Semi-annual report | 2025 refrigerator market summary: Challenges and Product Trends Amid Structural Adjustments

In the first half of 2025, amid the complex changes in the home appliance market, the refrigerator industry is undergoing a test of structural adjustment and multiple pressures. From the overall market performance, the refrigerator industry is currently facing the predicament of weak structural upgrades and intense price wars. Additionally, due to previous demand being overstretched, the overall growth momentum of the industry is insufficient in the first half of 2025. At the same time, the accelerated iteration of product forms, deepening competition in segmented markets, and the ongoing evolution of channel patterns together depict the complex landscape of the current refrigerator market.

Insufficient industry growth momentum, price declines offset national subsidy benefits.

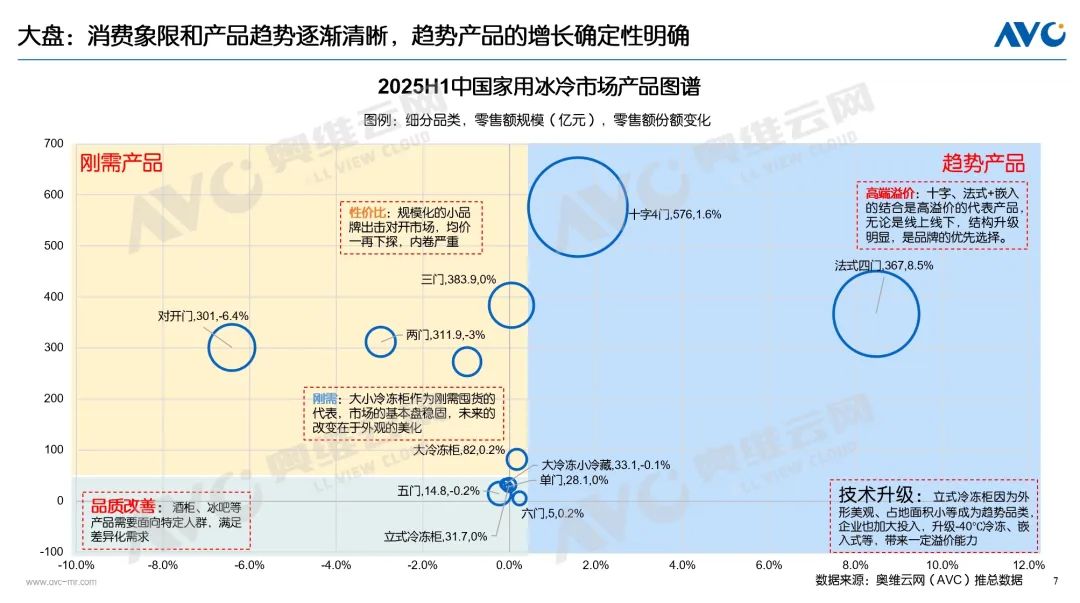

In the first half of 2025, the household refrigeration market is exhibiting a clear parallel pattern of "essential demand" and "trends." Essential categories, represented by side-by-side and two-door refrigerators, are currently characterized by intensified price competition and need to seek breakthroughs through aesthetic optimization and market segmentation. In contrast, trend categories, such as French door and cross refrigerators, are becoming the core battlefield for brands due to high-end premiums and technological upgrades, with clear growth momentum. Overall, the current refrigeration market is in a stage where consumption upgrading and structural adjustment coexist.

From the perspective of the refrigerator industry itself, the market pressure faced by refrigerators is the most significant among the four major industries of refrigeration, washing, air conditioning, and color TV. This is mainly due to two factors: first, there is a lack of effective breakthroughs in industrial structure upgrading, and leading companies are clearly lowering prices, resulting in intense price competition both online and offline; second, due to the substantial demand being pulled forward in the fourth quarter of 2024, the market performance in 2025 is expected to be less than anticipated, and there is no significant improvement overall.

According to data from Aowei Cloud Network's total statistics, from January to June 2025, the retail sales of the refrigerator industry reached 67.28 billion yuan, a year-on-year increase of 3.5%; the retail volume reached 19.889 million units, a year-on-year increase of 2.7%.

