Revenue Nears 3.8 Billion With 20% Growth, But Net Profit Drops 15%: CNNC Titanium Dioxide Faces Industry Pressure While Advancing New Energy

China Nuclear Huayuan Titanium Dioxide Co., Ltd. (stock code: 002145, referred to as "China Nuclear Titanium Dioxide") recently released its semi-annual report for 2025. During the reporting period, amidst the overall price decline and increased cost pressures in the titanium dioxide industry, China Nuclear Titanium Dioxide achieved stable revenue growth by expanding its sales scale and exploring new energy materials business. However, its profitability was somewhat squeezed.

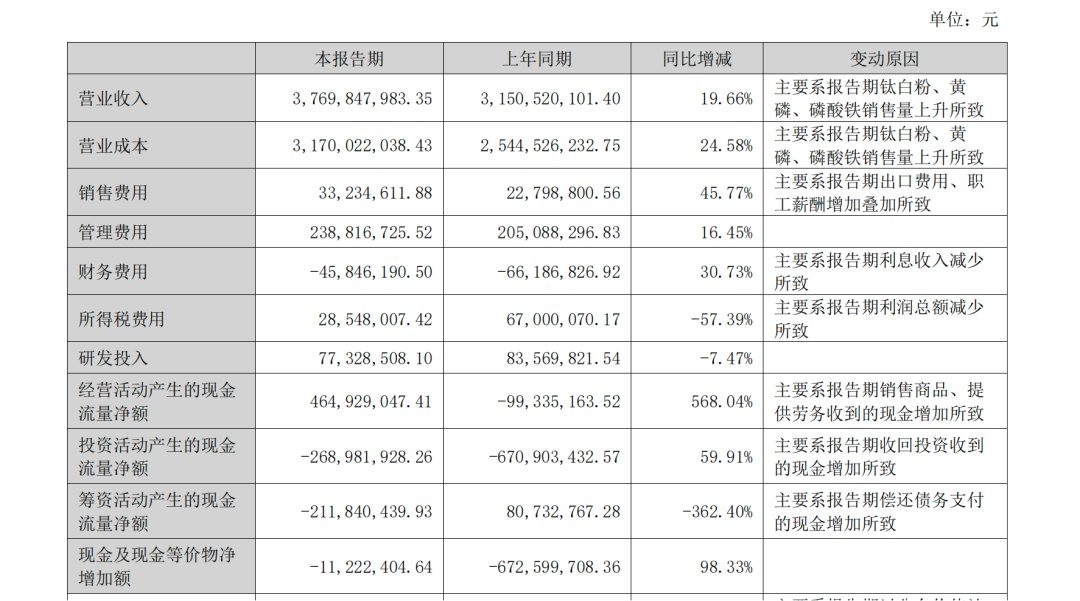

From January to June 2025, CNNC Hua Yuan Titanium Dioxide Co., Ltd. achieved a total operating revenue of 3.77 billion RMB, representing a 19.66% increase from the 3.151 billion RMB in the same period last year. The net profit attributable to shareholders of the listed company was 259 million RMB, a decrease of 14.83% year-on-year; with the net profit after deducting non-recurring gains and losses amounting to 220 million RMB, down 12.92% year-on-year. Profitability has declined, with basic earnings per share at 0.0711 RMB and a weighted average return on equity of 2.14%, a decrease of 0.41 percentage points compared to the same period last year.

It is worth noting that the net cash flow generated from operating activities of CNNC Titanium Dioxide has improved significantly, rising from -99.3352 million yuan in the same period last year to 465 million yuan in the current period, a year-on-year increase of 568.04%, mainly due to increased cash received from sales of goods. As of June 30, 2025, CNNC Titanium Dioxide's total assets amounted to 19.988 billion yuan, an increase of 2.65% compared to the end of the previous year; net assets attributable to shareholders of the listed company were 12.058 billion yuan, remaining basically unchanged from the previous year.

