PVC Monthly Report: Futures fall below the "5" mark again, expectations have not been fulfilled as spot prices return to low levels.

01

Domestic PVC Market Analysis

1. Overview of the Domestic PVC Market

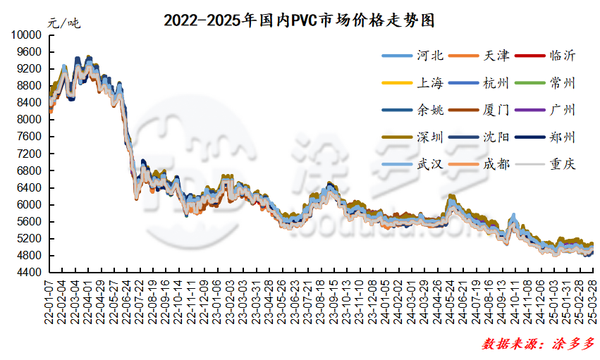

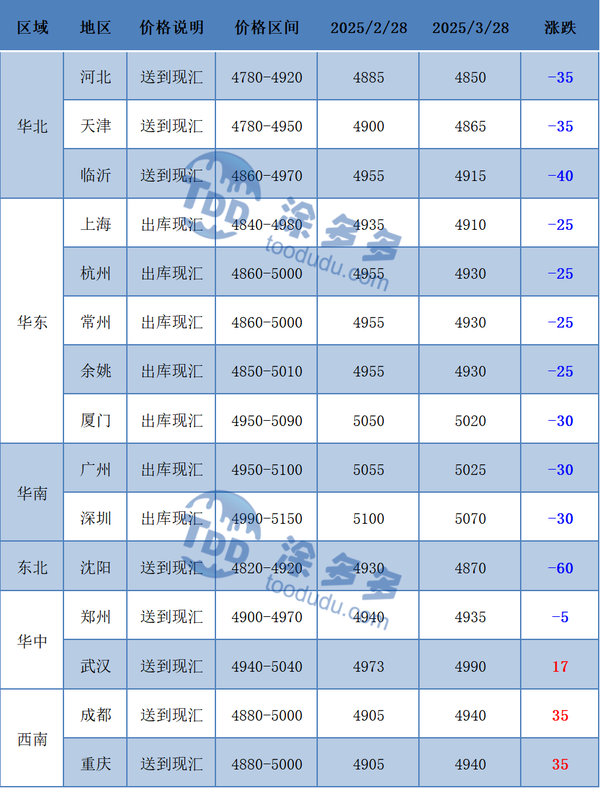

This month's PVC spot market price trend once again showed a downward trend in March, with the futures hitting a low of 4992, refreshing the low point for the year 2025. The overall trend of the spot market first declined and then rose, with factory prices dropping back to low levels.

2. Taiwan Province of China Formosa Plastics Shipping Schedule Quotation

In April, the export shipping price of Taiwan's Formosa Plastics PVC was reduced by $20-40/ton. The FOB price in Taiwan is $680, the CFR price to mainland China is $700, the CFR price to India is $700, and the CFR price to Southeast Asia is $730.

Taiwan Province, China, Formosa Plastics April shipping schedule quotation: (USD/ton)

3. Market Forecast

In terms of futures: The price movement of the PVC2501 contract on Friday showed no significant changes in its fluctuation range, remaining in a sideways state throughout the day, forming a doji candlestick. In terms of trading, both long and short positions did not show any significant movement, and there was a slight reduction in positions on Friday. From a technical perspective, the Bollinger Bands (13, 13, 2) have an upward opening, with the middle and upper bands clearly turning upward, while the lower band remains flat. The KD lines on the daily chart show a narrowing distance, and the MACD line continues to show a golden cross trend. Currently, the direction of the trend line is also unclear, and there are not many fundamental factors influencing the short term. Therefore, the price movement is likely to remain difficult to escape from the sideways trend, with attention on the fluctuation range of 5080-5160.

