Second quarter financial reports are here! how did basf, dow, and honeywell perform? who is turning the tide in the chemical industry's cold winter?

Amidst the intertwining backdrop of global economic fluctuations and geopolitical conflicts, the supply-demand imbalance challenge in the chemical industry is intensifying. Recently, global chemical giants such as BASF, Dow, and Honeywell have successively released their financial reports for the second quarter of 2025. How did each company's performance fare? Which products are profitable? And what important industry information was revealed?

BASF: Significant Decline in Sales, Noticeable Business Segmentation

On July 30th, BASF Group released its financial data for the second quarter of 2025 and its full-year outlook. According to the financial report, the company's sales for this quarter amounted to 15.8 billion euros, a decrease of 342 million euros compared to the same period last year, representing a decline of 2.1%. Net profit plummeted by 81.6% year-on-year, amounting to only 79 million euros (compared to 430 million euros in the same period last year).

The chemical business continues to drag down overall performance, particularly the petrochemical department, which is significantly impacted by supply surplus.Chemical sales revenue decreased by 11.9% year-on-year. The profit in the basic chemicals business segment was significantly under pressure, with earnings before interest, taxes, depreciation, and amortization (EBITDA) excluding special items decreasing by 185 million euros to 1.8 billion euros compared to the same period last year, and the profit margin falling from 12.1% to 11.2%.

In stark contrast to this,Agricultural solutions business performs remarkably well.In the second quarter, sales increased by 21% year-on-year, mainly due to strong demand for crop protection chemicals, particularly herbicides, with the department's profits nearly doubling. BASF also revealed that it is advancing the legal separation of its agricultural division, with plans to complete the initial public offering of this business by 2027.

The Surface Technologies division, driven by the recovery in car sales, achieved a year-on-year sales increase of 11.0%, with significant improvements in the business, including automotive catalysts. The Nutrition and Care business segment also showed a growth trend, with product price increases partially offsetting the performance decline in other segments.

In terms of business optimization, the acquisition consultation of BASF's coatings business is underway, covering the automotive coatings segment, with sales expected to reach $4.4 billion in 2024. Dr. Markus Kamieth, Chairman of the Executive Board of BASF Group, stated to analysts on July 30, "The acquisition process is progressing smoothly."

In terms of cash flow, cash flow from operating activities in the second quarter was 1.6 billion euros, a year-on-year decrease of 365 million euros, mainly due to changes in trade payables. However, with the end of the investment peak period for the integrated production base in South China, cash flow from investing activities improved significantly by 1 billion euros, resulting in a year-on-year increase in free cash flow of 62 million euros to 533 million euros.

In terms of the full-year outlook, BASF has lowered its earnings forecast, adjusting its expected earnings before interest, taxes, depreciation, and amortization (EBITDA) excluding special items to between 7.3 billion and 7.7 billion euros (previously 8.0 billion to 8.4 billion euros). The company noted that macroeconomic and geopolitical uncertainties are increasing, and the anticipated growth in global GDP, industrial production, and chemical demand is lower than previously forecasted. Ample market supply will continue to suppress upstream business profits.

Covestro's second-quarter performance is under pressure, with both sales and profits declining.

On July 31, the global chemical giant Covestro presented a challenging performance report amid a complex and volatile economic environment. The unexpected increase in U.S. import tariffs, which triggered supply chain disruptions, coupled with downward pricing pressure due to an oversupply in global markets, and geopolitical tensions combined to form obstacles to performance growth. Although sales remained relatively stable, multiple external factors still led to significant fluctuations in the group’s core financial indicators, while also accelerating the company's strategic adjustments and deepening transformations.

According to financial report data, in the second quarter of 2025, Covestro Group's sales decreased by 8.4% year-on-year to 3.4 billion euros (compared to 3.7 billion euros in the same period last year); earnings before interest, taxes, depreciation, and amortization (EBITDA) declined by 15.6% to 270 million euros (compared to 320 million euros in the same period last year), which is at the upper end of the company's own forecast range. This result was partly benefited by the reversal of 44 million euros in bonus provisions adjusted after the annual forecast. In terms of net profit, although still negative, it improved from -72 million euros in the same period last year to -59 million euros. Free operating cash flow further pressured from -147 million euros in the same period last year to -228 million euros.

In terms of the two main business segments, the performance in the second quarter showed a divergence.Sales revenue of the functional materials sector declined by 11.8% year-on-year.Revenue decreased to 1.6 billion euros (1.8 billion euros in the same period last year); EBITDA fell from 196 million euros to 149 million euros, mainly due to declining profit margins and expenses related to the STRONG transformation plan; free operating cash flow was -172 million euros, a further pressure compared to -89 million euros in the same period last year. In contrast,The performance of the solutions and specialty chemicals sector is relatively stable.Sales decreased by 5.4% to 1.7 billion euros (compared to 1.8 billion euros in the same period last year), while EBITDA slightly increased to 175 million euros (compared to 174 million euros in the same period last year). The resilience of this segment is attributed to the positive impact of reduced expenditures related to the STRONG transformation plan and increased sales volume. Free operating cash flow also rose from 36 million euros to 56 million euros, becoming the "stabilizer" of the group's performance.

