[PP Weekly Outlook] Market Expected to Test Transactions Around 6,800–7,000 RMB/Ton Today

1. Focus points

1 、 9/5: The market continues to focus on the OPEC+ meeting this Sunday, concerned about the introduction of a new production increase plan, leading to a drop in international oil prices. NYMEX crude oil futures contract for October fell by $1.61 to $61.87 per barrel, a decrease of 2.54% compared to the previous period; ICE Brent crude futures contract for November fell by $1.49 to $65.50 per barrel, a decrease of 2.22% compared to the previous period. China's INE crude oil futures contract 2510 fell by 1.3 to 482.3 yuan per barrel, and the night session fell by 10.4 to 471.9 yuan per barrel. 。

2 This week (20250829-0904), the average operating rate of the domestic polypropylene downstream industry increased by 0.49 percentage points to 50.23% compared to last week.

3 September 8:The polyolefin inventory of the two major oil companies is 700,000 tons, an increase of 30,000 tons compared to last week. 。

Core logic: Incremental release on the supply side, slow improvement on the demand side, and significant difficulty in passing costs along the industry chain.

2. Price List Form

|

Product |

Category |

9 April 4th |

9 May 5th |

Price change percentage |

unit |

|

Crude Oil |

NYMEX |

63.48 |

61.87 |

-1.61 |

USD/barrel |

|

ICE Brent Crude Oil |

66.99 |

65.50 |

-1.49 |

USD/barrel |

|

|

Acrylic acid |

Domestic propylene |

6605 |

6560 |

-45 |

Yuan/ton |

|

Methanol |

Domestic Methanol |

2380 |

2380 |

0 |

Yuan/ton |

|

PP Main futures contract |

Closing price |

6939 |

6961 |

22 |

Yuan/ton |

|

Mainstream price of wire drawing |

Zibo |

6956 |

6948 |

-8 |

Yuan/ton |

|

Ningbo |

6862 |

6845 |

-17 |

CNY/ton |

|

|

Guangzhou |

6991 |

6975 |

-16 |

Yuan/ton |

|

|

Related Products |

PP Powder |

6780 |

7050 |

270 |

Yuan/ton |

|

PE |

7453 |

7452 |

-1 |

CNY/ton |

|

|

Remarks: |

|||||

|

1 The above RMB prices are all tax-inclusive and for telegraphic transfer. |

|||||

|

2 The prices for the two periods refer to the point-in-time prices from the two previous working weeks before this week, not the weekly average prices. |

|||||

|

3 The rate of change in price refers to the month-on-month percentage change. |

|||||

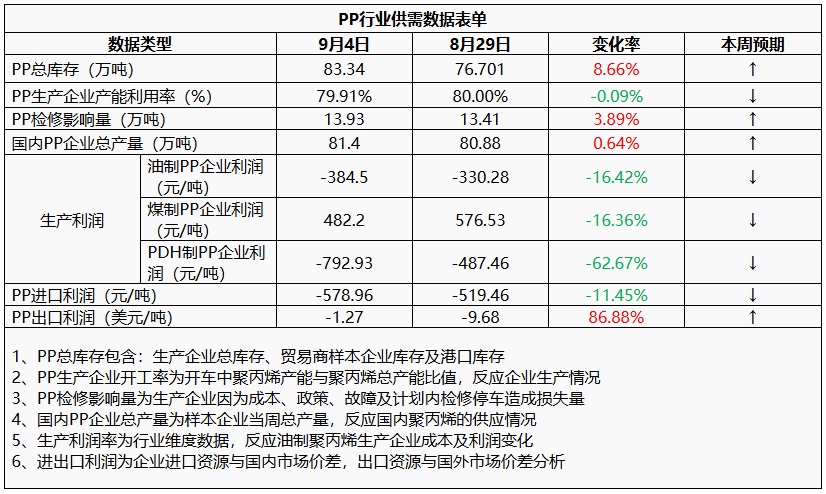

3. Data Forms

IV. Market Outlook

During the supply-side incremental release period, demand is rising slowly, but the main increase in new orders remains limited. The destocking of existing market inventory is sluggish, leading industry participants to hold a weak outlook on future demand. Cost-side expectations are losing support, but increased maintenance activities will temporarily ease supply-demand pressures in the market. On the policy front, continued efforts are being made, with much hope pinned on a potential Fed rate cut to boost market liquidity. In the short term, there is fierce competition between supply-demand and cost factors. It is expected that today’s market will focus on verifying transactions in the range of 6,800-7,000 yuan/ton.

5. Data Calendar

|

Data Project |

Publication Date |

Previous data |

This period's trend is expected |

Unit |

|

PP Total Inventory |

Wednesday 4:30 PM |

83.34 |

↑ |

Ten thousand tons |

|

PP Production Enterprise Capacity Utilization Rate |

Thursday 4:30 PM |

79.91% |

↓ |

% |

|

PP Weekly maintenance impact |

Thursday 4:30 PM |

13.93 |

↑ |

Ten thousand tons |

|

Total Domestic PP Production Volume |

Thursday 4:30 PM |

81.4 |

↑ |

10,000 tons |

|

Oil-based PP company profit |

Thursday 4:30 PM |

-384.5 |

↓ |

Yuan/ton |

|

Coal-to-PP Enterprise Profit |

Thursday 4:30 PM |

482.2 |

↓ |

Yuan/ton |

|

PDH Manufacturing PP Enterprise Profit |

Thursday 4:30 PM |

-792.93 |

↓ |

Yuan/ton |

|

PP Import Profit |

Thursday 4:30 PM |

-578.96 |

↓ |

Yuan/ton |

|

PP Export Profit |

Thursday 4:30 PM |

-1.27 |

↑ |

USD/ton |

|

1 Consider significant fluctuations as those with an increase or decrease exceeding 3% in data dimensions. 2 "Considered a narrow fluctuation, highlighting data with an increase or decrease of within 0-3%." |

||||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track