Rongsheng Environmental Protection's revenue has declined, but its net profit has hit a 7-year high. What secrets lie behind this phenomenon?

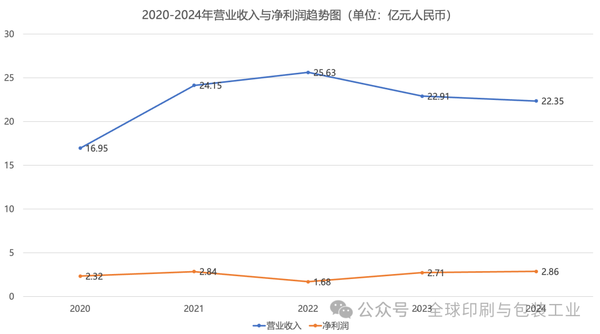

On the evening of March 25, Zhejiang Rongsheng Environmental Paper Industry Co., Ltd. released its annual report for 2024. The report showed that by the end of the fiscal year 2024, the company's total assets amounted to 4.706 billion yuan, with shareholders' equity totaling 2.329 billion yuan, and a debt-to-assets ratio of 50.52%. In 2024, the company achieved operating revenue of 2.235 billion yuan, a decrease of 2.45% compared to the previous year; it realized a net profit attributable to shareholders of listed companies of 286 million yuan, an increase of 5.79%; the net profit attributable to shareholders of listed companies after deducting non-recurring gains and losses was 236 million yuan, a decrease of 11.42% compared to the previous year.

The main reason is that in 2024, the decline in the sales price of raw paper led to a year-on-year decrease in the company's operating revenue. The decrease in the procurement prices of raw materials such as waste paper and raw coal was greater than the decrease in the product sales price, resulting in an increase in gross profit margin and net profit. Although the gains from wealth management products increased and the interest income from bank deposits decreased, this led to a year-on-year decrease in net profit attributable to shareholders of the listed company after excluding non-recurring gains and losses.

It should be noted that the decline in the sales price of raw paper directly led to a decrease in revenue, reflecting intense market competition and potential downward pressure on the industry. If the price of raw paper continues to fall in the future, it will pose challenges to the company's revenue and profitability. From the perspective of the past five years of operation, although the operating revenue was not the highest, the net profit still reached a new high over the past five years. However, it is worth pointing out that the growth in net profit largely relied on non-recurring gains, which are not sustainable growth points for the company's main business. Once investment income fluctuates or decreases, the company's overall profitability may be significantly affected.

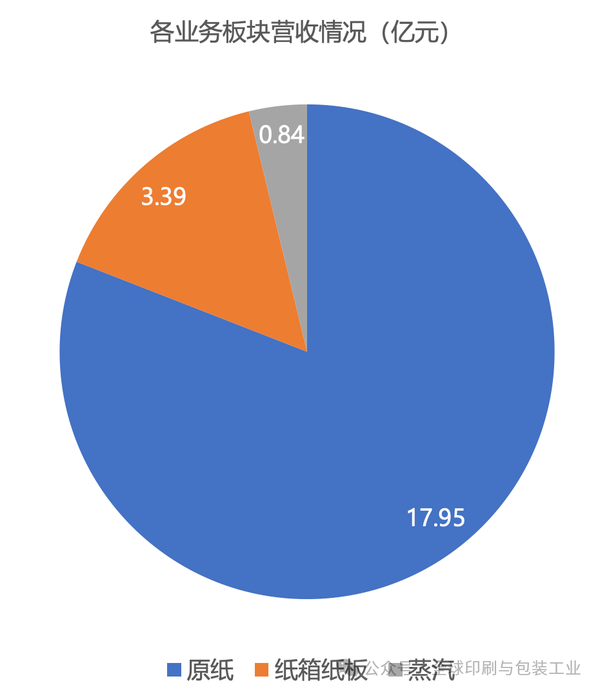

In terms of product categories, the paper business, including corrugated original paper, kraft linerboard, and high-density paperboard, remains the primary source of revenue, with total revenue reaching 1.795 billion yuan and a gross profit margin of 13.45%. In 2024, the total output of the original paper was 798,300 tons, with sales totaling 800,100 tons, representing a year-on-year growth of 0.91%. The average price of the original paper was 2,243.67 yuan per ton. By comparison, in 2024, the total output of white cardboard paper by Guanhao Hi-New was 690,369 tons, with sales totaling 632,830 tons, at an average sales price of approximately 6,066 yuan per ton, nearly three times that of the former. The significant disparity in both product prices and profitability reflects that the company still has room for improvement in its product structure and market positioning.

