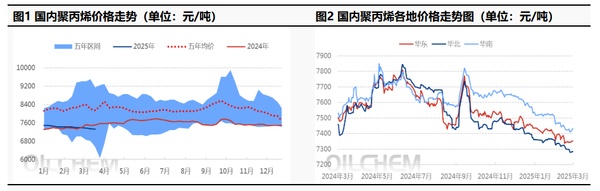

【PP Daily Review】Up 1-24! Cost support strengthens, PP market rises slightly.

1.将上述内容翻译为英文后,结果如下: 1. Summarize

①, Sinopec Southwest PP price adjustment: Raffia, film and fiber down 50, injection molding down 50-100, copolymer down 50-80, pipe up 50; Sinopec East China PP up 50, Yangzi K8003 fixed at 7800, 1215C fixed at 7850, Zhenhai M60T fixed at 7650, M09 fixed at 7750, M30RH fixed at 7800.

② As of today, the domestic polypropylene shutdowns have increased by 1.42% to 17.93% compared to yesterday, primarily due to the shutdown and maintenance of Yulong Petrochemical's Line Five (300,000 tons/year) PP plant and Beihai Refining and Chemical's (200,000 tons/year) PP plant. The daily production percentage of pull lines has decreased by 2.74% to 25.28% compared to yesterday, while the daily production percentage of low melt index copolymers has decreased by 0.66% to 10.35%.

③, This week (20250307-0314), the supply-demand gap narrowed significantly to 40,000 tons, primarily due to a noticeable decrease in supply caused by increased plant maintenance. This, coupled with a slow recovery in demand, led to an improvement in the supply-demand balance.

2. Present Situation

Today, polypropylene filaments in the East China region closed at 7352 RMB/ton, up 1 RMB/ton from yesterday, meeting early expectations.

Today, the futures narrowly rebounded, with the market center shifting upward by 10-30 yuan per ton in the morning. Wholesale market traders tested following the涨势, with crude oil rising as cost support remained solid. However, demand showed no significant change, with downstream continuing to make just-in-time purchases. Trading remained cautious in the pit, with the mainmainline in the Hu東 area for rayon yarn closing between 7280-7430 yuan per ton by midday.

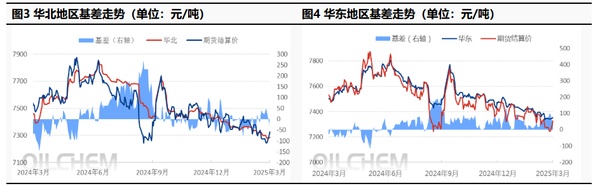

3, Basis between futures and spot

The price difference of ethylene in the Yangtze River Delta region is 26 yuan per ton, down 24 yuan per ton from yesterday. In the Beijing region, the price difference is -41 yuan per ton, down 23 yuan per ton.

4. Price Forecasting

Here is the translation: Exports impose tariffs on imported goods, reducing export orders, which in turn leads to a decrease in terminal demand and a decrease in the market's upward momentum, but new production capacity is limited, leading to lower production and a slower increase in supply, and is expected to support prices in the short-term market around 7280-7450 USD/ton.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track