Specialty Engineering Plastics PPS Sector Heats Up: Why Are Giants Like Wanhua Chemical Rushing In?

Recently, the polyphenylene sulfide (PPS) industry has been dynamic, attracting widespread market attention. In September 2025, Wanhua Chemical announced a patent for the preparation of PPS resin, focusing on molecular weight control and end-group ratio optimization, significantly enhancing the material's processing performance and reactivity with silane coupling agents. This is the second related patent the company has released this year; back in April, it announced a technology aimed at reducing the generation of oligomer waste during the polymerization process.

Source: Chemical New Materials

Almost simultaneously, at the end of August, Huangshan Dongtai Qixin Technology Co., Ltd. announced the official commencement of its annual 80,000-ton PPS resin project. With a total investment of 1.6 billion yuan, the project is expected to achieve an annual output value of 4 billion yuan after production begins, and is poised to become one of the leading domestic producers of PPS monomers.

01 PPSCore materials of high-end manufacturing.

PPS, or polyphenylene sulfide, is a high-performance thermoplastic resin composed of alternating benzene rings and sulfur atoms, with a well-ordered molecular structure and a crystallinity of up to 75%. Its melting point is approximately 285°C. This material possesses several excellent properties: high mechanical strength, resistance to high temperatures, chemical corrosion resistance, good flame retardancy, outstanding electrical performance, and thermal stability. Therefore, it has become an irreplaceable strategic material in many high-end manufacturing fields.

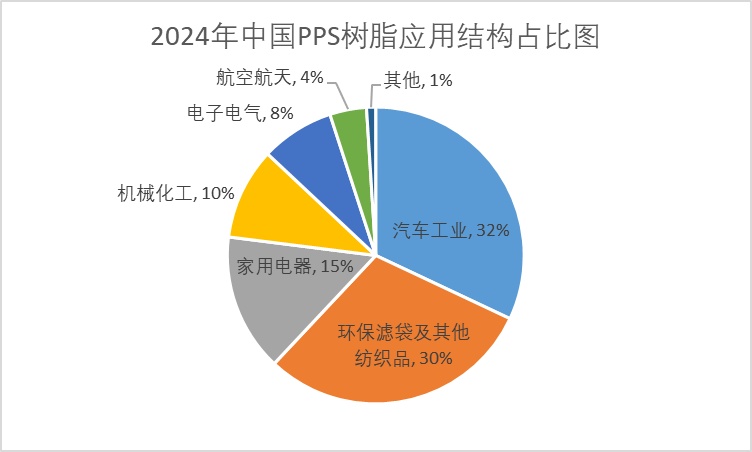

Its application scope is extremely broad. For example, the automotive industry utilizes PPS to achieve lightweight designs, applying it to engine peripheral components and battery systems for new energy vehicles. In the electronics and electrical sector, it is used in 5G communication equipment, high-frequency connectors, and insulation components. In terms of environmental protection, PPS fibers are employed as industrial filter bags in high-temperature and corrosive environments. In addition, it is widely used in aerospace, military equipment, and medical devices.

The figure shows Xinhua Cheng's low ash content cross-linked PPS resin product (Image source: Xinhua Cheng)

02 PPSMarket Landscape: Intensified Competition Among Domestic and Foreign Enterprises

Currently, global PPS production capacity remains concentrated in the hands of a few international giants, including Japan's DIC, Kureha, Toray, and Belgium's Solvay. These companies have significant advantages in continuous production, process stability, and the development of high-end grades. In contrast, although the domestic industry started early, there was insufficient early-stage technological accumulation, and large-scale development has only been achieved in the past five years.

As of 2024, there are a total of 11 PPS resin manufacturers nationwide, with a total nominal production capacity of 92,000 tons per year, an effective capacity of approximately 68,000 tons per year, and an actual output of nearly 50,000 tons.

In line with global trends, the concentration of the PPS industry in China is also high. Five companies—Zhejiang NHU, Chongqing Lion, Tongling Ruijia, Zhongtai Xinxin, and Binhua Group—account for 91% of the total effective production capacity. As the leading company, Zhejiang NHU currently has a production capacity of 22,000 tons per year, consistently operating at full capacity and planning further expansion.

03 PPS Capacity Expansion: List of Projects Under Construction and Planned

In terms of capacity expansion, by June 2025, the total planned and under-construction PPS projects in China will have a total capacity of approximately 250,000 tons per year. However, most of these projects are still in the early stages, and it is expected that few will actually be realized. For example, Shengji New Materials' first phase of a 30,000-ton facility will be put into operation in the second half of 2025, Xinjiang Jufang Gaoke's production line technology upgrade is expected to be completed in October, and Mingquan New Materials' second phase is planned to be completed in 2027.

By the end of 2025, China's total PPS production capacity is expected to reach 129,000 tons, showing significant growth compared to previous years. However, by 2030, the compound annual growth rate is projected to slow to 2.1%, with production capacity reaching 143,000 tons per year, and market competition is expected to become more rational.

Table: Planned Projects of China PPS (as of June 2025) Data Source: China Huaxin

04 Consumption Growth: Dual Drivers of New Energy Vehicles and Environmental Policies

The market demand continues to grow strongly. In 2024, the apparent domestic consumption of PPS resin reaches 56,000 tons, with a compound annual growth rate of 9.5%. Among this, the dependency on imports remains high, with approximately 30,000 tons needing to be imported from abroad. The self-sufficiency rate has not yet surpassed half, standing at only 46.4%.

The main drivers of growth come from two aspects: the industrial environmental protection upgrade driven by the "dual carbon" policy (such as the application of high-temperature filter bags in the power and cement industries) and the demand for lightweight materials spurred by the boom in new energy vehicles. Currently, the automotive sector has become the largest consumer market for PPS, followed by environmental filter bags and household appliances.

Source of image: High Performance Resins and Applications

In terms of product types, injection molding grade, fiber grade, and extrusion grade PPS dominate the market. Fiber grade products are mostly used in eco-friendly textiles, while injection molding and extrusion grades are widely used in the automotive, electronics, machinery, and aviation sectors.

05 Future Prospects: Opportunities and Challenges Coexist

Looking ahead, China's PPS industry faces both opportunities and challenges. On one hand, domestic enterprises still lag behind international companies in high-end products, development of specialized materials, and production stability, especially encountering technical bottlenecks in continuous production control and byproduct treatment. On the other hand, with the ongoing expansion of the electronics, electrical, and new energy vehicle industries, the global supply-demand balance for PPS is becoming increasingly tight, presenting huge growth potential in the domestic market.

For enterprises such as Wanhua Chemical and other giants, the layout of PPS aligns with their strategies of high-end and green development. Although specific mass production plans have yet to be announced, the frequent release of patents and industry collaborations indicate that their commercialization process is steadily advancing.

In this context, whether domestic companies can break through technical barriers and enhance product competitiveness will be key to truly competing with international giants.

Edited by: Lily

Sources: High Performance Resins and Applications, Chemical New Materials, China Chemical Information, Special Plastics World, Sina Finance, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track