Prosperity and Hidden Concerns Coexist: Is the High Growth of China's Household Air Conditioners in 2025 a Mirage?

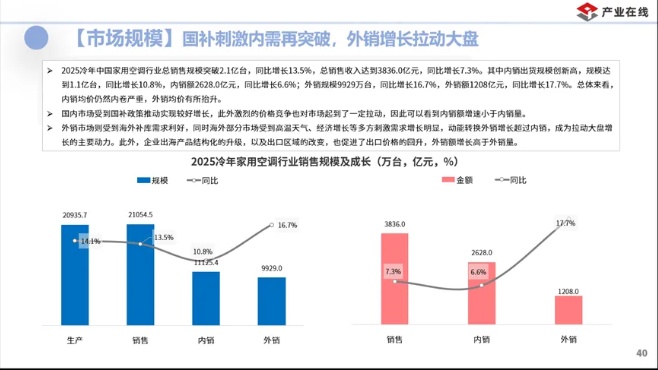

According to data from the Industrial Online, the Chinese household air conditioning industry concluded the 2025 cooling season with record-breaking production and sales, achieving a production volume of over 209 million units and sales of 211 million units, representing year-on-year increases of 14.1% and 13.5%, respectively. However, beneath the surface of these numbers lies a deeper issue: the demand spurred by the old-for-new policy has led to overextension, alongside the shifting of orders due to fluctuations in overseas tariffs, and structural contradictions of overcapacity and a shortage of high-end products, collectively painting a picture of both prosperity and underlying concerns.

Image Source: "China Household Air Conditioner Industry Research and Forecast Report"2025"Cold Year"

The growth of China's air conditioning industry is facing unprecedented challenges as the marginal effects of policy stimulus diminish and the restructuring of global supply chains accelerates.

In the first half of 2025, China's GDP grew by 5.3% year-on-year, with the service sector accounting for over 59%. The growth rate of per capita disposable income (4.7%) outpaced the CPI (-0.1%). However, the consumer confidence index remained low, fluctuating around 88. After a steep decline in 2022, the contraction in consumption among low- and middle-income groups has become the core issue of insufficient domestic demand.The seemingly robust economic fundamentals cannot hide the structural bleeding in consumption.Air conditioning, as a representative of upgrade consumption, relies heavily on the dual stimulation of policies and climate for market growth, rather than the endogenous enhancement of consumer capacity.

The trade-in policy can be seen as a "buffer" rather than an "engine." In 2025, more than 30 provinces and cities nationwide will continue or expand the scope of subsidies. Hubei will expand the subsidized categories from 8 to 12, and Yunnan will add 13 compatible products, including robotic vacuum cleaners. A subsidy of up to 2,000 yuan per unit for first-level energy efficiency air conditioners has indeed driven a domestic sales scale of 111 million units. However, the policy mainly stimulates replacement demand from existing stock. The proportion of first-level energy efficiency products in the 2025 cold season jumped from 55% to 80%, essentially "consuming future replacement demand in advance" rather than creating new demand.

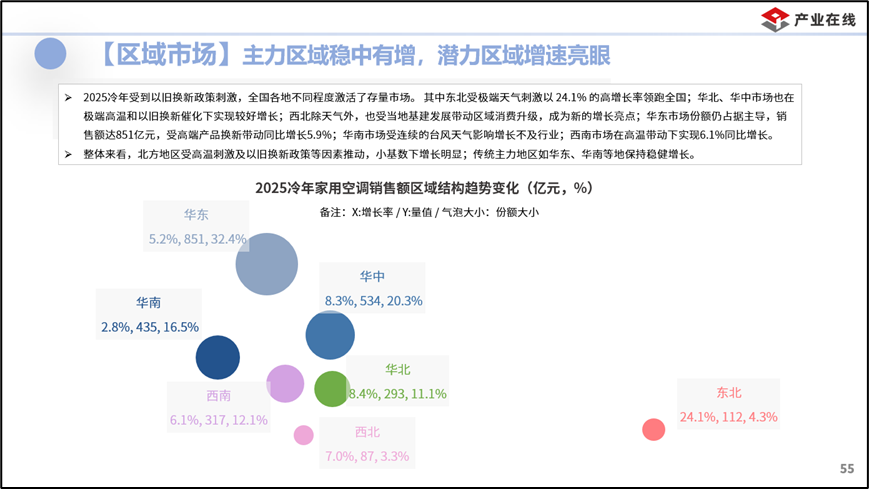

Climate factors have become an unexpected variable in this year's air conditioning market. The national average temperature in the summer of 2025 reached 22.3°C, tying with 2024 as the highest since 1961, with higher temperatures of 2-4°C observed in regions such as Shandong and Henan. A total of 57 national weather stations recorded historic high temperatures. The extreme high temperatures directly stimulated a boom in the northern market, with Northeast China leading the nation with a growth rate of 24.1%, and Hebei and Shanxi exceeding 9%. In contrast, South China struggled due to frequent typhoons and heavy rain, exposing the vulnerability of the air conditioning industry, which relies heavily on weather conditions. This climate-driven advantage is not sustainable; once conditions return to normal, the market will face a demand vacuum.