Breaking the inertia of growth, under the pressure of scale, industry prices have entered a downward channel.

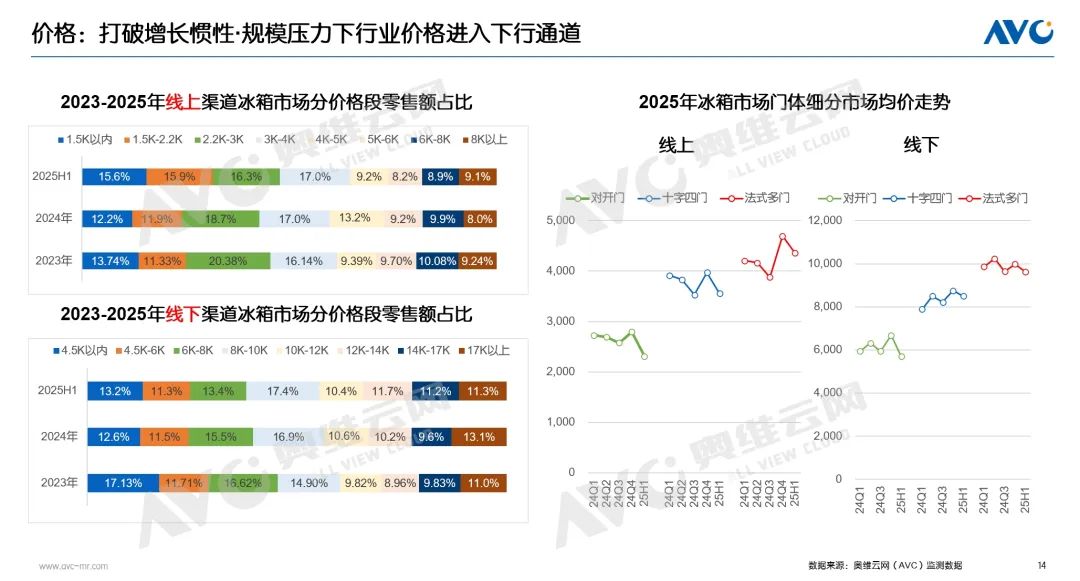

From the perspective of price, the momentum for structural upgrades in the refrigerator industry significantly slows down in the first half of 2025. According to monitoring data from AVC, the online channel price structure shows a clear change, with the market share of low-end models priced below 2.2K significantly increasing, becoming the main price segment for growth; meanwhile, in the offline channel, the market share of mid-to-high-end models priced between 8K and 14K shows a prominent upward trend, with the combined market share of this price range reaching 37.7% in 2024, and this proportion increasing to 39.5% by the first half of 2025.

From the price level of key door types, the price reduction for side-by-side refrigerators is the most significant, while the price fluctuations for cross and French door types are more moderate. According to monitoring data from Aowei Cloud Network, in the first half of 2025, the average price of side-by-side refrigerators offline dropped by 7 percentage points year-on-year, and online it dropped by 14 percentage points year-on-year.

Product Trend 1: French and cross products accelerate the replacement of traditional swing doors and other door types.

