Revenue and net profit surge in q1 2025! chemical industry leader goes public in hong kong

On July 29, 2025, Binhu Chemical Co., Ltd. (601678.SH), a leading domestic chlor-alkali chemical company, announced that it is formally planning to issue H-shares overseas and list them on the Hong Kong Stock Exchange. Meanwhile, the company is in discussions with relevant intermediaries regarding the specific progress of this H-share listing, and relevant details have not yet been determined.

Who is Binhua Co., Ltd.?

Binhua Co., Ltd. was established in 1968 and listed on the Shanghai Stock Exchange in 2010. The company has five major business divisions: chlor-alkali, petrochemical, specialty chemicals, new materials, and new energy. It is the largest supplier of propylene oxide and oilfield additives in China, the largest supplier of trichloroethylene in the country, and an important producer of caustic soda products.

Caustic soda is widely used in industries such as light industry, chemical, textile, metallurgy, pharmaceuticals, and petroleum. According to statistics, by the end of 2024, China's total caustic soda production capacity will amount to 50.1 million tons. Among these, Binhuashares has a caustic soda production capacity of 610,000 tons, ranking among the top in Shandong Province. At the same time, Binhuashares is the largest producer of granular caustic soda in China, and its flake caustic soda production capacity holds a leading position in Shandong Province.

In terms of propylene oxide, as a bulk chemical raw material, its end products are mainly used in fields such as furniture, automobiles, construction, and industrial insulation. According to statistics, the global production capacity of propylene oxide in 2024 is 17.925 million tons, with domestic capacity accounting for approximately 8.16 million tons. Currently, Binhu Chemical has a production capacity of 510,000 tons, accounting for about 6.25% of the domestic capacity, ranking among the top in the country in terms of commercial volume.

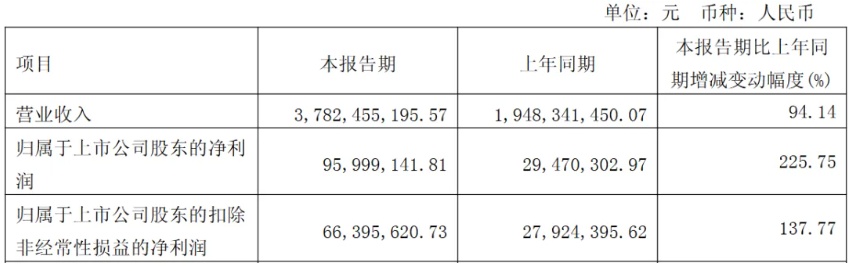

In the first quarter of 2025, Binhu Chemical's revenue was 3.782 billion yuan, representing a year-on-year increase of 94.14%. The net profit was 96 million yuan, a significant year-on-year increase of 225.75%. The strong recovery in performance provides strong support for the company's listing in Hong Kong.

This H-share listing plan is regarded as an important measure by Binhu Chemical to respond to the national "dual circulation" strategy and expand into overseas markets. Through the Hong Kong capital platform, Binhu Chemical is expected to further enhance its international brand influence, optimize its financing structure, and provide financial support for the implementation of subsequent overseas projects.

Why did Binhua Co., Ltd. choose to go to Hong Kong at this time?

Zhuanshi Vision believes that Binhu Chemical's decision to choose a listing in Hong Kong is based on the following considerations:

1. Capital requirements during industry transformation period

The chlor-alkali industry in China is transitioning from traditional manufacturing to high-end and green development. Binhua Co., Ltd. also aims to establish a high-end electronic chemical base in northern China, a "new energy + chemical" zero-carbon demonstration park, a green low-carbon circular economy industrial park, and a new chemical materials industrial base, promoting the digitalization of the industry.

These projects have high technical barriers and long investment cycles; H-share financing can alleviate funding pressure.

2. Seizing international market share

In 2024, the global propylene oxide production capacity will reach 17.925 million tons, with China accounting for 45.5%. However, the overseas market is still dominated by companies such as Dow and BASF. Binzhou Chemical is testing the waters overseas through a $300 million "new energy + chemical" integrated project in Egypt (including green chlor-alkali and solar power plants). Its listing in Hong Kong will strengthen its influence over the international supply chain.

3. The Endorsement Effect of Technological Upgrades

Over the years, the company has been deeply involved in the chlor-alkali chemical industry, consistently striving to strengthen the industrial chain. It has established and put into operation the world's first industrialized oxygen cathode ion membrane electrolyzer, built the country's first trichlorethylene device transitioning from batch to continuous production, and possesses the nation's first large-scale industrialized granular caustic soda unit, breaking the monopoly of foreign technology. The high-salinity wastewater generated by the glycerol-based epichlorohydrin plant is treated using catalytic wet oxidation to degrade TOC, making it the first company in the country to realize the reuse of treated high-salinity wastewater in ion membrane caustic soda plants.

On June 29, 2025, the company's chlorohydrin process for producing propylene oxide with calcium saponification successfully passed the expert evaluation organized by the China Chlor-Alkali Industry Association, becoming the first domestic enterprise to pass the verification for the chlorohydrin process of propylene oxide production. Listing on the H-shares market will help showcase its technological strength to international investors and attract ESG-themed funds.

