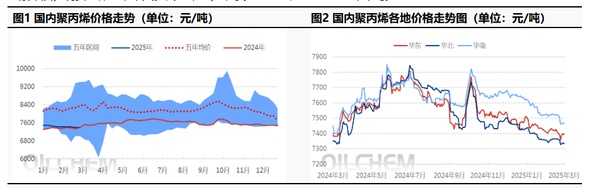

[PP Daily Review] Up and Down 1-5! Terminal Purchasing Continues with Rigid Demand, Expecting a Narrow Fluctuation in the Polypropylene Market

1. Today's Summary

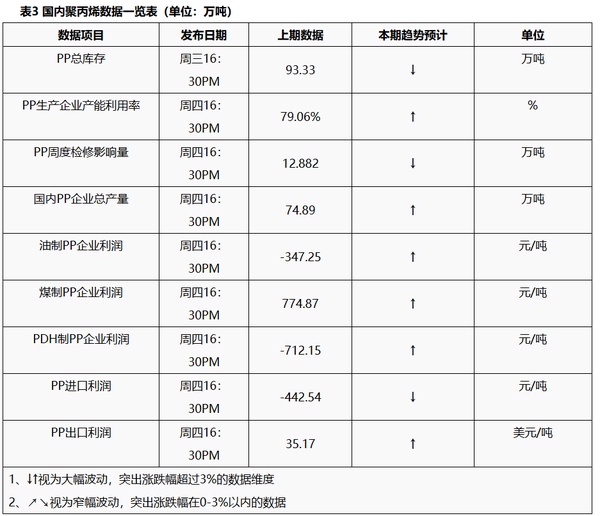

① March 4 report: Early morning polyolefin inventory at the two oil companies was 845,000 tons, down 15,000 tons from the previous day.

Today, the domestic polypropylene shutdown impact remains steady at 12.81%, and there are no changes in the domestic PP maintenance devices today. The daily production ratio of drawing wire has decreased by 1.95% from yesterday to 30.81%, while the daily production ratio of low melt co-polymer has increased by 0.84% from yesterday to 12.90%.

③. The supply-demand gap this week (20250222-0228) is 77,020 tons. As downstream demand continues to recover, inventory is being slowly depleted, but supply still shows a growing trend, maintaining a slight surplus in the supply-demand gap.

2. Spot Overview

Taking East China as the benchmark, today's PP granule closing price was 7393 yuan/ton, down 4 yuan/ton from yesterday, in line with the early expectation.

Today, the futures market showed weak oscillation during the session. Downstream demand has not shown any significant changes, with purchases mainly limited to essential needs, resulting in only limited increases in orders. Market participants are operating on a follow-the-market basis, and the trading atmosphere within the market is lukewarm. Overall, the spot prices have not fluctuated much. As of the afternoon session, the mainstream price for East China**** (lā sī) was between 7340-7450 yuan per ton. Note: "**** (lā sī)" is typically used in the context of wire drawing or bar stock but lacks direct translation in this financial context. It might refer to a specific type of material or product.

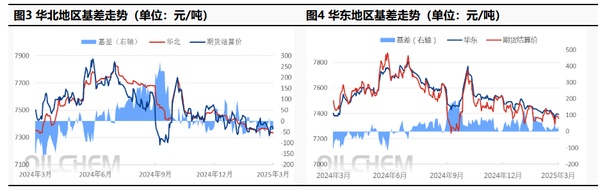

3. Basis

In terms of basis, today the polypropylene basis in East China is 32 yuan/ton, an increase of 14 yuan/ton compared to yesterday; the basis in North China is -27 yuan/ton, a decrease of 26 yuan/ton compared to yesterday.

4. Production Dynamics

The polypropylene capacity utilization rate rose from 81.17% to 81.90%, an increase of 0.73% compared to yesterday. The main reason is the restart and ramp-up of a 500,000 tons/year PP unit at Guangdong Petrochemical. The oil-based profit increased by 141 yuan/ton to -268 yuan/ton.

5. Market Sentiment

Upstream inventory remains high, with active transfers to intermediate links. Traders mainly follow the market trend in shipments. However, downstream order increments are limited, and trading within the market is subdued. The market anticipates that the Two Sessions will bring macro-favorable policies to boost the market.

6, Price Forecasting

At the beginning of the month, most upstream petrochemical enterprises maintained firm prices for sales. Middlemen adjusted their offers and shipments accordingly, with****transactions in the market. Spot prices fluctuated within a narrow range, and the circulation of market goods was slow. Factories maintained consumption of the industrial chain inventory based on****. It is expected that tomorrow...Polypropylene marketMaintaining a fluctuating range of 7350-7450 yuan per ton, with a focus on demand and inventory changes. As the peak season of "Golden March" approaches, order situations may slightly improve, and on-site trading is expected to show positive trends.

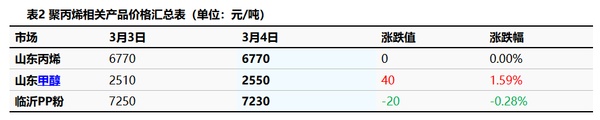

7. Relevant product information

8. Data Calendar

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track