Real estate is still in a state ofDeep adjustment rangeIn the first half of 2025, the national sales area of commercial housing decreased by 3.5% year-on-year, while the growth rate of development investment fell by 11.2%, and the completed area dropped by 14.8%. Although the "old-for-new" policy partially offset the insufficient demand for new homes, the characteristic of air conditioning as "multiple units per household" still heavily relies on revitalizing the existing housing stock. Currently, the second-hand housing market is recovering slowly, and the construction of affordable housing has yet to form a scale effect, indicating that the industry's long-term growth lacks effective support from the real estate sector.

Affected by abnormal weather,2025 cold yearThe domestic air conditioning market shows a distinct "temperature difference" between the north and south: traditional main markets such as East China and South China are experiencing a slowdown in growth, with growth rates below the industry average; while traditional low-penetration areas like North China, Northeast China, and Northwest China are experiencing an explosion in growth, with North China exceeding 7% and Northeast China achieving an explosive growth of 24.1% due to extreme high temperatures.

This differentiation essentially stems from the "penetration rate gap" — the national average air conditioner ownership is 150.6 units per 100 households. In northern regions, the ownership is relatively low, with less than 20 units per 100 households in provinces such as Qinghai, Gansu, Tibet, and Heilongjiang. Although there is significant growth potential, it is hindered by income levels and consumption habits, making it difficult to sustain rapid long-term industry growth.

Furthermore, under the influence of national subsidy policies, the differences in enterprise layout and channel transformation in the domestic market have further accelerated the "Matthew Effect." Currently, the proportion of online channels has increased to 29.6%, and new e-commerce platforms such as Douyin and Pinduoduo have become the main forces for growth. Amid channel transformation, the integrated model of "capturing traffic online and creating experiences offline" has become mainstream, while companies sticking to traditional channels are gradually being marginalized.

Image source: "China Household Air Conditioner Industry Research and Forecast Report"2025"Cold Year]"

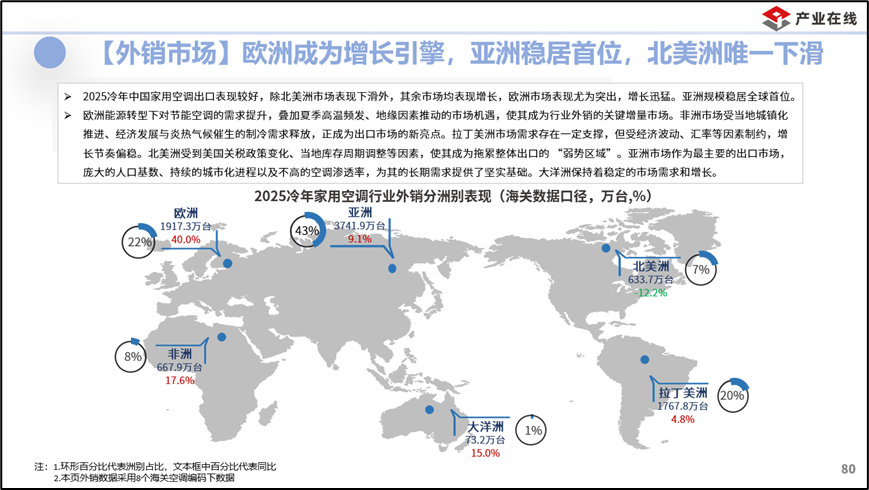

The export market has fallen into an imbalance between offense and defense. According to data from Industry Online, the export of household air conditioners in the 2025 cooling year is expected to reach 99.29 million units, a year-on-year increase of 16.7%. However, structural contradictions are prominent: the European market has achieved a 40% growth due to inventory replenishment and high temperatures, while emerging markets like Russia and Saudi Arabia have performed well; in contrast, the North American market has been affected by tariff policies, leading to a year-on-year decline of 17% in exports to the U.S., and the recovery of local light commercial production capacity in the U.S. has directly squeezed the market share of Chinese companies.

Moreover, in regions such as Southeast Asia and Mexico, the diversion of orders due to low tariffs is diluting China's cost advantage in air conditioning.In August 2025, the tariff on air conditioners exported from Thailand to the United States has been reduced to 19%, which is much lower than the tariff on Chinese exports to the U.S. Some companies have started to shift their production capacity to Thailand and other lower-cost regions.