On June 29, Binhu Chemical Group's calcium-based saponification process for the chlorohydrin method of propylene oxide successfully passed the expert review organized by the China Chlor-Alkali Industry Association, becoming the first chlorohydrin method propylene oxide production enterprise in China to pass the verification (Image source: Binhu official website).

4. Avoid single market risk

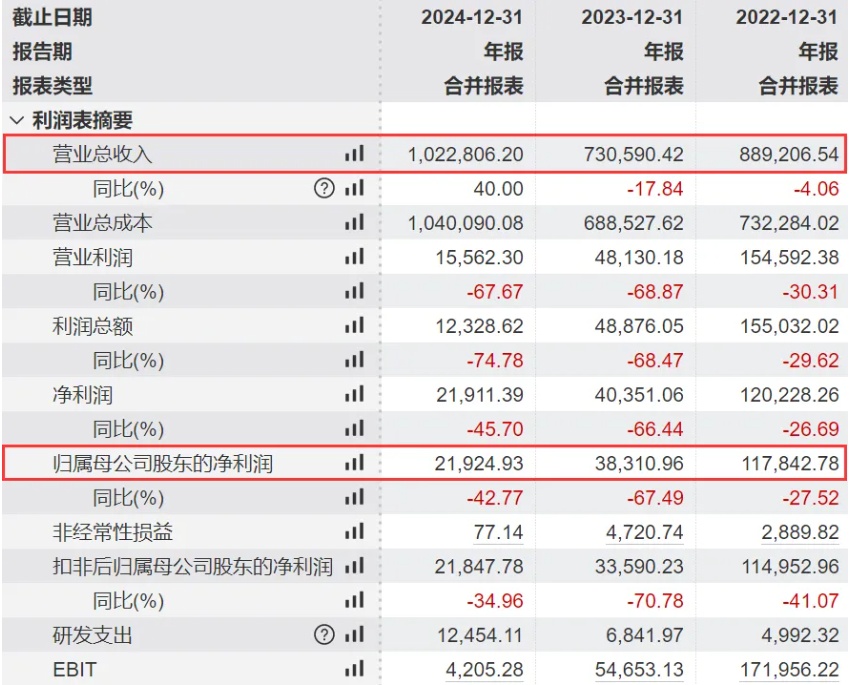

From 2022 to 2024, Binhuacheng’s net profit attributable to shareholders fluctuated from 1.178 billion yuan to 219 million yuan, significantly affected by the domestic chemical industry cycle. A Hong Kong listing platform can help diversify risks and leverage international pricing mechanisms to enhance valuation.

Image source: Wind

Summary of Recent Major Actions of Binhua International

Ambitious BinHua International has been expanding its global and high-end presence in recent years.

In August 2024, Binhu Chemical Co., Ltd. announced the first public notice of the environmental impact assessment for its 1,000-ton/year polymethyl methacrylate (PMMA) pilot project, marking its entry into the PMMA industry.

In April 2025, BinHua Co., Ltd. signed an investment agreement with the Suez Canal Economic Zone Authority of Egypt to launch an integrated "new energy + chemical" project with a total investment of $300 million. The project plans to build a green chlor-alkali plant with an annual capacity of 300,000 tons and a supporting 50MW solar power plant. It will become Egypt's first zero-carbon chemical demonstration project. The signing ceremony was held in Cairo, attended by Egypt's Minister of Industry, who delivered a speech stating that the project will drive the upgrading of Egypt's chemical industry chain and is expected to create approximately 800 jobs. BinHua Co., Ltd. stated in the announcement that this project is the first step in the company's overseas strategy, with plans to be completed and operational by 2026.

Source of image: Middle East Hot Land

On the eve of the official launch of propylene futures and options by the Zhengzhou Commodity Exchange, Binhu Chemical, leveraging its keen market insight and strong sense of industrial responsibility, took the lead in submitting an application to become a designated delivery plant warehouse for propylene, making it one of the first chemical enterprises in China to actively embrace this financial innovation. On July 18, Binhu Chemical successfully obtained the qualification as a delivery plant warehouse, and on July 22, as a designated representative and a key propylene producer in Shandong Province, was invited to attend the listing ceremony for propylene futures and options. As an important propylene producer in Shandong, Binhu Chemical has an annual production capacity of 600,000 tons, with stable product quality and well-developed storage and logistics facilities. With the delivery plant warehouse qualification, Binhu Chemical can make better use of financial instruments to manage price risks and further enhance its influence in the regional propylene market.

Source: BinHuaRen

The Phase I project of the Northern High-end Electronic Chemicals Base, invested and constructed by Binhua Co., Ltd., is also noteworthy. Located in Binzhou, Shandong, this project primarily produces key materials for semiconductors, such as ultra-high purity electronic-grade hydrofluoric acid and electronic-grade sulfuric acid, with a designed annual capacity of 50,000 tons. The Phase II project is planned to commence by the end of 2025, adding new product lines such as electronic-grade ammonia.

From the shores of Bohai to the Hong Kong capital market, BinHua Co., Ltd.'s listing in Hong Kong is not only a means of financing but also a microcosm of the advancement towards high-end and globalization of China's chemical industry. As the "dual carbon" goals progress, its technological reserves and green initiatives may become the key assets attracting international investors.

Editor: Lily

Sources: Olefin Industry Innovation and Development Research Society, Securities Times Network, Binhuaren, Middle Eastern Hotspot, and other publicly available materials.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track