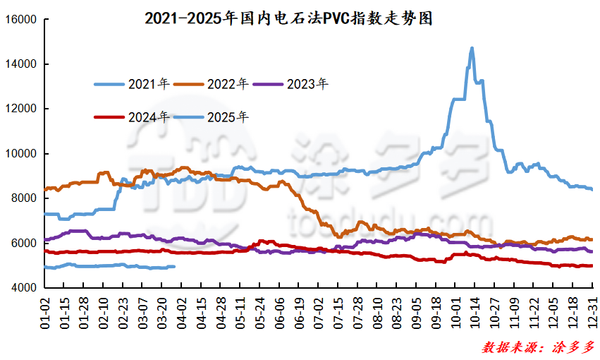

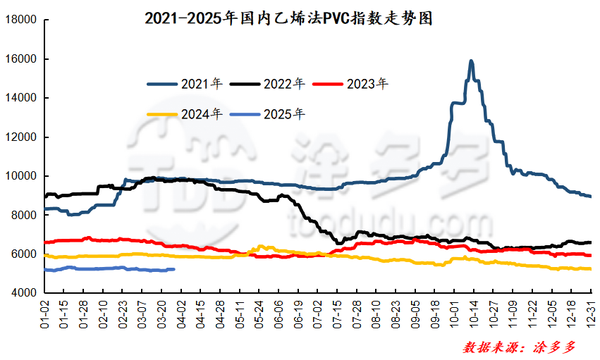

4. Domestic PVC Index

5. This month's PVC (powder) market price

02

Analysis of PVC Import and Export, Production Volume, and Operating Rate

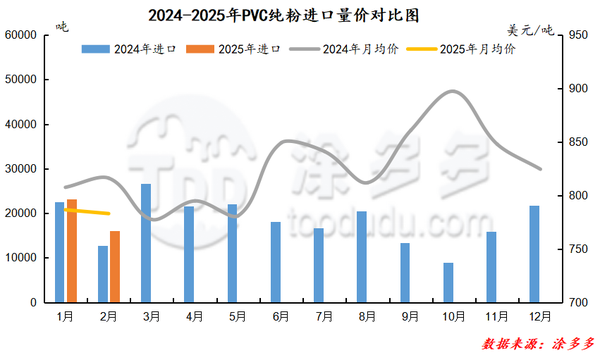

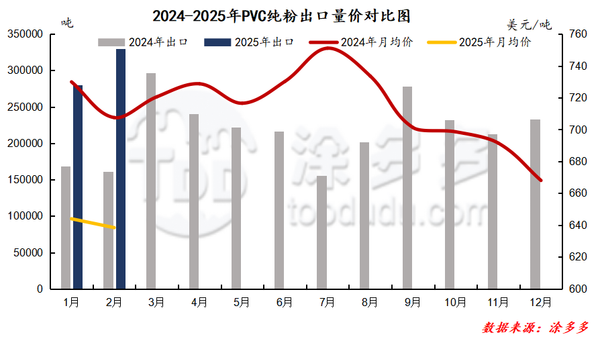

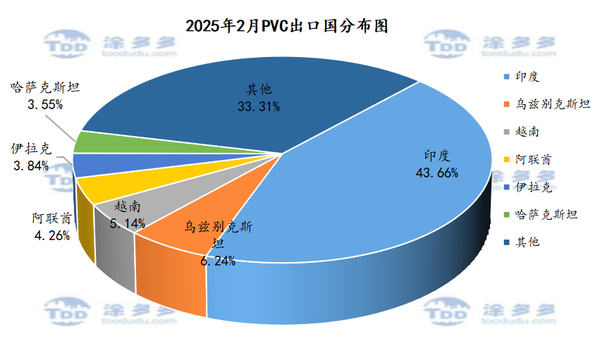

PVC Export Country Analysis: According to the latest statistics, in February 2025, China exported 143,900 tons of PVC to India, accounting for 43.66% of the total export volume; 20,600 tons to Uzbekistan, accounting for 6.24% of the total export volume; and 16,900 tons to Vietnam, accounting for 5.14% of the total export volume.