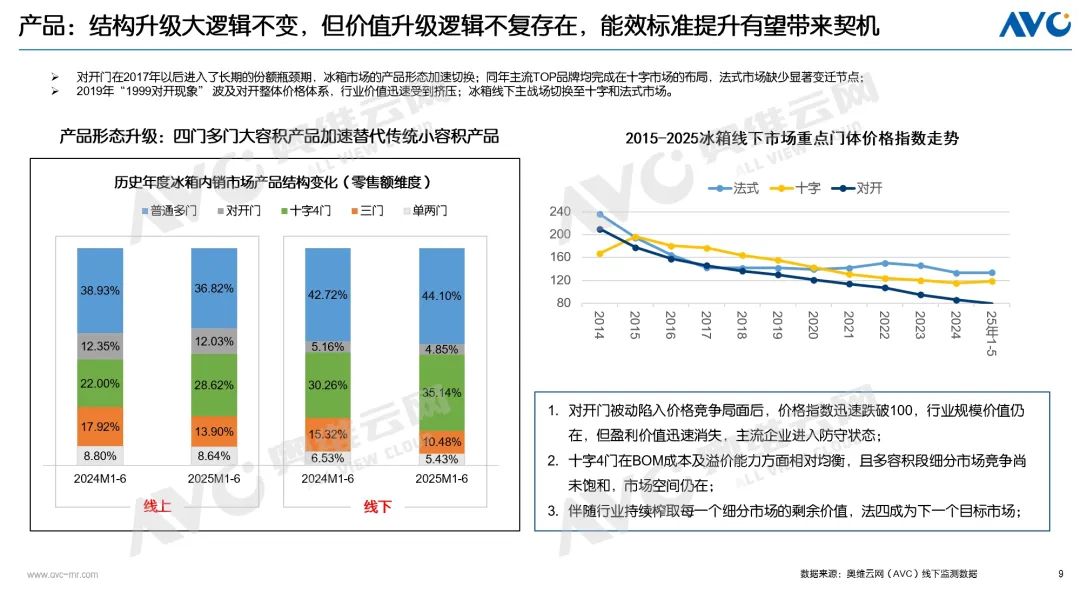

From the perspective of product trends, since 2017, side-by-side refrigerators have entered a long-term market share bottleneck, and the product form in the market has accelerated its iteration. In the same year, mainstream leading brands completed their layout in the cross-door refrigerator segment, while there was no significant transformative node in the French door market. The "1999 yuan side-by-side" phenomenon in 2019 impacted the pricing system of side-by-side refrigerators, squeezing the industry's value, and the main battleground shifted to the cross-door and French door segments. In recent years, the market share of French and cross-door products has continued to rise. According to statistics from Aowei Cloud Network, in the first half of 2025, in the online market, the combined market share of French and cross-door four-door products has exceeded 60%; in the offline market, the combined share of French and cross-door four-door products has nearly reached 80%.

Facing a passive price war, the price index has dropped below 100. While scale value remains, profit margins have disappeared, leading mainstream companies to shift to a defensive posture. The four-door refrigerator, due to its BOM cost balance and premium capability, along with the unsaturated competition in multiple capacity segments, still has market space. As the industry continues to explore the residual value of niche markets, the French-style four-door refrigerator has become a new competition target.

Product Trend 2: The embedded refrigerator market has entered the "deepening period of flat embedding popularization."

