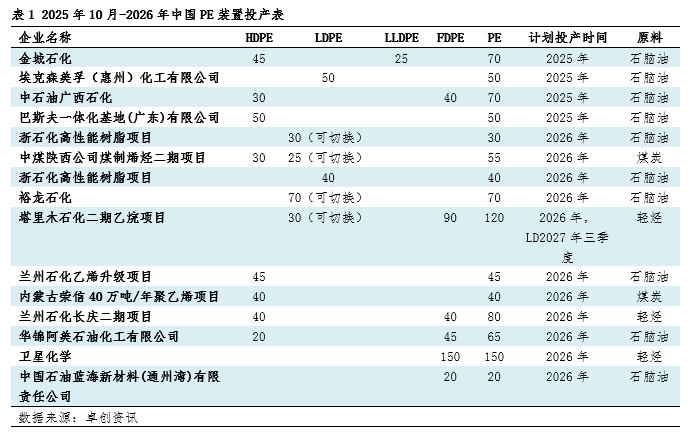

Statistics of domestic pe plants in the coming year

[China's polyethylene production capacity is expected to exceed 45 million tons by 2026, intensifying competition in general-purpose materials. The new capacity will primarily consist of full-density units, with oil-based production dominating and an increased proportion of light hydrocarbon-based production. The main production areas are Northwest and East China. Companies are focusing on flexible production shifts to respond to the market, and industry competition is moving towards high-end differentiation.

Future new capacity continues to be released, and the market may face oversupply.

As the world's largest consumer of polyethylene, China will continue to be a key region for new capacity additions in the future. The implementation of numerous private refining and chemical integration projects and comprehensive light hydrocarbon utilization projects will bring a substantial amount of new polyethylene capacity. It is estimated that between October 2025 and 2026, the planned polyethylene capacity under construction in China will be 9.55 million tons. As of now, domestic polyethylene capacity stands at 37.428 million tons, and by that time, China's total polyethylene capacity is expected to surpass the 45 million-ton mark. The polyethylene market will gradually shift from its previous "tight balance" state to a "loose balance" or even a phase of "supply surplus." Competition among producers will become increasingly intense, especially in the general-purpose material market, potentially leading to more frequent competition and squeezing industry profit margins. Additionally, if the aforementioned facilities commence production as scheduled, the reliance on imported sources will gradually decrease, leading to changes in traditional trade flows. Exporters from the Middle East and North America will need to find new markets for their products, with emerging markets such as Southeast Asia and South Asia becoming increasingly important. While the supply pressure for general-purpose materials increases, high-end polyethylene products (such as metallocene polyethylene and ultra-high molecular weight polyethylene) will remain relatively tight due to higher technical barriers, with more favorable profit margins. The focus of future competition will shift from mere "quantity" to "quality," and enterprises with core technologies and the ability to continuously launch high-performance differentiated products will occupy a more advantageous position in the market.

The full-density unit breaks the traditional design of units typically tailored for producing PE within a specific density range, allowing for switching between HDPE and LLDPE products. Currently, mainstream technology is the gas-phase process, mainly including Univation's Unipol PE process and Ineos's Innovene G process. Its core advantage lies in the unit design, which allows for relatively quick switching between different density products to meet market demands, flexibly adjusting production plans to maximize unit utilization and economic benefits. As seen in the table above, the future focus for enterprises is still inclined towards FDPE units, with a total planned production capacity of 3.85 million tons. Additionally, LDPE units have also planned the production of EVA products with a capacity of 1.55 million tons, indicating that companies are switching between multiple products due to market price differentiation and uncertainty. From a production path perspective, naptha as a raw material route accounts for a capacity of 5.10 million tons, still dominated by oil-based production, aligning with recent trends. Coal-based capacity is 950 thousand tons, and light hydrocarbon-based capacity is 3.50 million tons, with an increased proportion of light hydrocarbon-based production. Regarding production regions, the focus has shifted compared to the past five years, with the northwest region accounting for a capacity of 3 million tons, followed by the east region with 2.40 million tons, the north region with 1.80 million tons, and the south region with 1.70 million tons. Due to multiple market uncertainties and factors like trial operation faults, the listed unit production status may experience delays. Zhuochuang Information will continuously monitor the progress of new unit production.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track