[PVC Daily Review] Spot Trading Remains Stalemated, PVC Edges Up Intraday

1. Today's Summary

① Domestic PVC manufacturers have individually raised ex-factory prices by 50 yuan per ton.

②. There are currently no new enterprise maintenance plans being added.

Focus on key areas and weak links; structural monetary policy tools will continue to exert force.

2 Spot Overview

Based on the Changzhou market in East China, today's cash settlement price for calcium carbide grade five in East China is 4,920 yuan/ton, an increase of 30 yuan/ton compared to the previous trading day. 。

The domestic PVC spot market prices remain firm, driven up during the day by sentiment in the black sector. Spot trading atmosphere is flat, with no short-term improvement in the fundamentals. The acetylene-based spot price on a cash basis in East China is 4,880-5,000 yuan/ton, while the ethylene-based price is 4,850-5,150 yuan/ton.

|

Figure 1 Domestic PVC Price Trend (Unit: RMB/ton) |

Figure 2 Domestic PVC Price Trend Chart by Region (Unit: Yuan/Ton) |

|

|

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

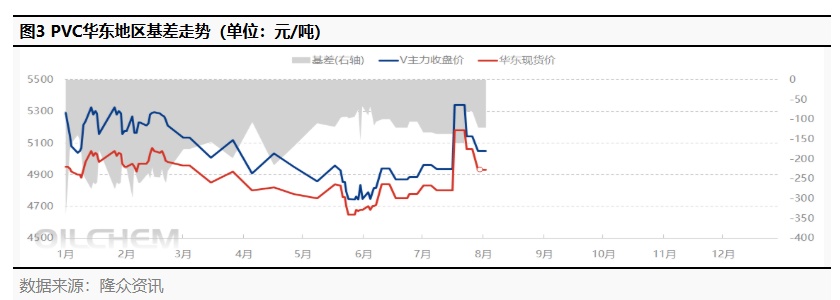

3、 Spot-Futures Basis

Table 2 Major Delivery Location Basis (Yuan/Ton)

|

Region |

Previous trading day |

Today |

Rise and fall |

Month-on-month |

|

East China (09 Contract) |

-100 |

-100 |

0 |

0% |

|

Source of data: Longzhong Information |

||||

From the perspective of basis, the PVC basis for the September contract in East China is in the range of -60 to -180, while the January contract is in the range of -180 to -240.

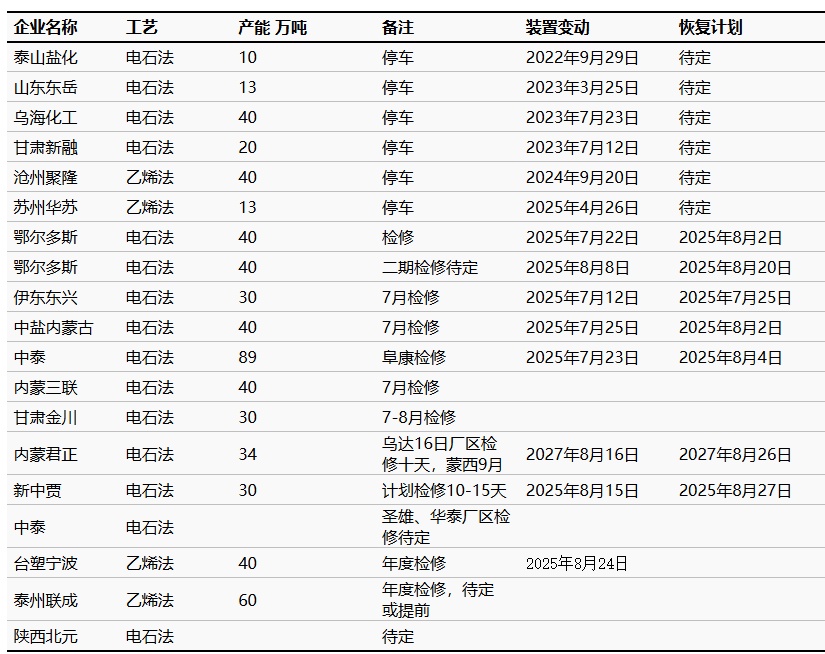

4、 Production Dynamics

Table 3 PVC Maintenance Device Summary Table

Formosa Plastics' Mailiao plant in Taiwan plans maintenance in mid to late August. 。