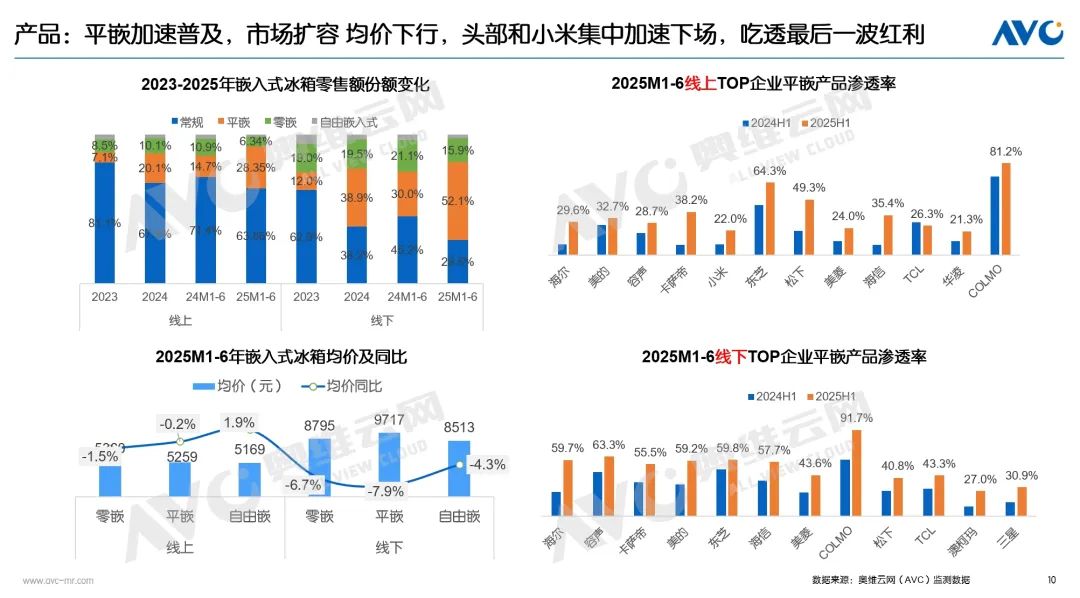

The flat embedded category has become the core driving force of the refrigerator embedded market. It is promoting overall market growth through accelerated popularization and scale expansion, while the technological form continues to iterate and upgrade, showing an evolutionary path from "conventional" to "flat embedded → zero embedded → free embedded." According to data from Aowei Cloud Network, the retail share of the flat embedded market is rapidly expanding from 12.0% to 52.1% from 2023 to 2025, clearly reflecting the accelerating process of flat embedded replacing conventional refrigerators. In addition, advanced forms such as zero embedded and free embedded are gradually penetrating the market. For example, Toshiba's Dabaipi series has gained wide consumer favor with its high-capacity all-embedded design.

From the perspective of pricing, the flat-panel market is experiencing a contraction in premium space due to an increase in participants. In the first half of 2025, the average product price of flat-panel products across all channels is showing a downward trend, indicating the intense competition for the last wave of dividends in the flat-panel market.

From the perspective of brand penetration, in the first half of 2025, industry players have increased their investment in the flat embedded category. High-end brands focus on technology premium to consolidate their market share in flat embedded products, while new players like Xiaomi are entering the market with cost-effectiveness, intensifying competition in the mid-range. The penetration rate of flat embedded products across various brands is rapidly increasing.

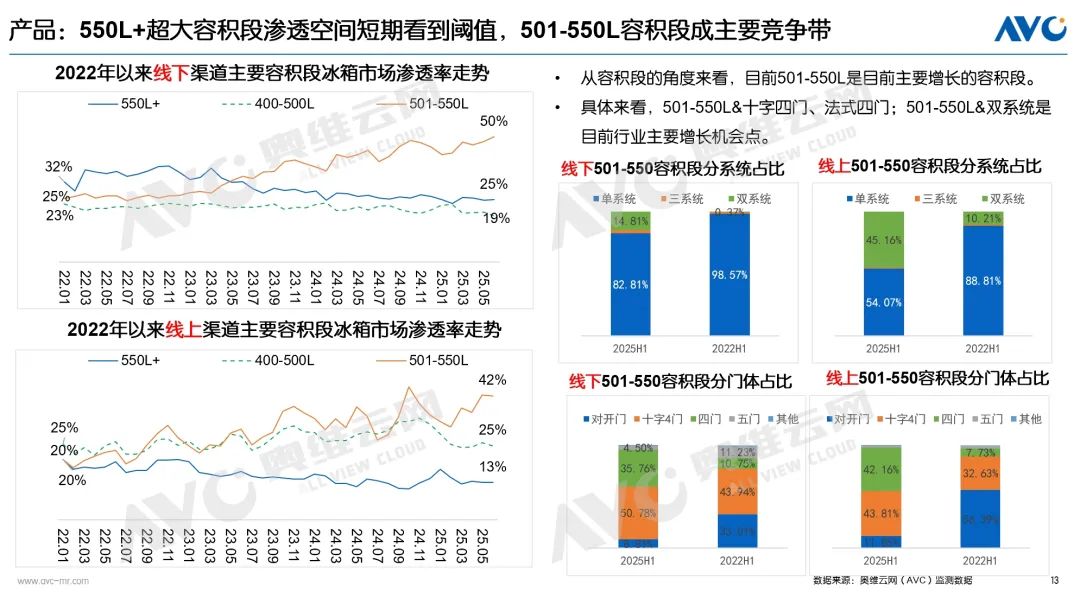

Product Trend Three: The penetration space of ultra-large capacity has peaked, with the 501-550 capacity segment becoming the main competitive area.

