"Recommendations for the 15th Five-Year Plan: Cultivating and Expanding Emerging Industries and Future Industries; International Oil Prices Fall; Plastic Futures Fluctuate Within a Narrow Range"

1. Overnight Crude Oil Market Dynamics

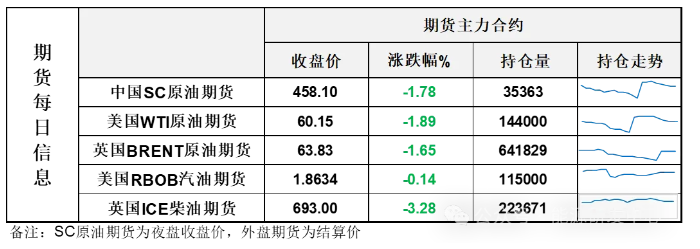

On October 28, the market focused on the continuation of the OPEC+ production increase plan, coupled with a still poor demand outlook, leading to a decline in international oil prices. NYMEX crude oil futures for the December contract fell by $1.16 per barrel to $60.15, a decrease of 1.89% compared to the previous period. ICE Brent crude oil futures for the December contract fell by $1.22 per barrel to $64.40, a decrease of 1.86% compared to the previous period. China's INE crude oil futures for the 2512 contract fell by 2.0 to 466.4 yuan per barrel, and the night session dropped by 8.3 to 458.1 yuan per barrel.

Market Outlook

Oil prices cooled significantly on Tuesday, with international oil prices experiencing a plunge shortly after the domestic afternoon closing. The Middle Eastern physical discount also quickly retreated again, resulting in a sharp drop in oil prices at the close and a noticeable decline at the beginning of the month. Clearly, concerns about supply due to sanctions on Russia are dissipating.

At the macro level, in the latter part of this week, there will be significant macro events such as the Federal Reserve's interest rate meeting and the meeting between Chinese and U.S. leaders. Prior to the meeting, there have already been some relatively optimistic news, which is expected to boost market sentiment and have a positive impact on oil prices. Meanwhile, concerns over sanctions on Russia have eased. The complex factors affecting oil prices mean that short-term fluctuations are still likely. In the medium to long term, the loss in supply is limited, and oil prices will still face pressure from oversupply. After a full rebound in oil prices has digested the positive factors, it is still likely that oil prices will be under downward pressure. During periods of high oil price volatility, it's important to maintain a proper sense of timing.

II. Macroeconomic Market Dynamics

1、U.S. Secretary of Commerce: Will sign a $490 billion investment agreement in Japan.

The U.S. government shutdown continues as the Senate rejects the temporary funding bill for the 13th time.

3、ADP released the national employment report, estimating that the average number of new jobs added over the four weeks ending October 11 was 14,250.

Israel claims that Hamas violated the ceasefire agreement and ordered multiple airstrikes on Gaza. Hamas denies violating the agreement and delayed the handover of hostage remains after the airstrikes. The United States says the ceasefire agreement remains valid.

Yesterday, the "CPC Central Committee's Recommendations on Formulating the 15th Five-Year Plan for National Economic and Social Development" was released. The recommendations propose cultivating and expanding emerging industries and future industries. It emphasizes accelerating the development of strategic emerging industry clusters such as new energy, new materials, aerospace, and low-altitude economy. It also aims to promote quantum technology, bio-manufacturing, hydrogen energy and nuclear fusion energy, brain-computer interfaces, embodied intelligence, and sixth-generation mobile communications as new economic growth points.

At a regular press conference hosted by Foreign Ministry spokesperson Guo Jiakun yesterday, a reporter asked if China plans to relax its export controls on rare earths in light of the upcoming trade agreement talks between the EU and Chinese delegations in Brussels, which will also discuss issues related to rare earths. Guo Jiakun stated that the essence of China-EU economic and trade relations is complementary advantages and mutual benefits. We hope the EU will adhere to its commitment to support free trade and oppose trade protectionism, refrain from taking restrictive measures at every turn, and instead resolve trade differences through dialogue and consultation. This will provide a fair, transparent, and non-discriminatory business environment for companies from all countries and take concrete actions to uphold market economy and WTO rules.

3. Plastic Market Dynamics

International oil prices have fallen, while domestic plastic futures are experiencing narrow fluctuations.

The plastic 2601 contract was quoted at 6984 yuan/ton, down 0.34% from the previous trading day.

The PP2601 contract is quoted at 6664 yuan/ton, down 0.18% from the previous trading day.

The PVC2601 contract is quoted at 4734 yuan/ton, up 0.15% from the previous trading day.

The styrene futures contract for 2512 was quoted at 6,467 yuan/ton, down 0.32% from the previous trading day.

4. Forecast of Today's Market Trend

PP:The supply-demand contradiction of polypropylene is difficult to alleviate, with limited market changes at the end of the month. In the short term, the high level of maintenance benefits still exists, but in the later period, there will be pressure from capacity release. On the demand side, the downstream performance during the peak season of "Silver October" is acceptable. However, under international trade barriers, market sentiment is cautious, and export orders will be restricted. It is expected that the polypropylene market will mainly undergo range-bound adjustments today, with the mainstream price of wire drawing grade in East China at 6,560-6,650 yuan/ton.

PE:In terms of cost, the support from crude oil prices is weakening. On the supply side, new production facilities are gradually coming online, leading to increased supply. Although there is an expectation of improvement in downstream operations and increased demand, overall, inventory pressure still exists. It is expected that polyethylene market prices will fluctuate slightly, with a range of 20-50 yuan/ton.

PVC:Recent disturbances in the PVC market are primarily concentrated on the cost transmission expected from the upstream black metals market and the impact of industry-related policies on price fluctuations. However, the peak for black metals has been reached, and the policy outlook is unfavorable, leading to a weak support trend in the market. From a fundamental perspective, PVC supply is recovering as the scale of maintenance decreases, while demand remains stable, increasing supply-demand pressure. The cost of the ethylene method is declining, while the cost of the calcium carbide method remains firm, intensifying competition in the ethylene-calcium carbide market. Overall, the PVC spot market continues to operate under pressure, with the price for calcium carbide method five-type cash in East China ranging from 4550 to 4680 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track