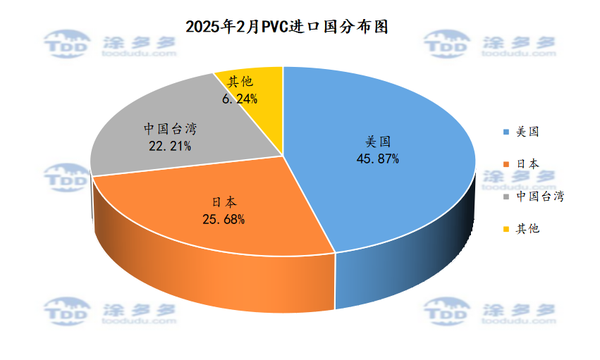

PVC Import Country Analysis: According to the latest statistical data, in February 2025, China imported 7,361.977 tons of PVC from the United States, accounting for 45.87% of the total import volume; imported 4,122.536 tons from Japan, accounting for 25.68% of the total import volume; and imported 3,565.50 tons from Taiwan, accounting for 22.21% of the total import volume.

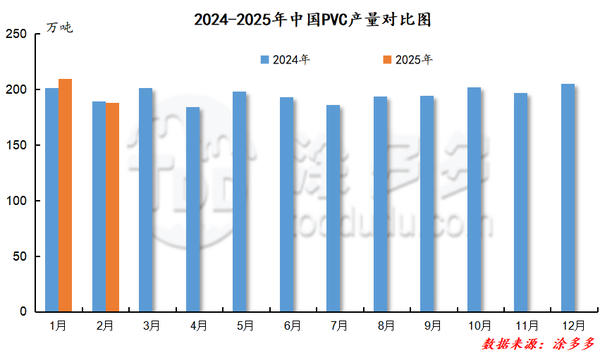

2. PVC Production Analysis

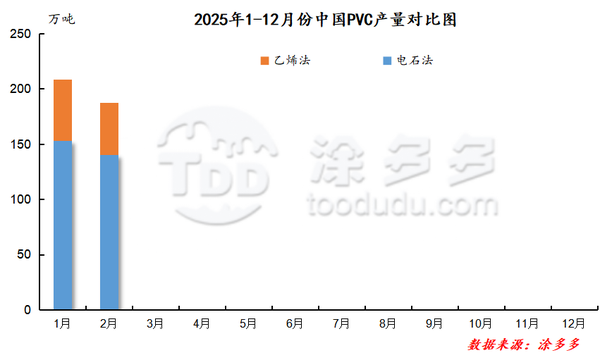

3. PVC Production Classification Analysis

In February 2025, the production of acetylene through the calcium carbide method was 1.408597 million tons, a month-on-month decrease of 8.43%. The cumulative production from January to February through the calcium carbide method was 2.9468 million tons, while the production through the ethylene method was 468,103 tons, a month-on-month decrease of 16.12%. The cumulative production from January to February through the ethylene method was 1.0262 million tons.

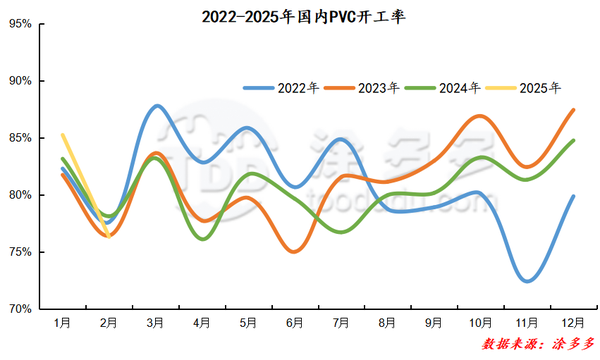

4. PVC Operating Rate Statistics

In February 2025, the domestic PVC operating rate was 76.33%, a year-on-year decrease of 1.81% and a month-on-month decrease of 8.93%.

