Prince New Materials reported a net loss of 68.5 million yuan! Packaging companies flocking to Southeast Asia.

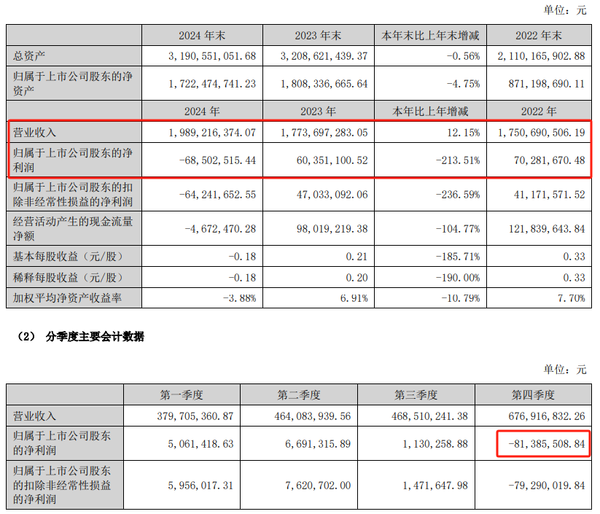

On March 28, 2025, Prince New Materials (002735.SZ) released its annual report for 2024, stating that the company achieved operating revenue of 1.989 billion yuan, a year-on-year increase of 12.15%. However, the net profit attributable to shareholders plummeted by 213.51% to -68.5025 million yuan, marking the first annual loss since its listing. The financial report indicated that the profitability of the company's core business is under pressure, with a year-on-year decline of 236.59% in net profit after deducting non-recurring gains and losses, and the net cash flow from operating activities turning negative, reflecting a dilemma of increasing revenue without increasing profit.

Main reasons for losses: Asset impairment and cost pressures

Wangzi New Materials attributed the decline in performance to multiple factors. First, the holding subsidiary Chongqing Fuyida Technology's profits did not meet expectations, leading to an impairment provision of 68.9 million yuan, which reduced the current period's profit and loss. Additionally, the disposal of non-current assets incurred a loss of over 12.99 million yuan, further dragging down profit performance.

Notably, the company's cash flow situation is concerning. During the reporting period, cash outflows from investment activities surged by 432.32% year-on-year to 528 million yuan, primarily used for the construction of production bases and equipment procurement in Southeast Asia. Meanwhile, cash inflows from financing activities decreased by 121.60% year-on-year, reflecting the capital market's cautious stance on its expansion strategy.

Prince New Materials Deepens Southeast Asia Layout, Global Strategy Advances Another Step

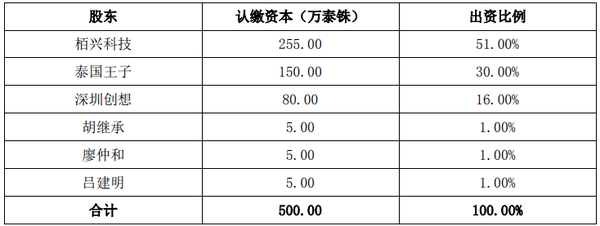

Facing intensified domestic market competition and changes in the international trade environment, Wangzi New Materials is accelerating its overseas expansion. Following the establishment of Thailand Tian Tai Environmental Packaging Technology Co., Ltd. in January 2024 to delve into the supporting materials market for industries such as new energy and electronic appliances, the company announced a major breakthrough in the Southeast Asian market on March 27, 2025.

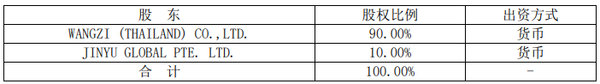

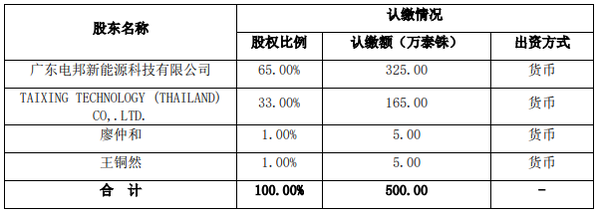

This strategic layout includes two core initiatives: First, a joint venture with a local Vietnamese company to establish Prince (Vietnam) Co., Ltd. (tentative name), focusing on developing packaging material markets for the electronics and home appliances and new energy industries, serving international leading enterprise customers within the region. Second, the establishment of Dianbang Technology (Thailand) Co., Ltd. in Thailand, concentrating on localized research, development, and production in emerging fields such as energy storage and mobile power sources.

