[PP Weekly Review] Macro Positive Factors Drive Market, Polypropylene (PP) Prices Rebound

1. This Week's Market Focus

1 ProductionThis week, domestic polypropylene production reached 773,600 tons, a decrease of 3,300 tons (0.42%) compared to last week's 776,900 tons; however, it increased by 120,600 tons (18.47%) compared to 653,000 tons in the same period last year. Production losses among manufacturers remained high during the week, with no new capacity additions, resulting in only a narrow adjustment in polypropylene output.

2 ) The average operating rate of the downstream polypropylene industry decreased by 0.07 percentage points to 48.45%.Polypropylene priceThe increase provides some support for polypropylene products. However, the off-season effect in end-user consumption will become more pronounced, and demand is expected to remain weak.

3 Inventory: As of July 23, 2025, China's total commercial polypropylene inventory stood at 814,400 tons, an increase of 33,200 tons from the previous period, up 4.24% month-on-month and 17.60% year-on-year. Producers' total inventory increased by 2.62% month-on-month; sample traders' inventory rose by 9.36% month-on-month; and sample port warehouse inventory grew by 6.50% month-on-month. By product type, raffia-grade inventory increased by 2.05% month-on-month, while fiber-grade inventory rose by 3.29% month-on-month.

2. This Week's Market Analysis

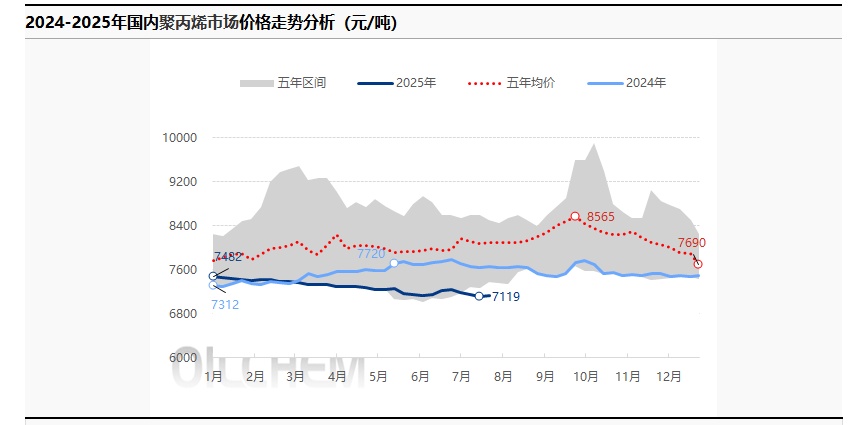

In this period, the spot price of polypropylene is running strong, with a price fluctuation range of 7099-7141 yuan/ton. Domestic efforts to counter internal competition are being promoted, with baseline assessments of outdated units in the petrochemical industry and inspections of coal mine production organized by the National Energy Administration gradually underway. The black commodity sector leads the market gains, with polypropylene prices rising due to coal cost pressures and expectations of reduced supply. However, the supply-demand structure remains unchanged, demand-side follow-up is weak, market transactions are concentrated mainly among intermediaries, and inventories have accumulated over the week. 。

3. Market Influencing Factors

The current supply-demand balance maintains a pattern of supply exceeding demand, with the surplus remaining positive but slightly narrowing, which somewhat eases the bearish impact on market sentiment. In the next period, the surplus in the supply-demand balance is expected to expand significantly, likely intensifying the bearish impact on prices.

4. Market forecast for next week

The expected increase in polypropylene consumption for the next period will maintain the supply and demand trading logic, focusing on identifying the transaction center of gravity. Key Focus: 1. Expectations of increased supply: Yulong Petrochemical's first production line will shut down within the week, and Zhejiang Petrochemical's third production line will start up within the week. The ongoing supply and demand interactions continue to drive market variables. 2. Weak demand: Both domestic demand and exports are under pressure. Downstream general products such as woven plastics and plastic films are in the off-season, and insufficient order follow-up is dragging down market transactions. 3. Cost-side easing expectations: With OPEC+ production increase expectations and easing geopolitical tensions, international oil prices are expected to ease; Saudi Arabia's CP prices are expected to decline in August, leading to a loosening of cost support from PDH production. 。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track