Shenzhen Inovance Technology Co., Ltd. (stock code: 300124.SZ), a leading company in domestic industrial automation, delivered an impressive quarterly report despite a high base in performance. According to the third-quarter report released on October 24, the company's revenue and net profit growth rates both exceeded 20%. However, the market seemed dissatisfied, with the company's stock price dropping more than 3% during intraday trading.

Some signals have raised investor caution—Inovance Technology's performance does not exhibit obvious seasonal characteristics, yet the company's revenue and net profit both declined quarter-over-quarter in the third quarter of this year. The company's three core businesses remain robust, but the relatively lower gross profit margins of the new energy vehicle and rail transit businesses, whose revenue contribution continues to increase, have dragged down Inovance Technology's overall gross profit margin. Analysts point out that amid the pressure on traditional strong businesses such as general automation and smart elevators, the progress of Inovance Technology's cultivated future growth curves—internationalization, AI, humanoid robots, and other strategic businesses—will be key to whether the company can achieve high growth (over 30%).

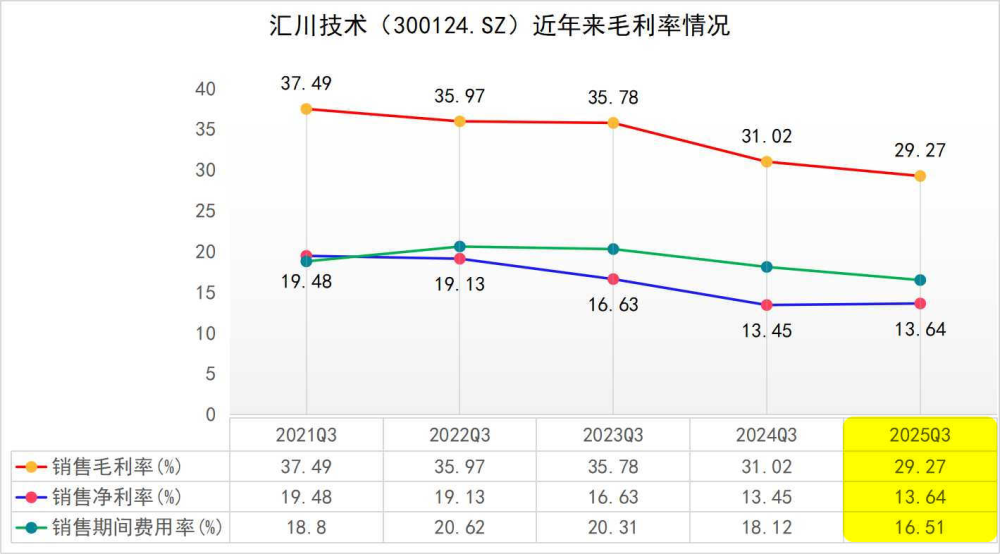

The overall gross profit margin dropped to 29.27%.

The proportion of revenue from new energy vehicle business has increased to 47%.

Over the past five years, Inovance Technology has achieved a "triple jump" from a single frequency converter manufacturer to a leader in general automation and then to a dual-driven platform of new energy and robotics. The company has established four major competitive advantages: technology, channels, production capacity, and customers. The company's revenue increased from 11.511 billion yuan in 2020 to 37.041 billion yuan in 2024, with a compound annual growth rate of approximately 34%, far exceeding the industry average of around 8%. The net profit attributable to the parent company increased from 2.1 billion yuan to 4.285 billion yuan, with a compound annual growth rate of 19.4%. During this period, the overall net profit margin was lowered due to the rise in raw material prices, price wars, and the expansion of the new energy business, but economies of scale still maintained double-digit profit growth.