In response to the persistently weak economic environment with no signs of short-term recovery, Covestro revised its fiscal 2025 performance forecast on July 11: the full-year EBITDA is expected to be adjusted from the original 1 to 1.4 billion euros to 0.7 to 1.1 billion euros; free operating cash flow from 0 to 300 million euros down to -400 million to 100 million euros; the gap between Return on Capital Employed (ROCE) and Weighted Average Cost of Capital (WACC) has also widened from 3-6 percentage points to 5-9 percentage points. However, the forecast for full-year greenhouse gas emissions remains unchanged at 4.2 to 4.8 million metric tons of CO2 equivalents, demonstrating its commitment to sustainability goals.

Dow's losses widened in the second quarter, with a loss of 7.8 billion in the first half of the year.

Dow Chemical, a major U.S. chemical giant, faced a more severe situation in the second quarter, with net sales of $10.1 billion, a 7% year-over-year decrease. All operating segments experienced a decline.The net loss further expanded from $290 million in the first quarter to $801 million, with a total loss of $1.091 billion (approximately 7.8 billion RMB) in the first half of the year.The specific data is as follows:

The decline in prices is the core factor for the decrease in performance. Local prices fell by 7% year-on-year, affecting all regions and operating segments. The largest business unit, packaging and specialty plastics, saw a sales decline of 8.9% and a volume decrease of 2% quarter-on-quarter, partly due to reduced ethylene feedstock earnings resulting from the startup of the Poly-7 polyethylene project along the U.S. Gulf Coast. According to generally accepted accounting principles, operating EBIT (Earnings Before Interest and Taxes) reported a loss of $21 million, down $840 million year-on-year, primarily impacted by the decline in prices and equity earnings.

To cope with pressure, Dow has implemented a series of cost-cutting measures: closing three factories in Europe, advancing layoffs, and reducing dividends by 50%. Notably, Dow has continuously paid dividends every quarter since 1912, and this adjustment is seen as an important move to address cyclical challenges. Dow's Chairman and CEO, Jim Fitterling, told analysts in a conference call on July 24, "The fixed dividend expenditure of $2 billion per year limits capital flexibility, and cutting the dividend provides greater room for maneuver to weather the storm."

In terms of cash flow, cash generated from operating activities in the second quarter was -$470 million, a year-over-year decrease of $1.3 billion and a quarter-over-quarter decrease of $574 million, primarily due to profit compression leading to reduced earnings. Despite this, the company still provided an overall return of $496 million to shareholders this quarter.

For the future, Dow is counting on strategic adjustments and project commissioning: it plans to achieve over $6 billion in revenue by 2026 through short-term cash support and earnings growth leverage measures. Short-term growth projects will be put into operation in the third quarter, and combined with long-term strategic investments, will focus on high-value application areas and advantageous end markets to enhance revenue resilience. Meanwhile, the company will continue to advance structural cost improvements and optimize global asset layout to address challenges such as anti-competitive behavior in the industry and oversupply.

Sisuoke's EBITDA increased by 8% quarter-on-quarter, orderly exiting non-core businesses.

On July 31, SESOKO released the financial report for the second quarter of 2025, which includes:

Net sales reached 1.59 billion euros, impacted by unfavorable year-on-year exchange rate changes (-4%) and a decline in volume (-3%), while prices remained generally stable. The consumer and industrial specialty chemicals business achieved year-on-year growth.

- Gross profit reached 506 million euros, down 13% year-on-year, mainly due to a decrease in sales volume and adverse exchange rate movements; the gross profit margin was 31.9%, up 20 basis points quarter-on-quarter.

The underlying EBITDA was 335 million euros, representing an organic year-on-year decrease of 8%, primarily due to a decline in the underlying EBITDA of the specialty polymers business. However, compared to the previous quarter, the underlying EBITDA achieved an 8% sequential increase, benefiting from the specialty polymers business.

The underlying EBITDA margin contracted organically by 110 basis points year-on-year to 21.1%, but due to improvements in both the Materials and Effectiveness & Maintenance segments, the underlying EBITDA margin increased by 190 basis points quarter-on-quarter.

Wacker's second-quarter performance meets expectations, significantly lowers full-year performance forecast.

On July 31, Wacker Chemie AG released its financial report for the second quarter of 2025. Data shows that in the second quarter of 2025, Wacker Group's sales amounted to 1.41 billion euros (second quarter of 2024: 1.47 billion euros), and EBITDA was 114 million euros (second quarter of 2024: 155 million euros). Both figures meet the current average market expectations of 1.45 billion euros for sales and 119 million euros for EBITDA.

