PVC Prices Surge Against Supply and Demand, PC and POM Continue to Hit New Lows

PVC prices surge against supply and demand trends, with policy becoming the biggest "driver"

Introduction: This week in ChinaPVC MarketPrices have risen sharply due to concerns over supply reductions stemming from black industry policies, leading to a notable increase in related sector prices during Tuesday afternoon trading and driving the market higher. However, the fundamental supply and demand imbalance in the PVC spot market persists, resulting in subdued market transactions. Nevertheless, short-term policy expectations continue to support the market sentiment, and PVC prices remain at elevated levels.

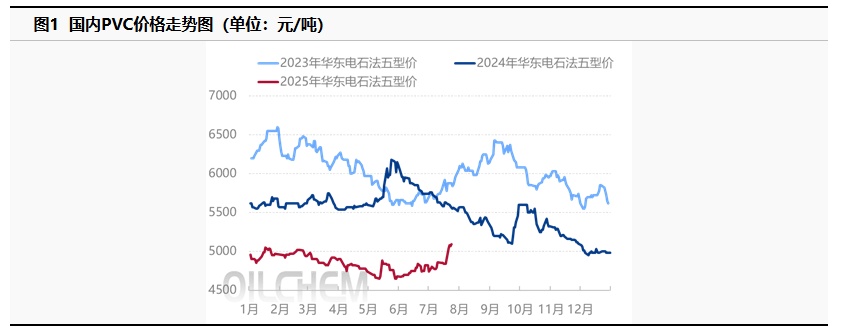

I. PVC Prices Soared During the Week

Recently, the domestic PVC market has continued its strong trend, but this week, policy-related positive information has been continuously released, from "anti-involution" to "eliminating outdated production capacity," consistently boosting market confidence. Consequently, PVC spot prices have risen accordingly. As the weekend approaches, intraday prices have fluctuated slightly up and down. However, considering that the current fundamentals of PVC still show weakness, the market is seeking to close deals at lower prices. In East China, the mainstream cash price for five-type calcium carbide method PVC with warehouse pickup is in the range of 5050-5150 yuan/ton, while the ethylene method price remains firm at 5900-5100 yuan/ton with self-pickup.

2. The domestic PVC supply and demand situation has slightly improved.

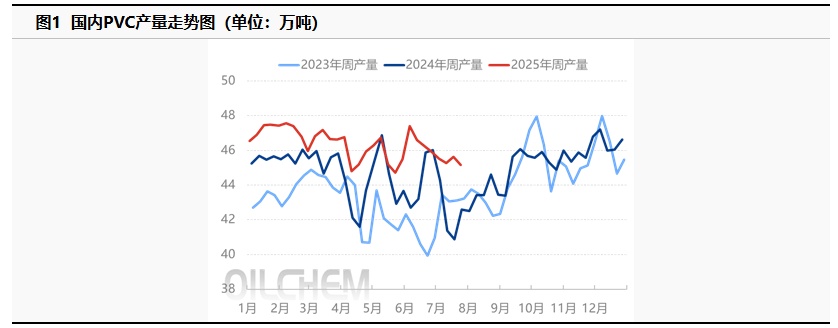

1、 Supply side slightly declines due to maintenance impact

Maintenance within the week slightly increased compared to the previous week, while domestic PVC supply decreased. This period's PVC production was 451,500 tons, down 25,600 tons from the previous period, a decline of 1.03%. The capacity utilization rate was 76.79%, down 0.80% from the previous period. The production decrease was mainly due to maintenance at Ordos Chlor-Alkali, Yidong Dongxing, Zhongtai Fukan, and Xinpu Chemical. Among them, ethylene-based production remained at a low level, primarily affected by the PVC operation decline at Xinpu Chemical’s vinyl chloride unit. Meanwhile, Qilu Petrochemical and Fujian Wanhua are still under maintenance and have not yet resumed, impacting ethylene-based PVC operation to remain low.

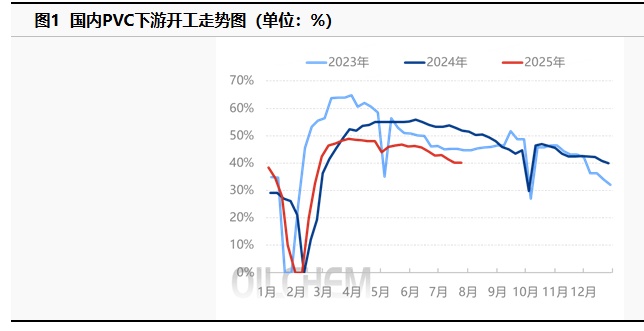

2 The demand side remains sluggish, but external demand expectations are improving.

Domestic demand: This week, the operating rates of major downstream pipe materials continue to decline, while the operating rates of profile materials temporarily remain stable, and the operating rates of other products are also relatively low. This week, the operating rate of domestic PVC pipe sample enterprises is at 32.52%, a decrease of 0.96% compared to the previous period. The domestic real estate market has been in a slump, and as the real estate industry is an important demand sector for PVC downstream, its weakness directly restricts the growth of PVC demand. Meanwhile, the southern region is experiencing the plum rain season, which not only hinders construction progress but also limits orders for downstream product enterprises, resulting in a continuous decline in operating rates within enterprises this week.

