【PVC Morning Update】The market lacks sustained upward momentum, and the PVC market is expected to maintain a range-bound oscillation.

I. Focus Points

On March 25, according to珑佑 [Note: It seems there's a typo in the source, it should be "隆众" which is likely a name of a news agency or company], the peace talks between Russia and Ukraine continued to progress, but at the same time, the situation in the Middle East remains uncertain, leading to fluctuating international oil prices. NYMEX crude oil futures for May fell by $0.11 per barrel to $69.00, a decrease of -0.16%; ICE Brent crude oil futures for May rose by $0.02 per barrel to $73.02, an increase of +0.03%. China's INE crude oil futures main contract for May increased by 4.0 yuan to 537.3 yuan per barrel, with the night session increasing by 1.3 yuan to 538.6 yuan per barrel.

Electric calcium: The domestic electric calcium market remained stable yesterday, with the mainstream trading price in Wuhai region at 2,700 yuan per ton. Production enterprises had smooth shipments. Inner Mongolia region experienced another round of power restrictions yesterday, intensifying market观望 (观望 needs to be clarified or translated, but typically it means "watching" or "waiting" in a market context). Whether the power restrictions will continue is key to impacting market supply. Recently, arrivals from downstream have improved compared to earlier periods, but overall unloading vehicles remain at low levels, and purchasing enthusiasm remains high. Raw material anthracite prices have decreased, reducing costs and intensifying market competition. It is expected that the domestic electric calcium market will remain stable today.

3. PVC: Yesterday, domestic PVC market prices rose slightly, but transaction volumes weakened. This week, there were limited new maintenance activities for PVC, and market supply remained high. Exports faced obstacles due to price and policy risks, while domestic demand remained stable, with market transactions mainly driven by just-in-time needs. The industry's inventory reduction expectations are slow, providing limited support for the market. As of March 24, the cash price for calcium carbide method PVC in East China was between 4900-5050 yuan/ton, while the ethylene method was between 5000-5200 yuan/ton.

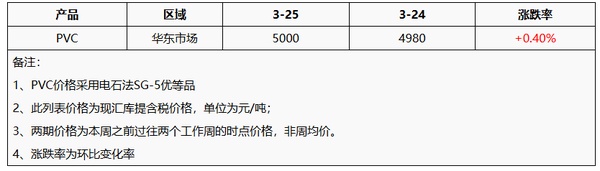

II. Price List

3. Market Outlook

The fundamentals of the PVC spot market show no significant improvement, with production companies maintaining high output expectations. Domestic demand remains stable, while foreign trade is cautious due to policy uncertainties. In the short term, the cost support at the bottom remains strong, but there is insufficient momentum for a sustained market rise. The domestic PVC market is expected to maintain a range-bound fluctuation, with the mainstream price of SG-5 in the East China PVC market ranging from 4,900 to 5,050 yuan/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track