefin products remained basically stable year-on-year. The revenue from the olefin product segment in the annual report includes not only the income from polyethylene and polypropylene but also income from EVA and other products related to olefins. Therefore, it is not possible to derive the price per ton of polyolefin products by dividing the segment revenue by olefin sales volume.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track