Restructuring and Upgrading! Chemical Giant Huntsman Plans Global Layoff of 10%

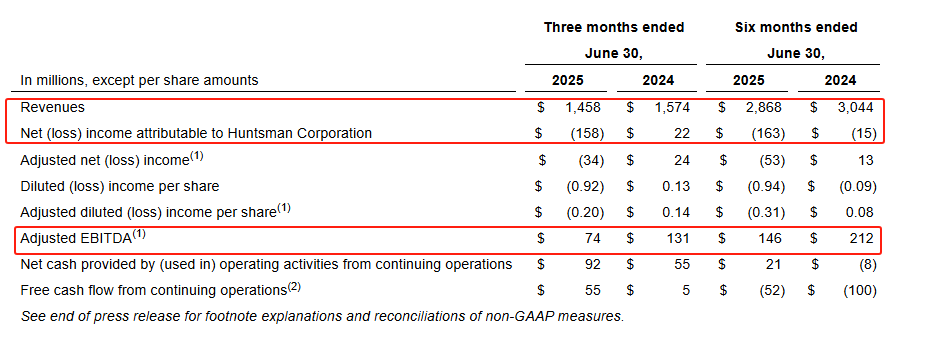

On July 31, Huntsman released its second-quarter and half-year financial results. Revenue for the first half of 2025 was $2.868 billion, down 6% year-on-year; net loss attributable to Huntsman was $163 million, compared to a net loss of $15 million in the same period last year; adjusted EBITDA was $146 million, down 31.1% year-on-year.

In the second quarter of 2025, revenue was $1.458 billion, down 7.4% year-on-year; net loss attributable to Huntsman was $158 million, compared to net income of $22 million in the same period last year; adjusted EBITDA was $74 million, a year-on-year decrease of 43.5%.

Chairman, President and Chief Executive Officer Peter R. Huntsman stated:

Due to the reduction in global construction and industrial activities putting pressure on our output, our second quarter performance was basically in line with expectations. The seasonal increase in construction demand that we usually see in the second quarter was weaker in 2025, and we believe this trend will not change significantly in the third quarter.

In view of the current returns, we have taken decisive measures to reduce costs and restructure, including the closure of the maleic anhydride plant in Moers, Germany, as well as other downstream plants in Europe and North America. The restructuring plan initiated at the end of 2024 will be further expanded in 2025, ultimately resulting in a nearly 10% reduction in our global workforce, with the largest layoffs occurring in the European region.

Through our cash management activities, we achieved positive cash flow in the second quarter. As we have stated in the past, while leading the company through the current environment, maintaining the balance sheet remains our top priority in addition to focusing on cash generation.

Huntsman reportedly has over 60 manufacturing, research, and operational facilities in about 25 countries/regions and employs approximately 6,300 people. This round of layoffs is expected to affect around 600 people. Huntsman's revenue from continuing operations in 2024 is approximately $6 billion.

Revenue from all business segments is unsatisfactory.

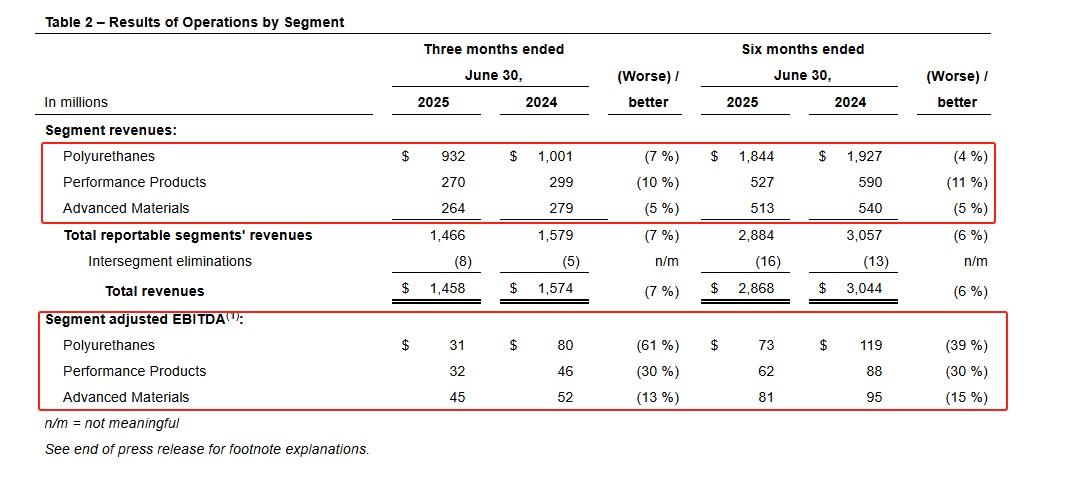

From the performance of Huntsman's various businesses, both revenue and adjusted EBITDA for the first half and the second quarter of 2025 declined year-on-year.

Polyurethane Business: Revenue for the first half of 2025 decreased by 4% year-on-year, and revenue for the second quarter decreased by 7% year-on-year, mainly due to declines in both average selling price and sales volume. The decrease in average MDI selling price was primarily caused by unfavorable supply and demand dynamics. The decline in sales volume was mainly due to reduced demand in construction-related markets, as well as the planned maintenance of the manufacturing plant in Rotterdam, the Netherlands, scheduled for the second quarter of 2025.The second quarterAdjusted EBITDA decreased year-on-year by61%,The impact was primarily due to a decrease in average selling prices, a decline in sales volume, a reduction in inventory, and a decrease in equity earnings from minority-owned joint ventures in China, but these effects were partially offset by a reduction in raw material costs and fixed costs.

Functional Product Business:Revenue in the first half of 2025 decreased by 11% year-on-year.In the second quarter, revenue decreased by 10% year-on-year, mainly due to a decline in sales volume. The average selling price remained relatively stable, as the decrease in price was largely offset by a favorable sales mix. The decline in sales volume was primarily due to reduced operating rates at the factory located in Moers, Germany, and a weak market environment, but it was partially offset by an increase in market share.The second quarterThe adjusted EBITDA decreased by 30% year-on-year, primarily due to a decline in sales revenue and the adverse impact of reduced inventory, but was partially offset by a decrease in variable direct costs and other fixed costs.

Advanced Materials Business: Revenue in both the first half and the second quarter of 2025 decreased by 5% year-on-year, in the second quarter.Adjusted EBITDA decreased by 13% year-over-year.The main reasons are the decrease in average selling price and the decline in sales. The decline in sales is mainly due to reduced demand in the coatings and aerospace markets.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track