Revenue exceeds 400 billion yuan for the first time! Midea announces generous dividends, executives' salary list exposed.

Guide: Air conditioning remains Midea's leading business. This year, Midea aims to achieve incremental growth through direct user engagement, overseas independent brands, and ToB business.

Author | Wang Zhen, Yicai

Midea Group (000333.SZ) achieved a record high in 2024 with revenue surpassing 400 billion yuan for the first time, announcing a dividend plan of 3.5 yuan (tax included) per 10 shares, totaling up to 26.7 billion yuan. Recently, Midea Group's Vice President and President of the Home Air Conditioning Division, Zhao Lei, who has recently emerged on social media, had a salary last year that was again higher than that of Midea Group's Chairman and President, Fang Hongbo.

Chairman and President of Midea Group Fang Hongbo

According to its annual report released on the evening of March 28, Midea Group achieved a revenue of 407.1 billion yuan in 2024, a year-on-year increase of 9.43%; net profit attributable to the parent company was 38.5 billion yuan, up 14.28%; cash flow from operating activities was 60.5 billion yuan, an increase of 4.51%; the weighted average return on equity was 21.29%, a decrease of 0.94 percentage points.

According to data from customs and AVC, China's home appliance exports reached 712.2 billion yuan last year, a 15.4% increase, while domestic home appliance sales (excluding 3C products) benefited from the trade-in policy in the second half of the year, reaching 907.1 billion yuan, a 6.4% growth. Additionally, GGII data shows that domestic industrial robot sales in 2024 were 302,000 units, a 4.5% decline. Under these circumstances, Midea focused on its core business, increased R&D investment, improved operational efficiency, and achieved success in overseas development.

From a business perspective, Midea Group's revenue from new energy and industrial technology, as well as smart home, grew rapidly last year. Smart home revenue reached 269.5 billion yuan, increasing by 9.41%; commercial and industrial solutions (ToB business) revenue was 104.5 billion yuan, up by 6.87%. Within the ToB business, revenue from new energy and industrial technology was 33.61 billion yuan, growing by 20.58%; smart building technology revenue was 28.47 billion yuan, increasing by 9.86%; robotics and automation revenue was 28.7 billion yuan, decreasing by 7.58%.

Photo provided by the interviewee.

Although Midea Group did not disclose the revenue of its segmented businesses such as air conditioners, refrigerators, washing machines, and small appliances in its smart home revenue as it did in previous years, a home appliance distributor in South China told First Finance that Midea currently leads among all brands in terms of home appliance sales revenue, with air conditioners accounting for half of it. Zhao Lei recently revealed that Midea's total domestic and overseas sales of home air conditioners will exceed 70 million units for the first time in 2024. It is evident that home air conditioners remain the leading business of Midea Group.

In terms of region and sales model, last year, Midea Group's overseas revenue growth rate was higher than its domestic revenue growth rate, and online growth rate was higher than offline growth rate. Domestic revenue was 238.12 billion yuan, up 7.68%, accounting for 58%; overseas revenue was 169 billion yuan, up 12%, accounting for 42%. Online revenue was 85.6 billion yuan, up 11%; offline revenue was 321.5 billion yuan, up 9%.

Midea Group's 2024 dividend payout has reached a new high, increasing from 30 yuan per 10 shares (tax included) last year to 35 yuan per 10 shares (tax included). The total annual dividend will also rise from 20.78 billion yuan last year to 26.7 billion yuan. Additionally, Midea Group plans to implement two cash dividends annually from 2025 to 2027. Furthermore, Midea Group intends to spend no less than 5 billion yuan and no more than 10 billion yuan within one year to repurchase A-shares, with a repurchase price not exceeding 100 yuan per share, of which 70% will be used for cancellation.

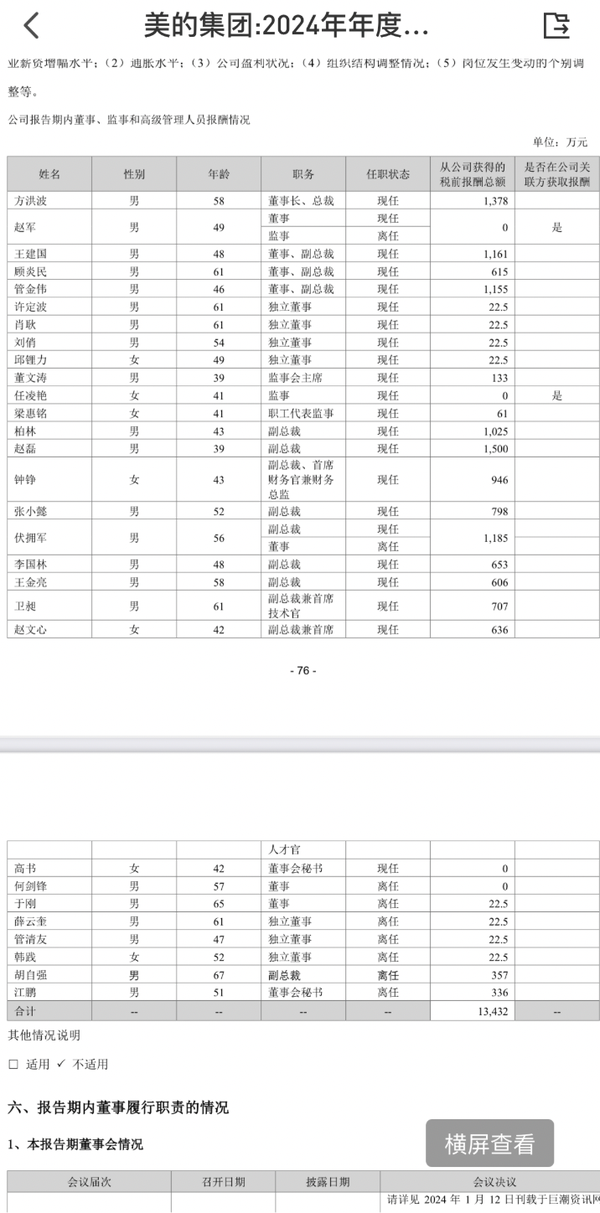

To stimulate internal entrepreneurship, some of the shares repurchased by Midea Group will be used for an equity incentive plan or employee stock ownership plan. Yicai Financial News has noted that in 2024, six senior executives at Midea Group continue to earn over 10 million yuan, with Fang Hongbo, Chairman and President of Midea Group, earning 13.78 million yuan. Zhao Lei, Vice President and President of the Home Air Conditioning Business Division, earns 15 million yuan, which is again higher than Fang Hongbo, but the salary gap between them has narrowed from 1.94 million yuan to 1.22 million yuan. Additionally, Fang Hongbo currently holds 1.53% of Midea Group's shares and is the fifth largest shareholder of the company.

Midea's senior management has recently undergone some adjustments. Fu Yongjun, director and vice president of Midea Group, whose annual salary was 11.85 million yuan last year, resigned from his director position on March 28 but retained his vice president position; on the same day, Gao Shu replaced Jiang Peng as the new secretary of the board of directors of Midea Group.

According to AVC's forecast, due to partial demand being exhausted, China's domestic home appliance retail sales this year are expected to only see a slight year-on-year increase. At the same time, China's exports this year also face more uncertainties. In response, Midea will achieve incremental growth this year through domestic DTC (direct-to-consumer) transformation, overseas OBM (own brand manufacturing) prioritization, and breakthroughs in ToB business. Additionally, the company plans to use no more than 16 billion yuan for hedging against bulk raw materials such as copper and will conduct foreign exchange derivative business within a balance limit of 37 billion USD.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track