【PVC Weekly Outlook】Macro expectations remain highly uncertain, with the market expected to maintain weak volatility today.

One, Focus Areas

1. 3/28: Market concerns about the U.S. increasing tariffs and enhancing trade risks may lead to a global economic recession, causing international oil prices to fall. NYMEXCrude Oil FuturesThe May contract fell to $69.36, down $0.56 per barrel, with a sequential decrease of -0.80%; ICE Brent futures for May fell to $73.63, down $0.40 per barrel, with a sequential decrease of -0.54%. China's INE crude oil futures main contract for May fell by 1.7 to 541.7 yuan per barrel, and during the overnight session, it fell by 3.7 to 538 yuan per barrel.

2. Calcium Carbide: As of last Friday, the mainstream trading price in the Wuhai region remained stable at 2,700 yuan/ton, with smooth shipments from production enterprises. Procurement in the Sichuan region has gradually recovered, leading to increased regional demand. In the Wumeng area, rain and snow have caused road transport disruptions, exacerbating regional supply shortages. The situation is expected to continue today.Calcium carbide marketSteady adjustment and operation, with enhanced regional performance.

3, PVC: Last week, domesticPVC marketThe prices have shown a trend of rising followed by a decline, with the main driver still being the macro sentiment. However, the fundamental improvement in PVC is limited, and there is insufficient momentum for sustained market increases, leading to price consolidation after the rise. During the week, production fluctuations due to upstream company maintenance and load variations were not significant. Domestic demand was lukewarm, while foreign trade inquiry atmosphere was slightly better, with concentrated delivery of export orders in the market. As of March 28, the华东region's electricity method Type I prices ranged between 4900-5050 yuan/ton for spot cash warehouse withdrawal, while the ethylene method was between 5000-5200 yuan/ton.

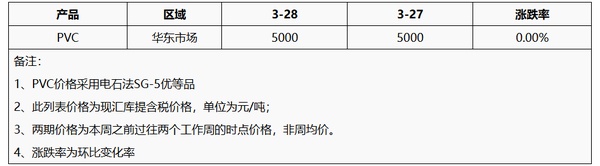

II. Price List

Market Outlook

This week, the number of maintenance shutdowns in PVC production plants remains low, and with the resumption of operations at plants that underwent maintenance last week, market supply is expected to increase. Domestic downstream demand is primarily driven by rigid needs, putting pressure on domestic supply-demand dynamics. Foreign trade is focused on fulfilling previous orders, which somewhat alleviates inventory pressure on the industry. Macroeconomic expectations remain highly uncertain, particularly regarding global tariff policies. The market is anticipated to maintain a weak and fluctuating trend today.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track