|

Figure 4 Domestic PVC Maintenance Losses and Price Linkage Trend Chart |

Figure 5 Comparison of PVC Capacity Utilization Rate and Price |

|

|

![[PVC日评]:现货交投僵持 PVC盘中小涨(20250806) [PVC日评]:现货交投僵持 PVC盘中小涨(20250806)](https://oss.plastmatch.com/zx/image/2cf0cd7ab6974fcca447484f1a5381cf.png) |

|

Data source: Longzhong Information |

Data source: Longzhong Information |

5、Price Forecast

The domestic PVC fundamentals have not improved recently, with fewer maintenance activities at upstream production enterprises combined with new additions, leading to a significant increase in market supply month-on-month. Meanwhile, domestic demand remains stable, and foreign trade exports are mainly focused on fulfilling existing orders. The supply-demand contradiction has intensified, with industry inventory expected to accumulate significantly, putting pressure on the market. On the macroeconomic front, the market prices have seen a slight increase driven by factors such as coke in the black sector, but there has been no impact on costs and other factors. In the short term, the market fundamentals remain under pressure from supply and demand, with spot prices experiencing weak fluctuations. Macro sentiment during trading hours can easily interfere with market trends. It is expected that the East China region's calcium carbide method for type 5 cash-on-delivery warehouse pick-up will be priced at 4,800-4,950 yuan/ton.

6、 Related Products

Calcium carbide : The domestic calcium carbide market supply is tightening, with mainstream trade prices quoted at 2300 yuan/ton in Wuhai and Ningxia regions. 。

Ethylene : Asian market ethylene prices show insufficient upward momentum, remaining stable recently. CFR Northeast Asia 820 USD/ton CFR Southeast Asia 830 USD/ton 。

7、Data Calendar

Table 4 PVC Data Calendar Overview

|

Data |

Publication Date |

Previous period data |

Trend Forecast |

|

PVC utilization rate |

Thursday 5:30 PM |

76.84% |

↗ |

|

Weekly PVC Production |

Thursday 5:00 PM |

45.23 |

↗ |

|

PVC Production Enterprise Plant Inventory |

Thursday 5:00 PM |

View data terminal |

↗ |

|

PVC third-party social inventory |

Thursday 5:00 PM |

72.21 |

↗ |

|

PVC production company export volume |

Friday 12:00 AM |

See data terminal |

↘ |

|

Operating Rate of Downstream PVC Product Enterprises |

Friday 5:00 PM |

See data terminal |

↗ |

|

Data Source: Longzhong Information Note: 1. ↓↑ is considered significant fluctuation; highlight data dimensions with a change exceeding 3%. 2. ↗↘ is regarded as narrow fluctuations, highlighting data with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[PVC日评]:现货交投僵持 PVC盘中小涨(20250806) [PVC日评]:现货交投僵持 PVC盘中小涨(20250806)](https://oss.plastmatch.com/zx/image/5fd32e2d4aaa4a7cb9fd428eb142c27d.png)

![[PVC日评]:现货交投僵持 PVC盘中小涨(20250806) [PVC日评]:现货交投僵持 PVC盘中小涨(20250806)](https://oss.plastmatch.com/zx/image/c7ed7e051ee24f5eb613dedfb2f4626f.png)

![[PVC日评]:政策预期落空 盘中PVC价格偏弱震荡(20250730) [PVC日评]:政策预期落空 盘中PVC价格偏弱震荡(20250730)](https://oss.plastmatch.com/zx/image/a1f1cd4fde4a4cf58c27c8d6c676fe56.png)