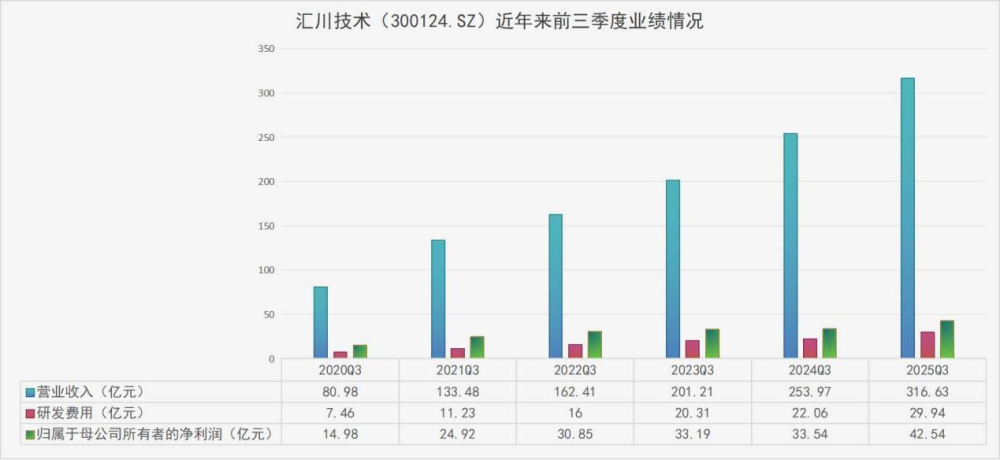

Overall, the company has maintained steady growth in performance this year. From January to September, Inovance Technology achieved operating revenue of 31.663 billion yuan, an increase of 24.67% year-on-year; net profit attributable to shareholders of the listed company was 4.254 billion yuan, an increase of 26.84% year-on-year; net profit attributable to shareholders of the listed company, excluding non-recurring gains and losses, was 3.888 billion yuan, an increase of 24.03% year-on-year. Specifically, from July to September this year, the company achieved operating revenue of 11.153 billion yuan, an increase of 21.05% year-on-year, a decrease of 3.28% quarter-on-quarter; net profit attributable to shareholders of the listed company was 1.286 billion yuan, an increase of 4.04% year-on-year, a decrease of 21.87% quarter-on-quarter.

In terms of business segments, general automation, new energy vehicles, and smart elevators are the three core businesses of Inovance Technology. Among them, the new energy vehicle business (according to the company's definition, combining the revenue of new energy vehicles and rail transit) has been the main driver of performance growth for Inovance Technology in the past two years. The company began its venture into automotive electronics in 2008, undergoing a complete development cycle of "business unit incubation → loss-bearing pressure → independent operation → blockbuster targeting → global expansion." In 2024, the new energy vehicle business (i.e., "new energy vehicles and rail transit," hereafter the same) achieved an operating revenue of 16.642 billion yuan, accounting for 44.93% of the company's total revenue for the period, surpassing the revenue share of "general automation" for the first time (41.15%).

In the first three quarters of this year, the company's new energy vehicle business achieved sales revenue of approximately 14.8 billion yuan, a year-on-year increase of about 38%, with the revenue proportion rising to 47%. However, due to the relatively low gross profit margin of the new energy vehicle business (17.45% in the first half of this year), as the revenue proportion of this business increases, the company's overall gross profit margin has declined instead. In the first three quarters of this year, the company's sales gross profit margin was 29.27%, the lowest since 2017.

Figure: Gross Margin Situation of Inovance Technology in Recent Years Source: Wind Chart: Guo Xinzhi

In the first three quarters of this year, Inovance Technology's general automation (including industrial robots) business achieved sales revenue of approximately 13.1 billion yuan, a year-on-year increase of about 20%. Among them, general frequency inverter products achieved sales revenue of approximately 4.05 billion yuan, general servo systems achieved sales revenue of approximately 5.34 billion yuan, and PLC & HMI achieved sales revenue of approximately 1.29 billion yuan; industrial robots (including precision machinery) achieved sales revenue of approximately 870 million yuan. The smart elevator business achieved sales revenue of approximately 3.6 billion yuan, remaining essentially flat year-on-year.

