Profit Drops Over 90%, Stock Price Rises Against the Trend, Dongfeng Motor Group's Sudden Trading Halt Sparks Speculation

On August 11, Dongfeng Motor Group Co., Ltd. (stock code: 0489.HK) suddenly announced a short trading halt before the market opened. Trading was suspended from 9:00 a.m. on August 11. As of the close on August 12, the stock had not yet resumed trading.

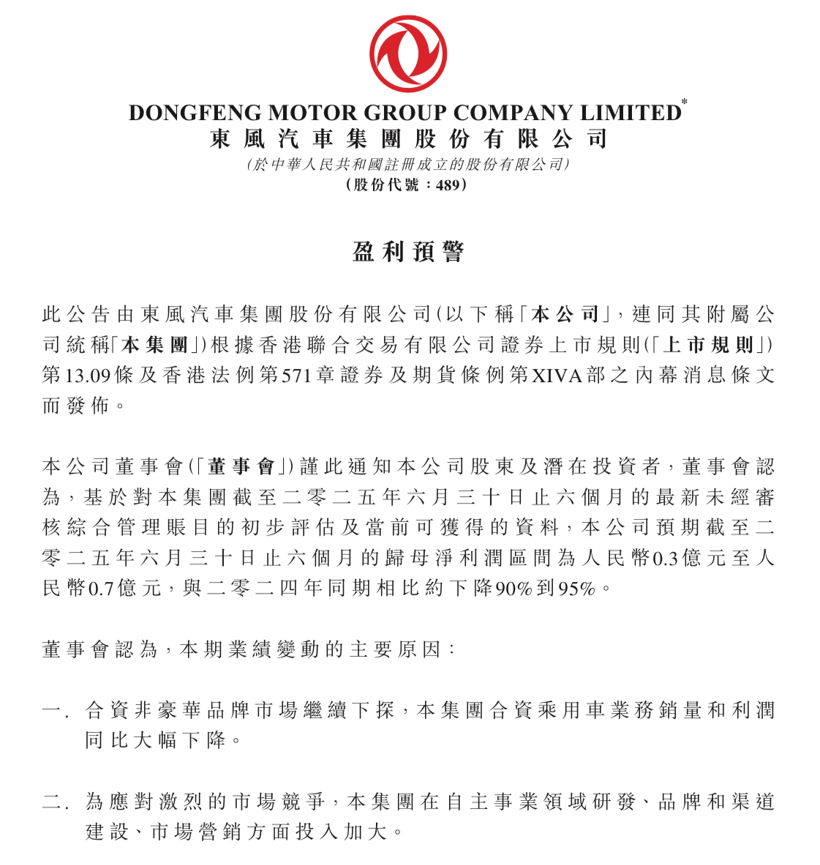

Notably, last Thursday (August 7), Dongfeng Motor Group issued a profit warning announcement: In the first half of 2025, Dongfeng Motor Group's net profit attributable to shareholders is expected to be between 0.3 billion and 0.7 billion yuan, a year-on-year decline of 90% to 95%.

Dongfeng Motor Group stated that the performance change during the period was mainly due to the continued decline in the joint venture brand market, leading to a significant year-on-year decrease in the volume and profit of the group's joint venture passenger car business. To cope with intense market competition, the group increased its investment in research and development, brand and channel development, and marketing in the independent business sector.

What is puzzling is that on the day the profit warning announcement was released, the company's stock price rose against the trend by 6.18%, and then increased by another 8.55% the following day, until trading was suspended on August 11. Recently, Dongfeng Motor Group's stock price has been continuously climbing, rising from a low of HKD 3.350 per share on June 23 to a high of HKD 6.300 per share on August 8.

This has triggered widespread speculation in the market. Members in the "stock forum" speculate that "Huawei and Lantu are cooperating for a backdoor listing," "Lantu is planning a spin-off IPO," "Could it really be privatization? Or the announcement of an A+H share issuance plan."

On August 12, Dongfeng Automobile Co., Ltd. (Stock Code: 600006), an A-share listed company, issued an announcement: On August 11, 2025, the controlling shareholder, Dongfeng Motor Group Co., Ltd., released a suspension announcement. According to the notice from Dongfeng Motor Group, the matters related to the suspension will not have a significant impact on the normal production and operation activities of the company.

But the forum members in the "stock forum" are still actively speaking, "Monster stock speculation?" "Could it be an investment guide?" "The fewer the words, the bigger the issue." "Merger and restructuring."

Since the partnership with Changan Automobile fell through, Dongfeng Motor has been taking rapid actions. It swiftly established Yipai Technology, assembling a team covering core functions across the entire value chain—including product planning, research and development, manufacturing, procurement, quality, sales, and service—in just six days. Within only two weeks of its founding, the goals and strategies for the second half of the year’s critical campaign have already been clearly laid out...

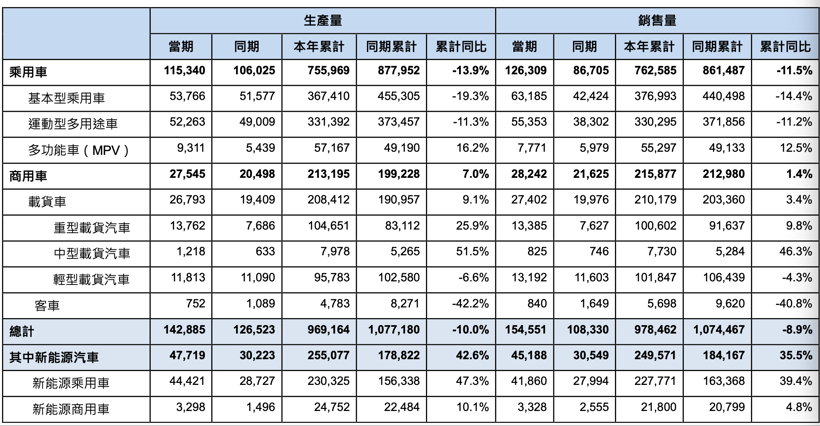

While attention continues to rise, the market has paid little attention to Dongfeng Motor’s sales report, which was only released on August 11. In July, Dongfeng Motor’s passenger vehicle sales surged by 45.7% year-on-year; however, cumulative sales for the first seven months still declined by 11.5%. Specifically, in July, eπ Technology sold 27,777 units, up 92.1%; Voyah Automobile sold 10,560 units, up 91.5%; Dongfeng Nissan sold 53,565 units, up 41.7%; Dongfeng Honda sold 24,383 units, up 71.4%; and Dongfeng Peugeot-Citroën sold 3,418 units, down 35.0%.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track