Image Source: "China Household Air Conditioner Industry Research and Forecast Report"2025"Cold Year"

The current focus of competition in the air conditioning industry has shifted from homogeneous "scale dominance" to differentiated "value breakthrough," officially entering an era of multidimensional competition. Leading brands have taken the lead in clarifying their breakthrough paths, while new players continuously inject fresh competitive logic, collectively driving the enrichment of competition dimensions in the industry.

The differentiation path of leading brands is now clear; it is no longer about homogeneous competition for "scale supremacy," but rather a dislocated breakthrough through "value deepening."

Midea's layout in the whole scene is not only reliant on Hualing to capture the mid-to-low-end cost-performance market, but also focuses on compound functional products under its main brand, while entering the high-end market with COLMO, which targets products priced at over 10,000 yuan. According to the "Quarterly Research Report on Domestic Sales of Household Air Conditioner Brands" released by Industry Online, the internal sales volume of COLMO air conditioners is expected to grow by 36.4% year-on-year in the first half of 2025. Gree is deeply cultivating its "core technology barrier," attempting to offset channel weaknesses through technological premium, while also launching low-end brands to encircle the low-end market. Haier's differentiation focuses on "globalization + scenario-based," and after the production launch of the Thai Chonburi Industrial Park, local production capacity in Southeast Asia has surpassed 6 million units. At the same time, Haier is promoting the "Smart Community Air Solution" domestically, linking air conditioning with whole-home appliances for energy control, thereby consolidating its market share in the northern regions through scenario stickiness.

Beyond the leading brands, the entry of new players has completely restructured the competitive logic of the industry.

Xiaomi, with its core strategy of "comprehensive to C+ ecological layout," initially relied on OEM production by companies like Changhong and TCL for air conditioners, focusing on high cost-performance and smart connectivity. This approach directly pressured traditional brands to cut prices of their mid-range models by 15%-20%. Its core competitiveness lies not in the hardware itself but in "ecological linkage" and the "to C model." This model not only triggered a transformation in pricing but also pushed the industry to shift from "channel-driven" to "user-driven," accelerating the adoption of online channels and smart technology. According to the "China Domestic Sales of Household Air Conditioners Quarterly Brand Research Report," the domestic sales of Xiaomi air conditioners in the first half of 2025 reached nearly 6 million units, marking a year-on-year growth of 54.5%, demonstrating strong momentum.

Non-traditional home appliance players like Dreame and Huawei are leveraging their cross-industry advantages to penetrate niche markets. Huawei does not manufacture its own brand of air conditioners but instead empowers third-party manufacturers to launch Huawei Smart Selection air conditioners through the HarmonyOS intelligent connection system, capturing the mid-to-high-end market with ecosystem premium. Dreame, transitioning from cleaning appliances, achieves brand breakthrough by relying on specialized functions and ecosystem synergy.

The strategy of these new players to "focus on ecosystems rather than production capacity, and prioritize scenarios over scale" has further squeezed the survival space of traditional small and medium-sized brands.