Graph: Business Segments of Inovance Technology Source: Company Announcements Chart by: Guo Xinzhi

Nurturing new growth poles and fully expanding overseas markets.

According to Wind data, since its listing on September 28, 2010, Inovance Technology has raised a total of 5.61 billion yuan in direct financing, including 1.941 billion yuan from its initial public offering and 3.669 billion yuan from private placements. The company has achieved a cumulative net profit of 30.299 billion yuan and has paid out 7.945 billion yuan in cash dividends, with a dividend-to-financing ratio of 141.62%. As of October 24, Inovance Technology's total market capitalization is 212.1 billion yuan.

The company's growth from a champion in a single track to a leading company in industrial automation is inseparable from its continuous expansion in technology and products. From January to September this year, the company's R&D expenses totaled 2.994 billion yuan, an increase of 35.74% year-on-year, mainly due to the increase in R&D personnel, employee compensation expenses, and travel expenses; the increase in R&D projects, as well as material costs and testing certification fees.

Chart: Revenue and R&D Expenses of Inovance Technology in Recent Years Source: Wind Chart by: Guo Xinzhi

From a technical perspective, since its establishment, Inovance Technology has extended from a single product of frequency converters to servo systems, and then to products such as electric control and drive systems for new energy vehicles. This extension is fundamentally based on power electronics technology, motor drive, and control technology, forming different product forms to meet the needs of various industries. From the client side, the company has evolved from originally offering frequency converters, servo systems, and PLCs, to incorporating robots, vision products, sensors, precision machinery, and pneumatic products. By combining these with the company's existing advantageous products and technologies, it accelerates product expansion and application, providing clients with comprehensive solutions involving multiple products.

In recent years, the company has established a future growth curve around strategic businesses such as internationalization, digitalization, energy management, AI, and humanoid robots.

In terms of global, in 2024, the company's overseas business revenue is expected to be approximately 2 billion yuan, a year-on-year increase of 17%, accounting for about 6% of the company's total operating income. Currently, the scale of the company's overseas business is still relatively small. Recently, during an investor survey, the company indicated that it hopes to continuously increase the proportion of overseas business in the future. Based on the set internationalization goals, the company is currently focusing on several areas in the overseas market: after 20 years of cultivation in the Chinese market, the company has experienced rapid growth and established a strong leading brand image in China. Based on its international strategy, the company needs to intensify efforts to promote the brand building of Huichuan in international markets; rapidly establish an international platform that includes sales, R&D, and supply chain; leverage customized solutions in the industry and the accumulated collaboration with multinational companies in the Chinese market to firmly pursue a strategy of exporting solutions, delivering advantageous solutions in various niche areas to the overseas branches of multinational clients.

In the field of humanoid robots, based on the company's in-depth insights, analysis, and preliminary research on the humanoid robot industry chain, and leveraging the company's technological accumulation in key areas such as motion control, servo drives, linear guides, and ball screws, the company has been steadily conducting R&D and exploration work in the humanoid robot field since the beginning of this year. By the end of September 2025, the company officially showcased humanoid robot-related component products at the China International Industry Fair, including a seven-degree-of-freedom bionic arm, planetary joint actuators, linear actuators, frameless torque motors, low-voltage DC drives, and planetary roller screws. Furthermore, the company will provide scenario-based products and solutions for customers based on manufacturing scenarios and actual customer needs. In the field of humanoid robots, the company will continue to leverage the advantages of industrial scenarios and adhere to strict industrial product development processes to create highly competitive core components and scenario-based solutions.

With the development of INVT's strategic business, the company is expected to add new growth drivers, and the growth rate is likely to return to previous levels.

On October 24, Huichuan Technology closed at 78.38 yuan per share, a decrease of 1.10%. Despite the drop in stock price, Chioce data indicates that as of October 20, the number of shareholders of Huichuan Technology was 143,200, continuing to decrease from 10,000 on October 10, which suggests that the company's secondary market chips are becoming more concentrated.