This week, the operating rate of domestic PVC profile enterprises was at 34.19%. During the week, the operating rate of profile enterprises decreased, mainly due to a reduction in orders for some profile enterprises, indicating a clear off-season demand in the industry. Looking at the subsequent order situation for enterprises, the domestic profile market faces both internal competition and substitution, with demand maintaining a competitive and declining pattern. Enterprises are mainly seeking future orders. From the perspective of the domestic real estate market, the door and window profile market is unlikely to see significant improvement. The overall focus for domestic profile growth is on exports and the development of special profiles.

External demand The export contracts expected to be signed this week are projected to slightly decline. This week's sample export orders from PVC production enterprises are expected to decrease by 14.29% compared to the previous week, reaching 26,000 tons. However, export prices have slightly increased, with the current FOB price at Tianjin Port ranging from $620 to $630 per ton. Some ethylene-based enterprises are performing relatively well in exports. This week, the Indian government announced that the anti-dumping duty decision would be delayed until September 25, giving exporters another window for concentrated exports. It is expected that there will be a rush to export in the future, which will continue to boost the PVC market. 。

3 Plant and warehouse inventories are decreasing, and social inventory

|

Figure 10 2024-2025 year PVC Social Inventory Change Chart (10,000 tons) |

Figure 11 2024-2025 Year PVC Enterprise Inventory Change Chart (10,000 tons) |

|

|

|

|

|

|

Data source: Longzhong Information |

Data source: Longzhong Information |

This week, according to new sample statistics, the social inventory of PVC increased by 3.97% week-on-week to 683,400 tons, a year-on-year decrease of 28.23%. Of this, inventory in East China was 625,100 tons, up 4.15% week-on-week and down 30.82% year-on-year; inventory in South China was 58,300 tons, up 2.01% week-on-week and up 19.79% year-on-year. The main reason for the increase in social inventory is that traders have recently concentrated on procurement, mainly for delivery purposes.

Although social inventories continue to increase, plant inventories have declined. According to preliminary statistics, the full-sample plant inventory of PVC production enterprises decreased by about 2.4% week-on-week. During the week, some companies underwent maintenance or reduced production due to malfunctions, and previously presold goods were shipped out intensively, resulting in a decrease in in-plant inventory.

1、 Although costs have recently decreased, the profit remains negative.

|

Figure 5 2024-2025 year PVC Trend of Cost by Process (Yuan / ton) |

Figure 6 2024-2025 Year PVC Profit Trend of Each Process (Yuan / (Ton) |

|

|

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

With the decline in raw material prices, the cost of PVC continues to decrease. This week, the national average weekly cost for carbide-based PVC enterprises was 4,946 yuan/ton, a week-on-week decrease of 0.54%. As for the ethylene-based process, due to the relatively stable price of ethylene in US dollars, costs remained largely unchanged, with only slight adjustments. The average weekly cost for ethylene-based PVC enterprises nationwide was 5,572 yuan/ton, a week-on-week decrease of 1 yuan/ton, or 0.02%.

Due to lower costs and rising PVC prices, the domestic PVC gross profit continues to improve and has currently reached a new high for the year, although it is still in a state of loss. According to data calculations by Longzhong Information, during this period, the weekly average profit of domestic carbide-based PVC enterprises was -256 yuan/ton, an increase of 103 yuan/ton compared to the previous period. The weekly average profit of ethylene-based PVC enterprises was -554 yuan/ton, an increase of 41 yuan/ton compared to the previous period.

Currently, policy support remains strong, and PVC prices are expected to stay firm. However, next week the calcium carbide market will show a clear oversupply, leading to a significant downward trend in calcium carbide prices. The profitability of the calcium carbide method is expected to continue improving.

3. Domestic PVC prices are likely to rise easily but fall with difficulty in the short term.

Overall,Next week, domestic PVC maintenance will still be relatively frequent. Erdos and Zhongyan will continue their maintenance, but the previous maintenance has resumed, and Qilu and Wanhua will continue production, leading to an expected increase in supply. The domestic demand is temporarily difficult to boost, and the operating rates of domestic downstream product companies remain low. However, prices of some products have increased, providing some support to PVC prices. On the external demand side, the announcement of India's anti-dumping duties has been delayed, allowing some time for exports. There might be a rush to export later, and the external demand outlook is positive. Future attention should still be paid to the impact of policies. The policy for eliminating outdated production capacity has not yet been finalized, and the salt chemical industry has also issued an "anti-involution" initiative. In the short term, there is still policy support, and it is expected that PVC spot prices will be more likely to rise than fall in the next period, continuing to operate at high levels.

Today's plastic price

(The above is a comprehensive summary from Daxie Yousu and Longzhong.)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[隆众聚焦]:供需天平倾斜 PVC现货承压前行 [隆众聚焦]:供需天平倾斜 PVC现货承压前行](https://oss.plastmatch.com/zx/image/5a09dcf08c154e88bd77b7497e971c71.png)

![[隆众聚焦]:供需天平倾斜 PVC现货承压前行 [隆众聚焦]:供需天平倾斜 PVC现货承压前行](https://oss.plastmatch.com/zx/image/ecd13e1f534f4104b0a32fcb362739bd.png)

![[隆众聚焦]:供需天平倾斜 PVC现货承压前行 [隆众聚焦]:供需天平倾斜 PVC现货承压前行](https://oss.plastmatch.com/zx/image/1dfb0c4772fa44c88de174b774ef821c.png)

![[隆众聚焦]:供需天平倾斜 PVC现货承压前行 [隆众聚焦]:供需天平倾斜 PVC现货承压前行](https://oss.plastmatch.com/zx/image/1b859db8694e4f7a94590056701bc97b.png)