[PVC Daily Review] End-of-Month Stocking Demand Remains Flat, PVC Transactions Slightly Insufficient

1. Today's Summary

Domestic PVC production enterprises have generally stabilized their ex-factory prices, with a few adjusting downward by 20-30 yuan/ton.

2. Yili is resuming operations, while Xinfa, Hangjin, and Tianye have some units under maintenance. 。

The global financial markets are set to a "Super Central Bank Week," as the Federal Reserve, European Central Bank, Bank of Japan, and Bank of Canada will all announce their interest rate decisions this week.

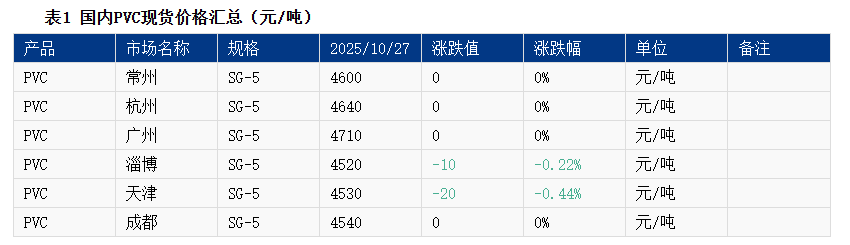

2 Spot Overview

Based on the East China Changzhou market, the spot warehouse price for Type 5 acetylene method PVC in East China is 4,600 yuan/ton today, stabilizing compared to the previous trading day. 。

At the beginning of the week, the domestic PVC spot market remained weak and stable, with participants mostly observing in the morning. During the day, prices fluctuated as they sought lower transaction levels, and in the afternoon, the black segment rose, leading to slight price fluctuations in PVC. However, the trading atmosphere remained subdued. In East China, the cash price for carbide-based PVC was 4570-4680 yuan/ton, while the ethylene-based PVC was priced at 4700-4900 yuan/ton.

|

Figure 1 Domestic PVC Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic PVC Price Trend Chart by Region (Unit: Yuan/Ton) |

|

|

|

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3. Futures-Spot Basis

Table 2 Main Delivery Location Basis (Yuan/Ton)

|

Region |

Previous trading day |

Today |

Rise and Fall |

Month-on-month |

|

East China (Contract 01) |

-60 |

-60 |

0 |

0% |

|

Data source: Longzhong Information |

||||

The PVC basis for the January contract in the East China region is in the range of -20/-120.

|

Figure 3 Basis Trend of PVC in East China (Unit: Yuan/Ton) |

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/f7d5189b74d940d484d6f4227f0062cb.png) |

|

Data Source: Longzhong Information |

4. Production Update

Table 3 PVC Maintenance Equipment List

|

Company Name |

Craftsmanship |

Capacity, ten thousand tons |

Remarks |

Device Change |

Recovery Plan |

| Shandong Dongyue |

Calcium carbide process |

13 |

Parking |

March 25, 2023 |

Pending |

|

Wuhai Chemical |

Calcium carbide process |

40 |

Parking |

July 23, 2023 |

Pending |

|

Jinchuan Xinrong |

Calcium carbide method |

20 |

Parking |

July 12, 2023 |

Pending |

|

Cangzhou Julong |

Ethylene method |

52 |

Parking |

September 20, 2024 |

Pending |

|

Suzhou Huasu |

Ethylene method |

13 |

Parking |

April 26, 2025 |

Pending |

| Inner Mongolia Yili |

Carbide method |

50 |

Maintenance |

September 30, 2025 |

October 25, 2025 |

| Shanxi Ruiheng |

Carbide method |

40 |

Maintenance for one week |

October 16, 2025 | October 22, 2025 |

|

Jin Yuyuan |

Calcium carbide method |

40 |

New plant maintenance |

October 12, 2025 |

October 23, 2025 |

|

Inner Mongolia Junzheng |

Calcium carbide method |

36 |

Mengxi Plant Maintenance |

October 10, 2025 |

October 21, 2025 |

|

Tuokexun |

Carbide method |

20 |

Maintenance |

October 15, 2025 |

October 21, 2025 |

|

Hangjin |

Calcium carbide method |

4 |

Maintenance |

October 20, 2025 |

October 30, 2025 |

|

Lutai Chemical |

Calcium carbide method |

37 |

October Maintenance |

October 12, 2025 | October 20, 2025 |

|

Xinjiang Tianye |

Carbide method |

20 |

Tian Neng Second Factory, originally Tian Yu New Reality |

October 10, 2025 |

October 18, 2025 |

|

Xinjiang Tianye |

Carbide method |

50 |

TianNeng Factory Area |

October 21, 2025 |

October 30, 2025 |

|

Shandong Xinfa |

Calcium carbide method |

75 |

Repair the second phase first, then repair the first phase. |

October 13, 2025 | November 3, 2025 |

|

Henan Lianchuang |

Calcium carbide method |

40 |

November maintenance |

||

|

Shandong Hengtong |

Ethylene method |

30 |

Overhaul |

||

|

Hanwha Ningbo |

Ethylene method |

40 |

December Annual Maintenance |

There are no new enterprise maintenance plans. 。

|

Figure 4: Trend Chart of Domestic PVC Maintenance Losses and Price Linkage |

Figure 5 Comparison of PVC Capacity Utilization Rate and Price |

|

|

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/11c1d8b4e6ce460991022db172427841.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

5. Price Forecast

During the week, the supply and demand fundamentals for PVC remained weak. At the end of the month, the stocking demand from downstream terminals remained flat, and the supply is expected to slightly increase, putting pressure on industry inventories. The black sector strengthened in the afternoon, driving expectations for industrial costs. Industry expectations are not performing well, providing limited support to the spot market. In the short term, under the pressure of supply and demand fundamentals, the market maintains small range fluctuations. In East China, the price for carbide-based type 5 cash on delivery is between 4,550-4,700 yuan/ton.

6. Related Products

Calcium carbide : DomesticThe mainstream trade price in the Wuhai region is quoted at 2,500 yuan/ton, with strong cost support in the calcium carbide market. 。

Ethylene : Port EthyleneCFR Northeast Asia is $765/ton, down $15/ton; CFR Southeast Asia is $755/ton, down $15/ton; ethylene method costs are weakening. 。

7. Data Calendar

Table 4 PVC Data Calendar Overview

|

Data |

Release Date |

Previous Data |

Trend Forecast |

|

PVC utilization rate |

Thursday 5:30 PM |

76.57% |

↗ |

|

PVC Weekly Production |

Thursday 5:00 PM |

46.66 |

↗ |

|

PVC production enterprise factory inventory |

Thursday 5:00 PM |

See data terminal |

↗ |

|

PVC Third-Party Social Inventory |

Thursday 5:00 PM |

103.52 |

↗ |

|

PVC production enterprise export volume |

Friday 12:00 AM |

See data terminal |

↘ |

|

Operating rate of PVC downstream product enterprises |

Friday 5:00 PM |

See data terminal |

↗ |

|

Data Source: Longzhong Information Note: 1. Treat ↓↑ as significant fluctuations, highlighting data dimensions where the price change exceeds 3%. 2. Consider narrow fluctuations, highlighting data with a price change within 0-3%. |

|||

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/830cb844fdfe498a88c7cf484bec6b58.png)

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/bb34012df454455585ab1355b076f7ff.png)

![[PVC日评]:PVC低价成交 供需维持双弱(20251014)](https://oss.plastmatch.com/zx/image/aa0cd93dcb714667b9ffb08fe4b9a591.png)