From the perspective of volume segment.Above 550L"The market penetration space for the super-large volume segment has reached a bottleneck."501-550L "The volume segment has become the mainstream competitive area in the refrigerator market, firmly occupying the core of current growth. In terms of channel penetration, starting from 2022, '501-550L"The penetration rate of the volume segment continues to rise across all channels, with an offline penetration rate reaching 50% and online exceeding 40%, significantly higher than..."400-500L"and"Above 550L"Volume segment."

In the "501-550L" volume segment, the competition focuses mainly on system and door configurations. In terms of system configuration, the advantages of dual systems are significant, with Midea standing out in this field; in the first half of 2025, its online sales of dual system refrigerators ranked first in the industry, demonstrating a notable lead. Regarding door configurations, cross four-door and French multi-door designs are mainstream. According to statistics from AVC, in 2025,501-550L"In the volume segment, the combined share of four-door cross-type and French multi-door refrigerators exceeds 80%, clearly reflecting the core competitive logic of 'large capacity + precise freshness storage'."

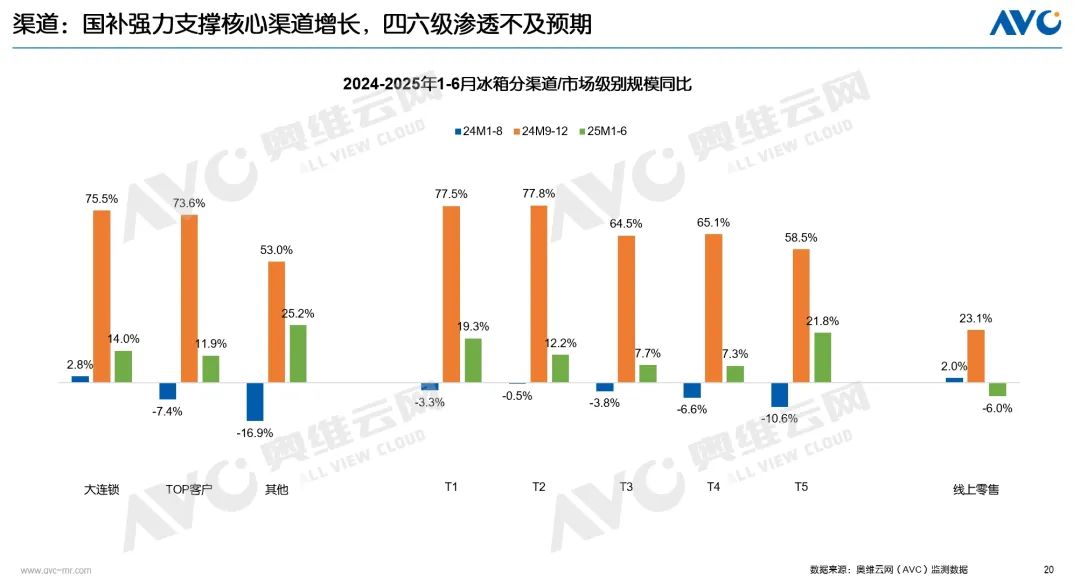

National subsidies support core channel growth, but the penetration in the fourth and sixth tier markets has not met expectations.

From the perspective of distribution channels, the national subsidy policy in 2024 will strongly boost core channels like JD.com and Suning, driving them to achieve rapid growth. According to data from Aowei Cloud Network, during the national subsidy period in 2024 (September to December), the year-on-year growth rates for major chain channels and top channels both exceeded 70%. However, entering the first half of 2025, the stimulating effect of the national subsidy policy significantly weakened, and the growth rates for these two major channels dropped to below 15%, showing a clear downward trend.

Previously, it was expected that the national subsidy would gradually penetrate the fourth and sixth-tier markets by 2025, thereby driving local renewal demand. However, from the actual performance, the penetration effect in the fourth and sixth-tier markets has not met expectations. In addition, with the tightening of the national subsidy policy in June, the possibility of subsequent funds further penetrating the fourth and sixth-tier markets has significantly decreased.

