[PP Weekly Review] Market Consolidates After This Week's Decline, Expected to Show Weak Narrow Adjustments Next Week

1Market Review: This week, the market declined and then consolidated, with the price focus continuing to slide.

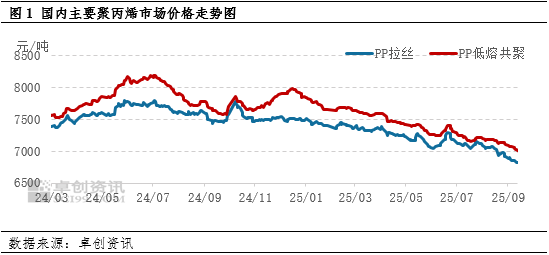

This week's domestic PP marketAfter the decline, there has been a consolidation, and the price center continues to move downward.As of this Thursday, the average weekly price of East China spinning is 6,773 yuan/ton, down 57 yuan/ton from last week, with a decrease of 0.83%. The regional price difference for spinning has slightly narrowed. In terms of types, due to insufficient support from fundamentals, the low-melt copolymer has a larger decline than spinning, and the price difference between the two continues to narrow.

2Market Outlook: As the National Day holiday approaches, there is insufficient fundamental support.

It is expected that the PP market will undergo weak consolidation next week. Taking East China as an example, it is anticipated that the price range for wire drawing will be between 6680-6800 yuan/ton, with an average price of 6760 yuan/ton. The price range for low-melt copolymer is expected to be between 6830-7000 yuan/ton, with an average price of 6910 yuan/ton.On the cost side, crude oil is expected to fluctuate mainly, providing limited guidance for PP. On the supply side, there will be no new capacity impact next week, but the number of maintenance facilities is expected to decrease, leading to a slight increase in supply. On the demand side, with the holiday approaching next week, most downstream entities have already completed pre-holiday purchases and are expected to mainly observe, making demand unlikely to provide support. Regarding inventory, production companies and traders are primarily focused on aggressive promotions to reduce inventory before the holiday, which is expected to weaken market support. Overall, the support from supply and demand fundamentals in the market next week is expected to be weak, with prices anticipated to adjust narrowly on the downside.

Supply:The maintenance of equipment is expected to decrease, while supply will increase slightly.Next week, there will be no impact from newly added production capacity. In terms of plant maintenance, there are no scheduled new maintenance units next week, and some existing maintenance units are expected to restart. The overall intensity of plant maintenance is expected to weaken, with an anticipated loss of 161,300 tons next week, a decrease of 18.12% compared to the previous week. Overall, supply is expected to increase next week. Regarding inventory, considering the increased inventory pressure after the holiday, production companies are primarily focusing on actively shipping before the holiday, and inventory is expected to slightly decline. For traders' inventory, on one hand, they need to prepare for the planned volume during the holiday period, and on the other hand, as the holiday approaches, downstream purchasing is gradually completing, increasing the resistance to traders' shipments. Therefore, inventory is expected to increase next week. For port inventory, domestic prices remain low, and the domestic and international markets continue to be inverted. Coupled with ample domestic supply, PP imports are limited. On the export side, overseas demand limitations restrict the growth of PP exports. Overall, PP port inventory is expected to remain relatively unchanged next week, around 39,000-40,000 tons.

Demand: Complete stocking in advance before the holiday, short-term demand is weak.Currently, the follow-up on new orders from downstream remains relatively limited. Recently, raw material prices have been hovering at low levels. After a slight recovery in downstream profits, there has been increased market participation to complete pre-holiday stockpiling. With the holiday approaching next week, the festive atmosphere in the market is gradually intensifying, and downstream purchasing enthusiasm is expected to weaken, leading to weak demand.

Cost:Next week, the average price of West Texas Intermediate crude oil is expected to be $64 per barrel, with a fluctuation range of $62 to $65 per barrel.Ukraine frequently attacks refineries within a certain European country's territory, causing it to restrict the export of oil products. Meanwhile, former U.S. President Trump openly calls on this European country, urging European nations to stop importing oil from it and completely eliminate their energy dependence on it. This situation poses a short-term risk of shifting global trade flows, although the risk of actual supply disruption remains low. Addressing the Middle East situation, the U.S. demands that Israel refrain from annexing the West Bank and calls for peace talks with Saudi Arabia, Qatar, and others, thereby reducing the risk of escalation. Consequently, geopolitical disturbances are providing support to oil prices, but cooling expectations exist, suggesting that oil prices may experience a fluctuating trend. From a risk perspective, the key concerns are the escalation of the Russia-Ukraine situation and the subsiding Middle Eastern geopolitical tensions. Crude oil is expected to mainly fluctuate, providing limited guidance for PP costs.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track