The revenue from corrugated cardboard is 339 million yuan, with a gross profit margin of 10.34%. In 2024, the production of corrugated cardboard is expected to be 199 million square meters, with sales reaching 191 million square meters, a year-on-year increase of 11.63%. The average price per square meter of corrugated cardboard is 1.71 yuan.

The majority of revenue comes from Jiaxing Rongsheng Packaging Materials Co., Ltd., which has a revenue of 298 million yuan and a net loss of 3.5973 million yuan. The second source is Anhui Rongsheng New Materials Technology Co., Ltd., with a revenue of 85.06 million yuan, also in a loss situation, with losses reaching 12.9564 million yuan. The poor profitability of these two companies severely drags down the overall profitability of the company. This may be related to factors such as intense market competition, ineffective cost control, or low operational efficiency, which need to be taken seriously by the company and effective measures should be implemented to reverse the situation.

The steam business generated revenue of 84.28 million yuan, with a gross profit margin as high as 52.61%. It is a strong profit-generating segment for the company, possibly due to the circular economy model such as waste heat recovery, aligning with environmental policy guidance. However, its revenue scale is relatively small.

In addition, the annual report shows that the sales to the top five customers amounted to 322,194,300 yuan, accounting for 14.41% of the total annual sales; the purchases from the top five suppliers totaled 1,118,275,800 yuan, accounting for 58.83% of the total annual purchases.

In terms of the 2025 business plan, Rongsheng Environmental Protection has proposed the "1+2+3+N" strategy, with "Year of Innovation Implementation" as the theme, focusing on three dimensions: market, production, and management, reflecting the company's clear planning and positive attitude towards future development.

First, optimize the industrial layout to solidify the foundation for development. Initiatives such as the construction of the headquarters building, upgrading the paper production base, renovating combined heat and power facilities, constructing projects funded by raised capital, and implementing intelligent upgrades aim to enhance the company's R&D capabilities, product competitiveness, operational efficiency, and sustainable development capacity.

Secondly, we will promote digital and intelligent transformation along with green upgrading. Through technological innovation, cooperation among industry, academia, and research, optimizing production processes, building industrial internet platforms, and deepening big data applications, the company is committed to achieving high-end, intelligent, and green transformation to enhance resource utilization efficiency and decision-making levels.

Finally, the company particularly emphasizes the dual-wheel drive of party building and talent development, indicating that the company attaches great importance to the leading role of party building and the construction of the talent team, which is crucial for the long-term stable development of the enterprise.

Clearly, Rongsheng Environmental Protection has a clear vision for its future development direction and strategic priorities, particularly in areas such as green environmental protection and intelligent transformation, where it has shown positive momentum. The challenge lies in effectively implementing various strategic measures to address the losses in its corrugated box and paperboard businesses, enhance the profitability of its original paper business, and tackle external risks such as market competition and fluctuations in raw material prices. These will be key issues that the company needs to focus on and resolve from 2025 onwards.

Overall, Zhejiang Rongsheng Environmental Protection achieved profit growth in 2024 through effective cost control and non-recurring gains, but the decline in revenue and the losses in the paper box and paperboard business cast a shadow over the company's future development. The company's proposed 2025 business plan outlines clear strategic directions, demonstrating a willingness to change positively. However, facing a complex market environment and challenges in its own business structure, whether Rongsheng Environmental Protection can truly achieve the goal of "steady progress and quality improvement" hinges on the effective implementation of its strategy and successful turnaround of its loss-making businesses.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track