Furthermore, on July 18, Wacker adjusted its forecast for the entire year of 2025. This move is primarily due to the persistent uncertainties in macroeconomic and geopolitical conditions, leading to weak customer demand across numerous user industries. Another reason is the unfavorable development of the euro to dollar exchange rate since the beginning of the second quarter, with the current exchange rate level expected to continue. Additionally, Wacker had previously predicted that the uncertainties brought by U.S. trade policies on solar-grade polysilicon would be eliminated within the year, and that demand in the polysilicon business sector would recover.

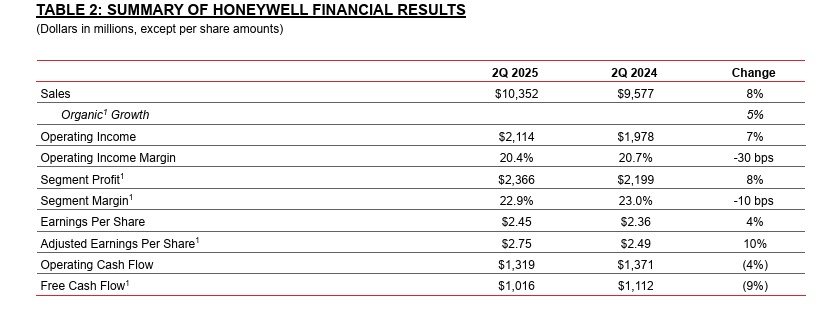

Honeywell's second-quarter performance exceeded expectations, with sales reaching $10.4 billion.

Honeywell's latest performance was like a bombshell, directly igniting the market atmosphere in the chemical industry. Specifically:

- In the second quarter, Honeywell's sales reached $10.4 billion (approximately RMB 74.5 billion), marking an 8% year-over-year increase. Organic sales grew by 5%, with both the defense and space business and the UOP business achieving double-digit organic sales growth.

- Driven by the growth of the building automation business, revenue was $2.11 billion, an increase of 7% year-on-year, and departmental profit increased by 8% to $2.4 billion.

- The operating profit margin contracted by 30 basis points to 20.4%, and the departmental profit margin contracted by 10 basis points to 22.9%, both in line with previous expectations.

- Earnings per share for the second quarter were $2.45, a year-over-year increase of 4%, while adjusted earnings per share were $2.75, a year-over-year increase of 10%. Operating cash flow was $1.3 billion, a year-over-year decrease of 4%, and free cash flow was $1.0 billion, a year-over-year decrease of 9%.

Despite the macroeconomic environment being full of uncertainties, Honeywell achieved impressive results in the second quarter, with both organic growth and adjusted earnings per share exceeding expectations. Led by the Smart Building Technologies group, three out of the four business groups saw sales growth of more than 5% this quarter, fully demonstrating the strong ability of the Honeywell Accelerator Operating System to adapt to changes and drive growth. This quarter, we continued to increase our efforts in new product innovation, further driving record growth in backlog orders. Meanwhile, we continued to adopt a prudent capital deployment strategy, selectively seizing quality acquisition opportunities such as acquiring Johnson Matthey's catalyst technology business and strategically acquiring Li-ionTamer.

Industry Outlook: Imbalance of Supply and Demand and External Uncertainties as Main Challenges

The global chemical industry is currently facing multiple challenges. The issue of oversupply has led to a drop in product prices, severely squeezing corporate profit margins. BASF's petrochemical division, Dow's packaging and specialty plastics division, and Covestro's functional materials segment have all been severely affected by this.

In addition, international trade frictions and geopolitical uncertainties have exacerbated the industry's difficulties, systematically undermining companies' profitability. Among them, BASF, Covestro, and Wacker have all downgraded their performance forecasts for 2025, while Dow has mentioned the negative impact of trade and tariff fluctuations. These external factors are putting pressure on the demand for chemical products. This predicament is not an isolated case—global chemical companies are generally facing the triple pressures of soaring production costs in Europe, weak end demand, and tightening environmental regulations, forcing them to reassess their strategic layouts.

In the strong support of its main business and capital combination, Honeywell was the first to achieve a performance turnaround. In February this year, Honeywell directly announced a "super spin-off" plan — splitting the company into three parts: Automation, Aerospace, and Advanced Materials, each independently listed. In May, it sold its personal protective equipment business, and by July, it was preparing to sell parts of its productivity and warehouse solutions. At the same time, it made significant acquisitions: acquiring Johnson Matthey's catalyst business for 1.8 billion pounds, Sundyne for 2.2 billion dollars, and strategically acquiring Li-ion Tamer.

In the future, with strategic adjustments such as BASF/SABIC divesting non-core businesses, Dow optimizing asset distribution, and Covestro deepening transformation/strategic acquisitions, leading companies are expected to better cope with cyclical fluctuations and gradually emerge from the current difficulties. Their transformation paths also provide important references for the industry. For the entire industry, this profound adjustment may accelerate the differentiation of enterprises and promote the concentration of resources towards leading companies with technological barriers and cost advantages.

Some of the materials are sourced from the WeChat public accounts of companies such as BASF, Dow, Wacker, SI Group, Honeywell, and the editorial department of Chemistry World.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track