Saudi Chemical Giant SABIC Reports Net Loss for Third Consecutive Quarter

Saudi Arabia's largest chemical company has reported a loss for the third consecutive quarter, missing analysts’ previous profit expectations, due to the closure of some assets amid a prolonged industry downturn.

According to a statement released on Sunday, Saudi Basic Industries Corporation (Sabic) reported a net loss of approximately 4.1 billion riyals (about 1.1 billion US dollars), compared to a loss of 1.2 billion riyals in the previous period. Analysts had generally expected the company to achieve a profit of 1.1 billion riyals for the quarter.

At the opening of the main stock exchange in Saudi Arabia, the company's stock price once fell by 1.9%.

The performance was affected by impairment expenses in two areas: firstly, the closure of a cracker unit at its Teesside plant in the UK; secondly, the investment in Clariant experienced impairment due to the decline in Clariant's share price.

Saudi Basic Industries Corporation stated that market sentiment remains unstable, and the company has found an oversupply and weak demand situation in most of its major chemical product sectors.

CEO Abdulrahman Fagih stated: "Due to excess capacity, the operating rate remains below the historical global average, and oversupply is putting pressure on profit margins."

Earlier this year, Saudi Basic Industries Corporation announced a corporate restructuring plan to cut costs, as weak demand has affected the earnings of major global chemical companies and compressed their profit margins. To address these challenges, companies have been selling assets and shutting down projects.

Dow Inc. reported its first quarterly loss in five years last month and announced the closure of three plants in Europe. LyondellBasell's second-quarter earnings fell short of expectations, and it delayed a project in Texas. However, the company stated that it remains "cautiously optimistic" about addressing the overcapacity issue in Europe and revitalizing the European chemical industry. Following the earnings report, the company's stock fell by 8% on Friday.

BASF SE is also selling one of its divisions to focus on its core business; Shell Plc recently stated that its chemical business has been sluggish for some time.

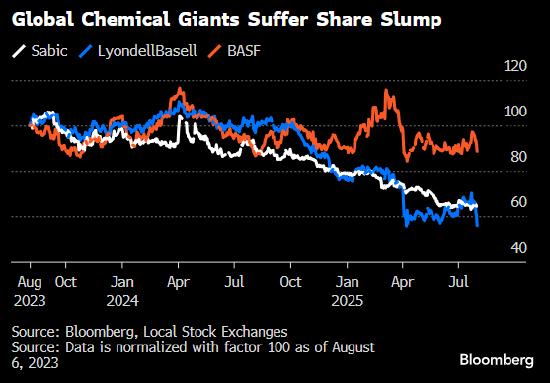

Shares of global chemical giants fall

Source: Data standardized based on August 6, 2023 (set as 100)

Analysts expect that Saudi Basic Industries Corporation (SABIC) will face continued margin pressure and weak pricing due to the persistent oversupply of major petrochemical products. However, the company's diversified product portfolio and fixed raw material cost structure are considered to help support its margins. As part of a broader operational review, SABIC is considering the public listing of its industrial gases division.

The Saudi company stated that it is still evaluating its strategic business in Europe and has not yet made a final decision regarding the potential initial public offering (IPO) of National Industrial Gases Co.

Saudi Basic Industries Corporation has lowered its capital expenditure guidance for 2025 from a previous maximum of $4 billion to $3 billion to $3.5 billion. The company’s second-quarter revenue exceeded analysts' expectations.

The share price of this chemical giant has fallen by about 20% this year. During the same period, the decline of the Saudi main index was about half of that.

Saudi Aramco, the world's largest oil exporter, holds a majority stake in Saudi Basic Industries Corporation, which is scheduled to announce its earnings on August 5.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track