[PVC Daily Review] Limited Midday Boost, PVC Spot Transactions Steady and Dull

1. Today's Summary

Some domestic PVC manufacturers have reduced their ex-factory prices by 10-100 yuan/ton.

The maintenance recovery of Yili and Jinyuyuan facilities has been delayed, and the Xinfeng facility is undergoing cyclic maintenance, while Hangjin is under maintenance. 。

"Expand domestic demand, increase vitality, and improve the environment; achieve fruitful results in deepening reforms during the 14th Five-Year Plan."

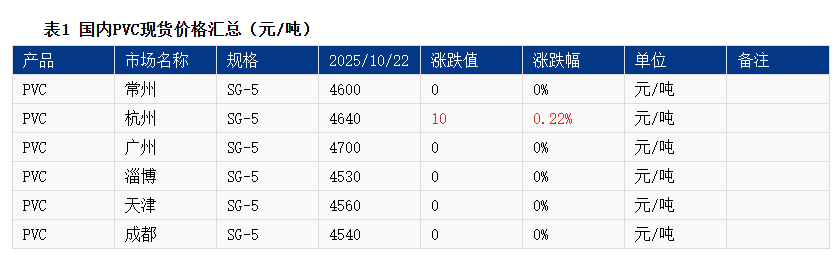

2 Spot Overview

Based on the Changzhou market in East China, today's cash price for calcium carbide using the five-type method in the East China region is 4,600 yuan/ton, unchanged from the previous trading day. 。

The domestic PVC spot market prices remained stable, with some slight fluctuations during the day. The atmosphere for terminal inquiries and transactions was sluggish, and there was no improvement in market supply and demand. The market was driven upward by expectations of supply changes in upstream black and other bulk commodities. In East China, the cash price for acetylene-based PVC was between 4570-4680 yuan/ton, while the ethylene-based PVC ranged from 4700-4900 yuan/ton, with high-end prices slightly declining.

|

Figure 1 Domestic PVC Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic PVC Prices in Various Regions (Unit: yuan/ton) |

|

|

|

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3、 Spot-Futures Basis

Table 2 Main Delivery Location Basis (CNY/ton)

|

Region |

Previous trading day |

Today |

Rise and fall |

Month-on-month |

|

East China (Contract 01) |

-60 |

-60 |

0 |

0% |

|

Data source: Longzhong Information |

||||

The PVC basis for the 01 contract in the East China region is in the range of -20/-100, and the basis has not been adjusted yet, with market transactions at a fixed price.

4、 Production Status

Table 3 PVC Maintenance List of Equipment

|

Company Name |

Craftsmanship |

Production capacity (10,000 tons) |

Note |

Device Change |

Recovery Plan |

| Shandong Dongyue |

Carbide method |

13 |

Parking |

March 25, 2023 |

To be determined |

|

Wuhai Chemical |

Calcium carbide process |

40 |

Parking |

July 23, 2023 |

Pending |

|

Jinchuan Xinrong |

Calcium Carbide Process |

20 |

Parking |

July 12, 2023 |

Pending |

|

Cangzhou Julong |

Ethylene method |

52 |

Parking |

September 20, 2024 |

Pending |

|

Suzhou Huasu |

Ethylene method |

13 |

Parking |

April 26, 2025 |

Pending |

| Inner Mongolia Yili |

Carbide method |

50 |

Planned maintenance |

September 30, 2025 |

October 25, 2025 |

| Shanxi Ruiheng |

Calcium carbide method |

40 |

Maintenance for one week |

October 16, 2025 | October 22, 2025 |

|

Jin Yuyuan |

Calcium carbide process |

40 |

New Plant Maintenance |

October 12, 2025 |

October 23, 2025 |

|

Inner Mongolia Junzheng |

Carbide method |

36 |

Mongxi Plant Maintenance |

October 10, 2025 |

October 21, 2025 |

|

Turpan |

Carbide method |

20 |

Maintenance |

October 15, 2025 |

October 21, 2025 |

|

Aviation Jin |

Carbide method |

4 |

Maintenance |

October 20, 2025 |

October 30, 2025 |

|

Lutai Chemical |

Carbide method |

37 |

October Maintenance |

October 12, 2025 | October 20, 2025 |

|

Xinjiang Tianye |

Calcium carbide method |

20 |

Tian Neng Second Factory, formerly Tianyu New Reality |

October 10, 2025 |

October 18, 2025 |

|

Xinjiang Tianye |

Carbide method |

50 |

Tian Neng Factory Area |

October 21, 2025 |

October 30, 2025 |

|

Shandong Xinfa |

Calcium carbide method |

75 |

Phase II maintenance first, then Phase I maintenance. |

October 13, 2025 | November 3, 2025 |

|

Henan Lianchuang |

Calcium carbide method |

40 |

November Maintenance |

||

|

Shandong Hengtong |

Ethylene method |

30 |

Overhaul |

||

|

Hanwha Ningbo |

Ethylene process |

40 |

December Annual Maintenance |

No new enterprise maintenance plans available. 。

|

Figure 4: Domestic PVC Maintenance Loss and Price Linkage Trend Chart |

Figure 5 Comparison of PVC Capacity Utilization Rate and Price |

|

|

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/fd42d20ae3324d7abde766bec5b0bddc.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

5、Price prediction

In the short term, as upstream maintenance of PVC is gradually completed, the future market supply volume is expected to rise again to a high level, with weekly average production expected to approach 500,000 tons. Additionally, new facilities are gradually commencing trial production within the month and increasing output. In the face of growing upstream supply, domestic market demand remains stable, while northern demand is expected to weaken due to climate impacts. However, exports are expected to remain favorable this month. Overall, the pressure from future supply slightly exceeds demand, putting pressure on the spot price center. On the macro level, short-term performance is suboptimal, with price ranges stabilizing only under the support of expected costs for black varieties. The cash-on-delivery warehouse price for carbide-based Type V in East China is between 4,550 and 4,700 yuan per ton.

6、Related Products

Calcium carbide : DomesticThe mainstream trading price in the Wuhai area is quoted at 2450 yuan/ton, and the calcium carbide market has recently stabilized. 。

Ethylene : The CFR China price for port ethylene is in the range of $760-790/ton, with the market negotiation focus leaning towards the weaker side. 。

7、Data Calendar

Table 4 PVC Data Calendar Overview

|

Data |

Publication Date |

Previous Data |

Trend forecast |

|

PVC utilization rate |

Thursday 5:30 PM |

76.69% |

↗ |

|

PVC Weekly Production |

Thursday 5:00 PM |

46.74 |

↗ |

|

PVC production enterprise factory inventory |

Thursday 5:00 PM |

View data terminal |

↗ |

|

PVC Third-Party Social Inventory |

Thursday 5:00 PM |

103.38 |

↗ |

|

PVC Production Enterprise Export Volume |

Friday 12:00 AM |

View data terminal |

↘ |

|

PVC downstream product enterprise operating rate |

Friday 5:00 PM |

See data terminal |

↗ |

|

Data source: Longzhong Information Note: 1. Consider a significant fluctuation as a large rise or fall, highlighting data dimensions with a change exceeding 3%. 2. Treat as narrow fluctuations, highlighting data with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/99b057bf84b847efb23fa18117e360f1.png)

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/08e0a0d9d0084983a1754b35bc0667aa.png)

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/e281a2bb0fed45a58bc2df0db5ad836b.png)