The above layout will create a synergistic dual-hub effect in Southeast Asia, integrating regional resources to further enhance the company's global supply chain service network and provide comprehensive end-to-end solutions for strategic emerging industries such as new energy and consumer electronics.

Shareholder investment situation of Thailand Tian Tai Environmental Protection Packaging Technology Co., Ltd.

Wangzi (Vietnam) Co., Ltd. Shareholder Capital Contribution Status

Industry Trend: Packaging Companies Clustering in Southeast Asia

Prince New Materials'布局 in Southeast Asia is not an isolated case. In recent years, listed companies in China's packaging industry have increasingly set their sights on the Southeast Asian market. Companies such as Yongtong Technology, Hengxin Life, Zhongxin Co., Jiaquan Technology, and Tianyuan Co. have all established production bases in Thailand, Vietnam, and other locations to be closer to international clients like Apple and Samsung, and to mitigate uncertainties brought about by Sino-US trade friction. Analysts point out that the Southeast Asian region boasts significant demographic dividends, large consumer market potential, and dense preferential trade agreements with European and American markets, making it an important destination for the relocation of Chinese manufacturing.

Taking Yuto Packaging Technology (002831) as an example, as a leading provider of comprehensive packaging solutions for high-end brands in China, it has an extensive presence in Southeast Asia, with factories in Bac Ninh, Vietnam; Rayong, Thailand; and Penang, Malaysia. By establishing local production bases, Yuto Packaging Technology can quickly respond to customer needs and achieve localized production.

Hengxin Life (301501) also established Hengxin Life Technology (Thailand) Co., Ltd. in February 2024. Hengxin Life's biodegradable plastic packaging products cover the catering industry, including fast food, takeout, and beverages, as well as various consumption scenarios, with a wide sales area. Setting up a factory in the Golden Pool Industrial Park in Thailand will help it further expand into the Asian market as well as the international markets of North America, Oceania, and Europe.

Zhongxin Co., Ltd. (603091) has also turned its attention to Thailand. In November 2023, it registered Thailand Zhongxin Environmental Technology Co., Ltd., planning to invest 50 million USD to purchase 130 acres of land in the Jinchi Industrial Park, to build a production base for 50,000 tons of pulp molded dining utensils annually. As a world-leading company in "disposable plant fiber biodegradable environmental dining utensils," Zhongxin's products are primarily for export, mainly to North America, Europe, and other countries and regions. The decision to establish a factory in Thailand is mainly due to local advantages such as lower labor costs and minimal tariff impact. Currently, the first workshop of its Thai factory has successfully commenced production, and the second workshop is in the process of equipment installation. It is expected that the output will exceed 30,000 tons in 2025 and reach 50,000 tons by 2026.

Jialian Technology (301193), as a new tea beverage supplier, is mainly engaged in the research, development, production, and sales of high-end plastic products and fully biodegradable products. In 2023, the company completed the registration of its subsidiary in Thailand, Thai Jiaxiang Co., Ltd., and purchased land for the investment in a new production base, with a planned investment amount not exceeding 300 million yuan. Jialian Technology's production capacity was originally concentrated in China; establishing a factory in Thailand can better explore and meet the needs of overseas customers, improve business layout and medium to long-term strategic development planning, and enhance the company's competitiveness and risk resistance in the international market. After the United States launched "anti-dumping and countervailing investigations" against similar products from China and Vietnam, the Thai factory has become a key node for undertaking orders from Europe and the United States, with external sales revenue expected to account for more than 60% in 2024.

However, industry insiders remind that overseas expansion needs to be cautious of risks such as geopolitical issues, labor regulations, and local management. Wangzi New Materials admitted in its annual report that the Thailand project is still in the early stages of construction and may be difficult to contribute profits in the short term. The company will continue to pay attention to investment returns and cash flow balance.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track