Short-Term Benefits Emerge: Polyethylene Market Stops Decline and Rebounds

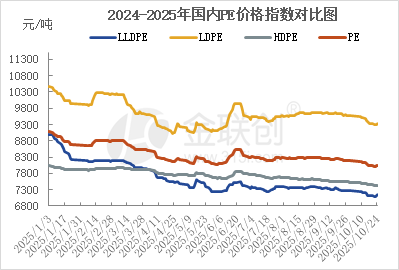

Data source: Jin Lian Chuang

In October 2025, after a weak decline, PE experienced a slight rebound. Prices of various products continued to hit new lows in the first and middle of the month, but stabilized and slightly rebounded in the latter part. Although October is a peak production season for agricultural films and downstream operations were relatively high, there was a lack of favorable macroeconomic support. Linear futures traded weakly, and following the National Day holiday, inventory accumulation occurred across the board. Downstream demand remained steady with small orders, while intermediaries took a cautious wait-and-see approach. The supply and demand fundamentals were weak, leading to a continuous price decline, particularly for high-pressure products, which saw significant drops. After the latter part of October, the easing of trade tensions between the U.S. and China, along with the convening of the Fourth Plenary Session of the 20th Central Committee of the Communist Party of China, provided macroeconomic support that stabilized the market and led to a slight rebound. As of October 24, the domestic linear mainstream prices ranged from 6,930 to 7,350 yuan/ton, with a noticeable recovery in the lower end of the price range.

The turnaround in this market cycle has been driven by multiple factors. Firstly, there has been a marginal improvement in demand. October is the peak season for the agricultural film industry, and from late October onwards, with the gradual cooling in the northern regions, the production of greenhouse films has significantly increased, leading to higher operating rates at agricultural film factories. Other packaging film and thin film industries have seen an increase in orders due to holidays and e-commerce events. As prices have been declining continuously, the market's attention to low-end prices has increased, prompting some traders to restock at low levels. Secondly, favorable macroeconomic factors have played a crucial role, with the "Fifteenth Five-Year Plan" reshaping industry confidence. The Fourth Plenary Session of the 20th Central Committee of the Communist Party of China began on the morning of the 20th in Beijing, where General Secretary Xi Jinping presented a work report on behalf of the Central Political Bureau and explained the "Recommendations of the Central Committee on Formulating the Fifteenth Five-Year Plan for National Economic and Social Development (Draft)" to the plenary session. The National Bureau of Statistics released key macroeconomic data for the first three quarters of 2025 and September, emphasizing this year's focus on expanding domestic demand and addressing "involution" competition. The central bank and the Ministry of Finance simultaneously signaled positive liquidity measures. Although the "Fifteenth Five-Year Plan" (2026-2030) is still being formulated, by considering the continuity of policies and the national strategic direction from the "Fourteenth Five-Year Plan," we can clearly predict the impact of the "Fifteenth Five-Year Plan" on the polyethylene market. It will not simply be a matter of stimulating or restricting capacity but will involve a systematic and comprehensive reshaping of development concepts, industrial structures, and competitive rules. The core impact path can be summarized as driving the market towards high-end and intensive development through a green revolution and supply-side reforms, ultimately achieving a reshaping of the industry landscape.

Although the market has rebounded in the short term, from a medium to long-term perspective, the key contradiction of supply exceeding demand has not yet been resolved. In the future, the supply side still faces a rebound. Domestic maintenance facilities are decreasing, with new capacities from Guangxi Petrochemical and ExxonMobil about to be launched, increasing domestic supply. In terms of imports, overseas demand is relatively weak, prompting foreign merchants to continue their willingness to ship to China. However, influenced by the added fees for vessels from the US to China and China's countermeasures, the buying atmosphere in China is weak. Domestic supply may see a certain rebound in November. On the demand side, the "Golden September and Silver October" expectations have fallen through, market confidence has been severely frustrated, agricultural film demand is entering the off-season, and festival packaging demand will still be evident. November will continue to focus on essential purchases and small orders. In terms of costs, the international crude oil market may mainly fluctuate and fall back, with high inventory and sufficient supply. In November, thermal coal prices may fluctuate narrowly, providing insufficient support from the polyethylene cost side. Overall, the supply-demand fundamentals remain weak, and the market in November will be characterized by a fluctuating pattern, with prices hovering at low levels. Considering that current prices are already at historical lows, the possibility of further deep declines is not high. Attention should be paid to domestic policy and the specific direction of China-US relations and their impact on demand-side disturbances.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track