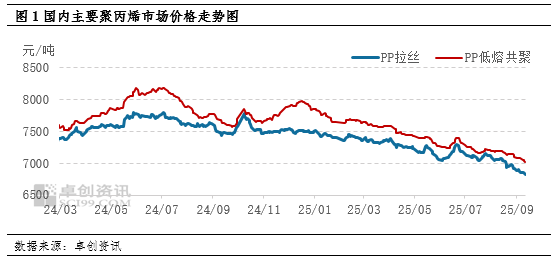

[PP Weekly Review] Market Continued Downtrend This Week, Narrow Weak Adjustment Expected Next Week

1Market Review: This week, the market experienced low-level fluctuations, with price levels slightly declining.

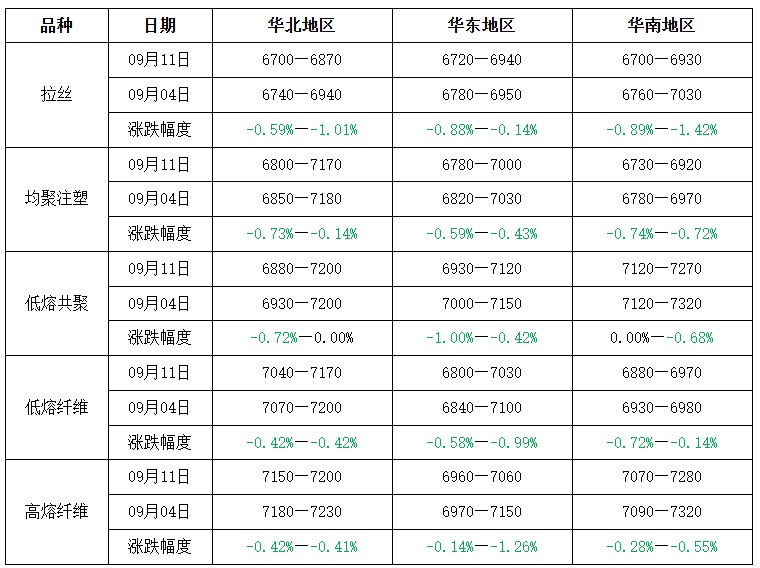

This week, domestic PP market prices continue to decline.As of this Thursday, the average weekly price of raffia in East China was 6,843 yuan/ton, down 47 yuan/ton from the previous week, a decrease of 0.68%. The regional price difference for raffia slightly widened but with limited space. In terms of varieties, the price difference between raffia and low-melt copolymer continued to widen. During the week, low-melt copolymer was also under pressure, but its price decline was not as significant as that of raffia.

Table 1: Domestic Market Price Assessment of Polypropylene This Week

Unit: Yuan/Ton

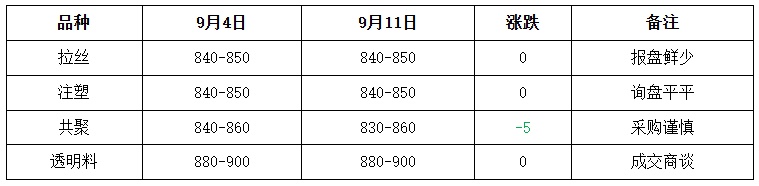

This week, the domestic PP USD market showed some signs of loosening, with sluggish trading activity.In the import market, since September, the fundamental contradictions in the USD import market persist, providing limited support to the. Some overseas production units resumed stable operations but, constrained by sales pressure, have once again offered quotations to the domestic market. However, due to currently weak demand, transactions are difficult to promote. Downstream factories continue to maintain just-needed purchases and small order transactions, with weak buying enthusiasm. In the domestic market, for September-October shipments, mainstream USD quotations for homopolymer raffia are in the range of $840-850/ton, and mainstream quotations for copolymer injection are also in the range of $840-850/ton; for copolymer transparent products, the mainstream USD price range for September-October shipments is $880-900/ton. In the export market, FOB indicative quotations for homopolymer raffia range from $845-875/ton. Overseas market demand remains weak, while supply is relatively sufficient, resulting in generally low purchasing enthusiasm. Additionally, the cost-profit margin of some PDH-produced PP enterprises has been further compressed, creating continued resistance to exports. Overall, inquiries in the export market this week remain acceptable, with transactions focused on negotiations, and limited improvement in the market trend.

