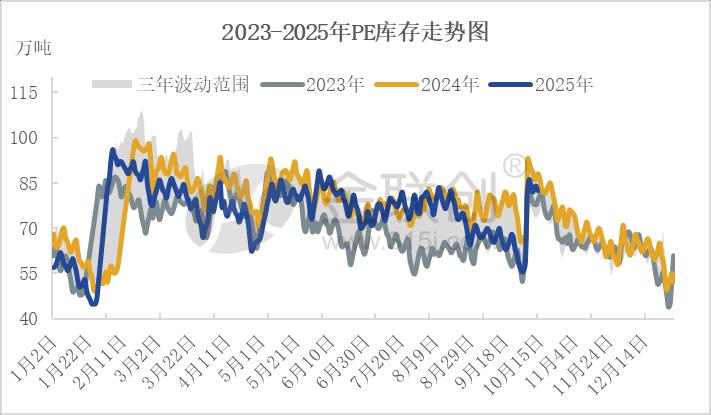

Pressure on Inventory Remains High, Polyethylene Market Continues to Face Downward Pressure

After the National Day holiday, the inventory levels of polyethylene are at relatively high levels. Although there is some demand for restocking from downstream factories after the holiday, the overall pressure to reduce inventory remains significant. Coupled with the gradual realization of new production capacity expectations, the market supply pressure continues to increase. Overall, under the dominance of a relaxed supply-demand situation, it is expected that polyethylene prices will continue to be under pressure in the short term, with a potential downward shift in focus.

Data Source: Jin Lian Chuang

The structural differentiation on the demand side is evident.

As temperatures gradually decrease in the northern regions, the demand for greenhouse films is starting to pick up. Some companies have already begun their autumn stocking. However, due to the delay in farming activities caused by the leap month in the lunar calendar and the relatively low profits from agricultural products, farmers are less willing to replace greenhouse films, which constrains the overall industry operating levels. The demand for mulch films is uneven across regions. In the northwest, the operating levels have slightly increased due to support from tender orders and garlic film demand. However, most other regions remain in the off-season, and the overall operating rate for mulch films remains relatively low.

The expectation of increased supply pressure

Recently, Daqing Petrochemical Linear/The low-pressure, Tianjin Petrochemical linear, and Guangdong Petrochemical full-density maintenance plans provide some support for supply, but the upcoming production capacity of ExxonMobil high-pressure and Guangxi Petrochemical is expected to increase supply.

Market Outlook

In September, the peak season demand did not meet expectations, and market transactions remained primarily demand-driven. The phenomenon of a lackluster peak season has become the norm in the industry, and the supply-demand conflict has not been effectively alleviated. Against the backdrop of new production capacity being released and limited demand stimulation, polyethylene prices are expected to continue facing downward pressure. Attention should be focused on the demand for agricultural films and the actual implementation of new production capacity. If the supply-demand structure cannot be effectively improved, the market may continue to experience weak and fluctuating trends.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track