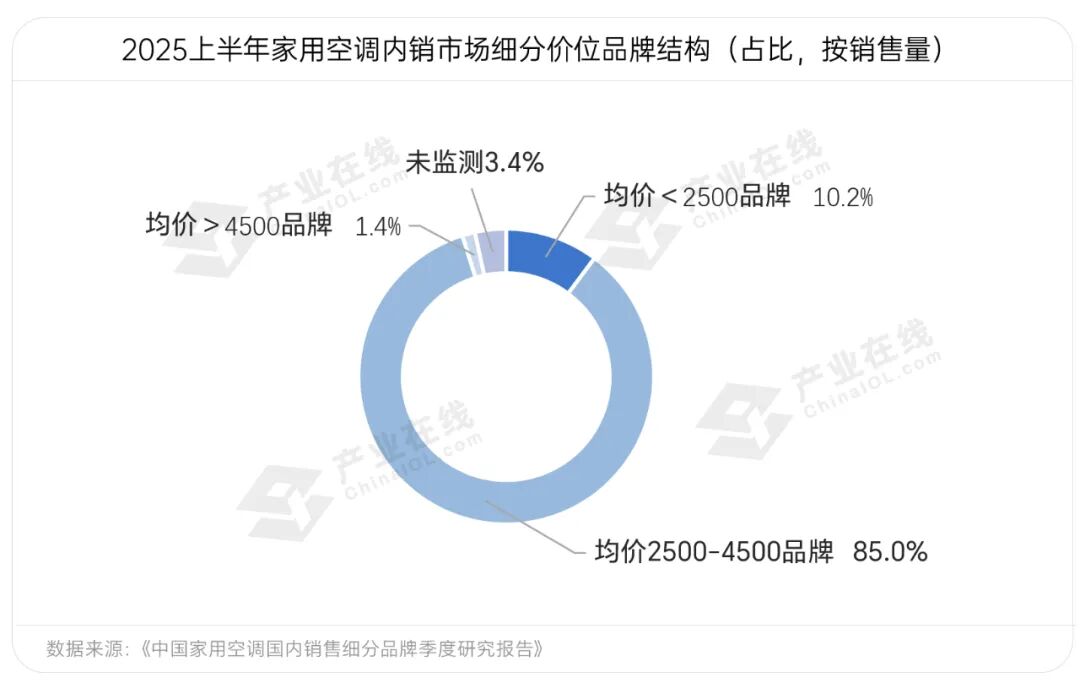

As players in the industry deepen their strategies, the brand matrix landscape in the air conditioning sector is gradually becoming clearer. According to data from Industry Online, the proportion of brands with an average price above 4500 yuan in the first half of 2025 is 1.4%. In addition to high-end brands like Midea’s COLMO and Haier’s Casarte, Meibo has also launched its high-end brand Meibang, attempting to carve out a space in the high-end market dominated by leading brands. The mid-range market is primarily a battleground for Midea, Gree, and Haier, as well as for many brands like Xiaomi and AUX, with prices concentrated between 2500 and 4500 yuan, attracting mainstream consumers with energy efficiency and basic smart features. The low-end market is occupied by brands such as Jinghong, Aufit, and Meibo.

In this matrix pattern, leading brands rely on sub-brands to cover all price ranges, while small and medium brands survive through a single positioning. The industry's "Matthew Effect" intensifies, but there are still new opportunities in niche markets.

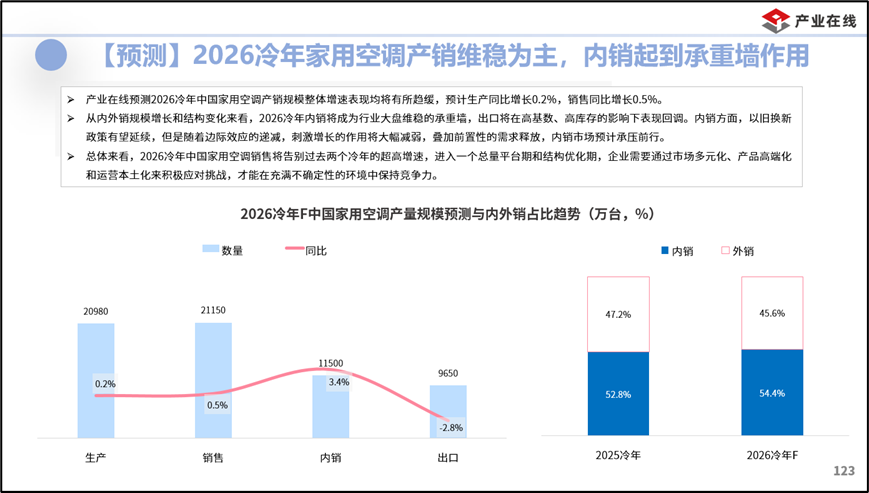

Industrial online forecasting, futureThe industry will bid farewell to the illusion of high growth and enter a "total platform period + structural optimization period." In the 2026 cold year, the growth rates of production and sales of household air conditioners will drop to 0.2% and 0.5%, respectively. Domestic sales, as the "load-bearing wall" supporting the overall development, will maintain slight growth, while exports will decline by 2.8% due to high base adjustments and high inventory levels overseas.

The diminishing marginal effect of policy stimulus, overseas tariff uncertainty, and high inventory levels will become the three core challenges facing the industry.

Image Source: "China Household Air Conditioner Industry Research and Forecast Report"2025 The Cold Year]

In the face of difficulties, Industry Online believes that the solution lies in the "three major shifts":

Firstly, shift from "policy dependence" to "technology-driven". The policy of trade-in cannot last long, and companies need to make breakthroughs in technologies such as new refrigerants, AI air conditioning chips, and photovoltaic direct drive. Product innovation will be the core for companies to maintain long-term competitiveness.

Secondly, shifting from "global sales" to "global manufacturing." In the face of tariff barriers, simple export trade has become unsustainable. Establishing localized production capacities in regions such as Southeast Asia and Africa is a key measure to address supply chain decoupling.

Thirdly, shift from "product thinking" to "scenario thinking." Air conditioners have evolved from "temperature control devices" to "air ecosystem hubs," and scenario-based innovation will unlock the value ceiling of products.

In summary, the unexpected growth of China's air conditioning industry in the cold year of 2025 is essentially the result of short-term stimuli from policies and climate. When these benefits fade, the industry will face the core contradiction of being "large but not strong." In the future, only by moving away from reliance on scale, delving deeply into technology, focusing on segmentation, and expanding globally can we achieve a true breakthrough in the "post-high-growth era."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track