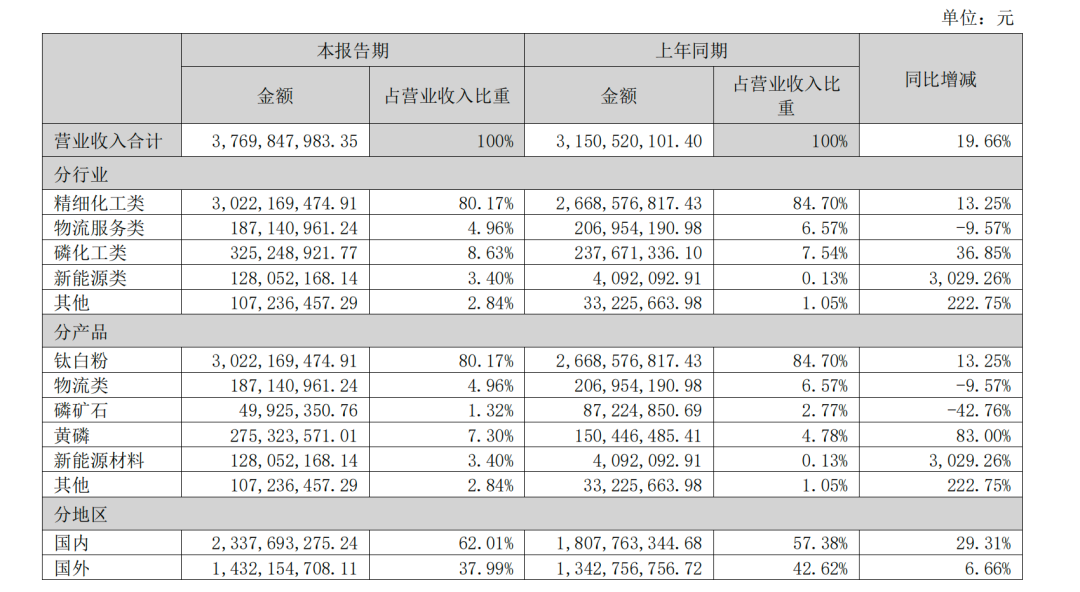

From a business structure perspective, CNNC Titanium Dioxide's revenue mainly comes from five major segments. Among them, the fine chemicals segment (titanium dioxide) remains the core product, still holding an absolute dominant position, with revenue of 3.022 billion yuan in the first half of the year, accounting for 80.17% of the total and a year-on-year increase of 13.25%. The phosphorus chemical segment recorded revenue of 325 million yuan, accounting for 8.63%, with a year-on-year growth of 36.85%. The new energy segment achieved revenue of 128 million yuan, accounting for 3.40%, with a remarkable year-on-year surge of 3029.26%. The logistics services segment generated revenue of 187 million yuan, accounting for 4.96%, experiencing a year-on-year decline of 9.57%. Other businesses brought in revenue of 107 million yuan, accounting for 2.84%, with a year-on-year increase of 222.75%. It is evident that new energy materials (such as lithium iron phosphate) and phosphorus chemical products (yellow phosphorus, phosphate ore) are becoming new growth drivers for the company.

In terms of capacity layout, CNNC Titanium Dioxide relies on five major production bases located in Jiayuguan and Baiyin in Gansu, Ma'anshan in Anhui, Kaiyang in Guizhou, and Panzhihua in Sichuan, forming a complete industrial chain layout and resource allocation capability. It has currently established an annual production capacity of nearly 550,000 tons of titanium dioxide, 500,000 tons of phosphate ore, 120,000 tons of yellow phosphorus, and 100,000 tons of ferric phosphate. The ongoing "sulfur-phosphorus-iron-titanium" green circular industry project is also expected to further consolidate its integrated cost advantage.

The core advantages of CNNC Titanium Dioxide in the industry mainly lie in technology, resources, and circular economy. Its predecessor was the Titanium Dioxide Division of China National Nuclear Corporation 404 Plant, hailed as the "Whampoa Military Academy" of the titanium dioxide industry. Through years of technology assimilation and innovation, it has achieved large-scale and low-cost production capabilities. In terms of raw material assurance, it has established long-term exclusive supply partnerships with suppliers for key raw materials like titanium concentrate, and the sulfuric acid is sourced from by-products within the industrial park, effectively reducing outsourcing costs. Regarding brand and customer resources, the "Jinxing" and "Taihua" trademarks have high recognition both domestically and internationally, with clients including industry leaders like Nippon Paint, and export business accounting for 37.99%. In terms of circular economy layout, it has achieved resource utilization of waste by-products through a "sulfur-phosphorus-iron-titanium" horizontal integration industry chain, and has extended upstream by acquiring phosphate mines to create a cost-competitive barrier.

Despite this, CNNC Hua Yuan Titanium Dioxide Co., Ltd. still faces industry challenges. In the first quarter of 2025, the price of titanium dioxide rose due to multiple factors, but it continuously declined in the second quarter as both domestic and international demand remained weak, causing the overall market to weaken steadily. CNNC Hua Yuan Titanium Dioxide Co., Ltd. admits to facing four major risks: overcapacity pressure from intensified market competition, fluctuations in the prices of key raw materials, volatility in titanium dioxide sales prices, and slower-than-expected progress in new energy projects investments. In response, CNNC Hua Yuan Titanium Dioxide Co., Ltd. is actively addressing these issues by increasing R&D investment, utilizing financial tools to hedge against exchange rate risks, and optimizing procurement and sales pricing mechanisms.

In addition, in the first half of the year, several strategic actions by CNNC Titanium Dioxide also drew attention: signing a strategic cooperation agreement with Nippon Paint to establish a strategic procurement relationship for titanium dioxide from 2025 to 2027; terminating part of the fundraising projects for "water-soluble monoammonium phosphate" and "annual production of 500,000 tons of iron phosphate," with the remaining raised funds permanently supplementing working capital; launching a share repurchase plan, intending to use 300 to 500 million yuan to repurchase shares for employee stock ownership or equity incentives; extending the duration of the employee stock ownership plan to align with the long-term interests of the core team. Overall, in the first half of 2025, while CNNC Titanium Dioxide maintained steady growth in the titanium dioxide main business, its phosphorus chemical and new energy businesses have become the second and third growth drivers. Although short-term net profit showed a decline due to the downturn in the industry cycle, the company's cash flow significantly improved, capacity layout was clear, and the advantages of the circular economy continued to strengthen.

In the future, as industry capacity gradually clears out, demand marginally recovers, and capacity is released and new clients are acquired in the field of new energy materials, CNNC Titanium Dioxide is expected to find new growth opportunities at the intersection of chemicals and new energy. However, whether the company can achieve a rebound in profitability under the dual drivers of "titanium dioxide + new energy" remains a point of ongoing interest for the market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track