03

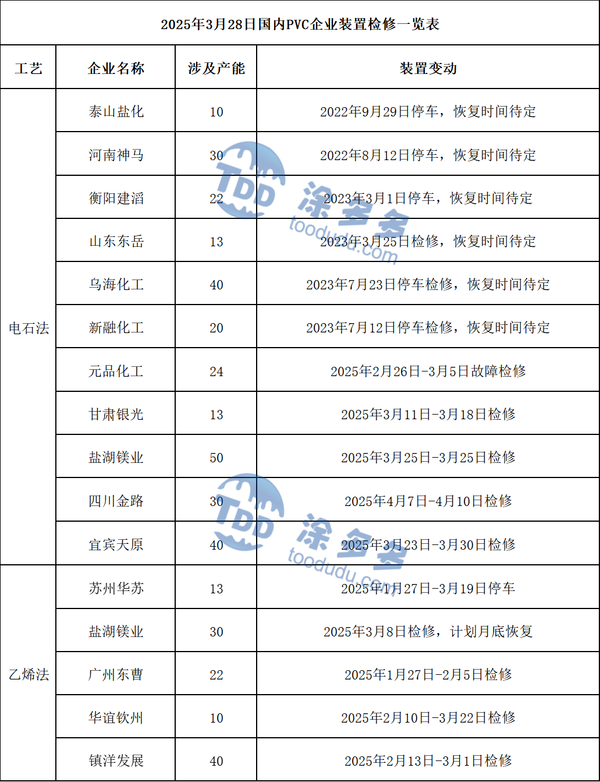

Overview of Production Enterprises' Equipment Status and Maintenance Loss Statistics for This Month

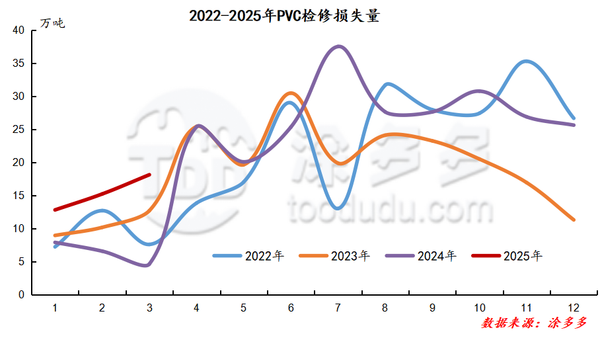

2. Maintenance Loss Statistics

04

Key Analysis of Related Chlor-Alkali Products

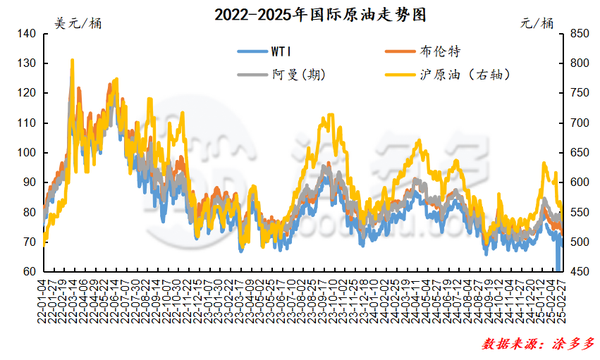

As of March 27, WTI price is $69.92 per barrel, Brent price is $74.03 per barrel, Oman (futures) price is $774.66 per barrel, and Shanghai crude oil is 543.4 yuan per barrel. Compared to the same period last month, WTI has decreased by $0.43 per barrel, Brent has decreased by $0.01 per barrel, Oman (futures) has decreased by $0.29 per barrel, and Shanghai crude oil has increased by 6.8 yuan per barrel.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track