Rapid Surge in Polypropylene (PP) Production Capacity Floods Impact Market Prices

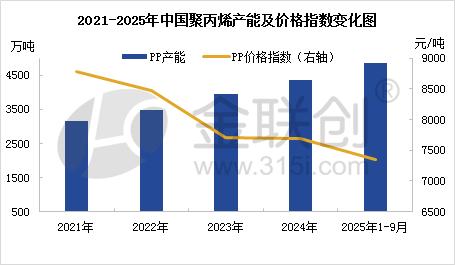

From 2021 to2025In [year], China's polypropylene (PPThe industry has entered a period of concentrated capacity release, with the scale of new capacity reaching a historic high. However, at the same time, the growth in demand has been relatively slow.PPThe price index continues to decline, and the supply-demand pattern has undergone significant changes.

Data source: JLC

Production capacity continues to grow rapidly, putting pressure on prices.

New capacity additions from 2021 to 2025 exceed2000 10,000 tons, average annual increase in production capacity400around ten thousand tons, with an average annual growth rate of11%The newly added capacity mainly comes from large private refining projects, with single-line capacity further increased to30-60Between ten thousand tons, Yulong Petrochemical190Ten thousand tons, Zhejiang Petrochemical Phase II90 Ten thousand tons, Jinneng Technology13510,000 tons per year, Zhongjing Petrochemical Phase II120 10,000 tons, Kingfa Sci. & Tech. Co., Ltd.8010,000 tons, Ningbo Daxie Petrochemical120Enterprises with an annual capacity of ten thousand tons; coal-to-olefin project, Inner Mongolia Baofeng15010,000 tons; additionally, the wholly-owned enterprise ExxonMobil Huizhou95Enterprises with a production capacity of ten thousand tons have been put into operation one after another.2025Annual new production capacity remains concentrated, as of9Month, newly added production capacity495.510,000 tons, the total domestic production capacity of polypropylene reached4864.5Ten thousand tons. Domestic polypropylene production capacity has seen explosive growth, and the import dependency rate has dropped to...10%The following, however, shows that the situation of oversupply is becoming increasingly evident.

Gold Union Innovation MonitoringPPFrom the perspective of the price index, in a situation of ample supply, the price index declines year by year. As of2025 9 PPThe average price index is7345 /tons, a year-on-year decrease352 /Ton, decrease4.57%。

2. Slowing demand growth and a clear imbalance between strong supply and weak demand

Data Source: JLC Network Technology

Although polypropylene has a wide range of applications, its apparent consumption growth rate is far lower than the speed of supply expansion. The growth rate of polypropylene apparent consumption has been slowing down year by year, with the growth rate shifting from...9% 3%Traditional demand remains weak, supported only by rigid demand. Traditional PP consumption industries such as plastic weaving and home appliances are experiencing sluggish growth, while high-end applications (such as automotive lightweighting and medical materials) have yet to fully fill the gap. The general-purpose materials face fierce competition among homogeneous products, and the economic slowdown has impacted the growth of orders in downstream industries. Demand for high-end series products has increased, but it is difficult to drive overall industry improvement.

3. The polypropylene industry will continue to face pressure in the future.

2021-2025PPThe market is showing a trend of "increasing volume without increasing profits."2025After the holiday, there are still over ten million tons of planned production capacity pending launch, but the actual implementation remains to be seen. Manufacturers need to break the deadlock through technological upgrades and demand innovation. In recent years, newly launched enterprises have mostly targeted high-end, high value-added products to enhance their own competitiveness. In the coming years, the industry may enter a period of intense consolidation, with the government introducing policies to counter excessive internal competition.”Measures such as "phasing out outdated production capacity" are being implemented to guide the industry towards healthy development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track