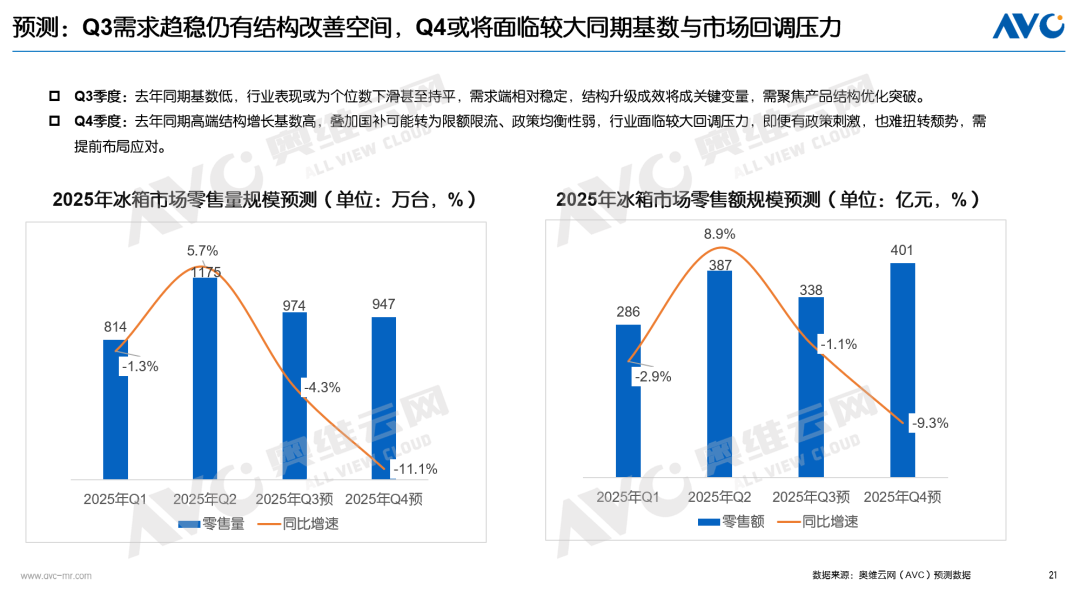

Demand is stabilizing in Q3, but Q4 may face significant market adjustment pressure.

We currently hold a cautiously optimistic attitude towards the overall market expectations for 2025, anticipating a slight negative growth trend in the second half of the year. Demand in Q3 is expected to remain stable. On one hand, we believe that the national subsidies from July to August 2024 have not yet been implemented on a large scale, and only in September will there be a high base due to the national subsidy policy. Therefore, the impact of last year's high base effect on Q3 2025 is relatively limited, and the overall industry performance may show a single-digit decline or even remain flat, indicating a relatively stable demand side. On the other hand, product structure upgrades will become a core variable, and focus should be placed on optimizing product structure breakthroughs to drive growth.

Q4 faces multiple challenges: first, the significant high base effect brought by the growth in high-end product structure in the same period of 2024; second, the national subsidy policy may shift to a quota and flow-limiting model, weakening the policy's balance and increasing market correction pressure. In this context, even with policy stimulus, it will be difficult to reverse the industry’s downward trend, and preemptive strategic planning is needed.

Overall, the refrigerator market in 2025 presents a distinct differentiation characteristic under pressure and transformation: on one hand, traditional categories are, with weak demand recovery; on the other hand, French-style, cross-door large-capacity products, and built-in categories such as flush-mounted models have become growth engines, driving the market towards high-end and scenario-based upgrades. The diminishing effect of national subsidies at the channel end and the difficulties in penetrating lower-tier markets have further intensified the industry's adjustment pains. In the future, companies need to focus on optimizing product structure, seeking breakthroughs through technological innovation and deepening in niche markets to cope with the potential adjustment pressure in Q4, while seizing new growth opportunities in the industry's transformation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track