Table 2: Domestic PP US Dollar Market Price Statistics

Unit: USD/ton

2Driving Factors: Insufficient Cost Support, Fundamentals Put Pressure on Prices

This week, crude oil prices declined week-on-week, limited by the return of geopolitical premiums and weaker economic data such as the non-farm payrolls. The cost support for PP weakened somewhat. Although maintenance of existing facilities increased during the week, market supply remained ample. On the demand side, there was no significant improvement as expected during the peak season, and the accumulation of finished product inventories in some areas restricted market transaction volumes. Although upstream raw material prices have recently weakened, most production routes are still operating at a loss, highlighting cost-side contradictions. Overall, the market is more evidently pressured by fundamentals. Under the dual pressure of ample supply and weak demand, PP prices continued to decline this week, and the low-level volatility of PP futures also suppressed market sentiment among participants.

3Market Outlook: Supply is expected to decrease, and the market's decline may slow down.

This week, the PP market fluctuated downward, and it is expected that the market will remain weak and fluctuate narrowly next week. Taking East China as an example, the price range for wire drawing is expected to be between 6,700-6,940 yuan/ton, with an average price of around 6,820 yuan/ton. The price range for low-melt copolymer is expected to be between 6,900-7,120 yuan/ton, with an average price of around 7,030 yuan/ton.On the cost side, crude oil is expected to fluctuate within a wide range, providing little clear guidance for PP costs. On the supply side, there will be no new capacity coming online next week, while maintenance at production facilities is expected to intensify, leading to a slight reduction in supply. On the demand side, there is limited improvement in new orders downstream, and thin factory profits combined with a lack of confidence in the market outlook are restraining procurement enthusiasm, so downstream players are expected to maintain a cautious, need-based replenishment pace in the short term. Overall, supply-side pressure is expected to ease slightly next week, but limited improvement in demand will continue to restrict market gains. Based on this, the PP market is expected to fluctuate narrowly with a weak tendency next week.

Supply: With an increase in maintenance of installations, supply is expected to decrease slightly.Next week, there will be no new capacity release, but there has been a concentration of unplanned maintenance recently. Combined with the planned maintenance at Qingdao Refining next week, it is expected that the loss will be 186,500 tons, a 3.32% increase compared to the previous period. Market supply is expected to slightly decrease. In terms of inventory, major producers continue to pressure intermediaries and downstream buyers to place orders and pick up goods, so enterprise inventories are expected to continue declining. However, considering that downstream demand has not significantly improved, intermediary market transactions are not performing well, which poses some resistance to destocking by traders. As for port inventories, the ongoing price inversion between domestic and foreign markets continues to restrict PP imports. Overseas demand remains weak, coupled with relatively sufficient supply, hindering PP exports. Overall, PP port inventories are expected to fluctuate within a limited range next week, around 38,000 to 39,000 tons.

Demand: New orders from downstream are limited and the profit level is low, making it difficult for demand to improve further.Although some downstream industries such as plastic packaging, food packaging, and home appliance components have seen an increase in production, overall new orders are limited, and profits are relatively thin, leading to no significant increase in raw material purchases. Some factories have indicated that they are still digesting the inventory of raw materials priced in July and have insufficient confidence in the short-term performance of PP prices, thus continuing to adopt a strategy of purchasing at lower prices in the short term.

Cost:The developments of the Russia-Ukraine issue and the Middle East issue next week, whether gradually easing or further escalating, will be key factors influencing oil price trends. The uncertainty will lead to wide fluctuations in oil prices. The average price of US crude oil is $63 per barrel, with a fluctuation range of $60-65 per barrel.If the situation escalates further, the price of crude oil will rise further, focusing on the resistance level at the key position of $65 for U.S. crude oil. Otherwise, if the U.S. requests to talk with Putin and mediates with Israel, leading to a de-escalation of the situation, the price of crude oil will fall. Therefore, geopolitical factors will dominate the trend of oil prices next week, with the Federal Reserve's interest rate cuts already largely priced in and unlikely to cause significant disturbances to oil prices, resulting in wide fluctuations in oil prices. In terms of risks, firstly, successful negotiations between Russia and Ukraine; secondly, the Federal Reserve significantly increases interest rate cuts. Crude oil is expected to fluctuate widely, providing limited guidance for PP.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track