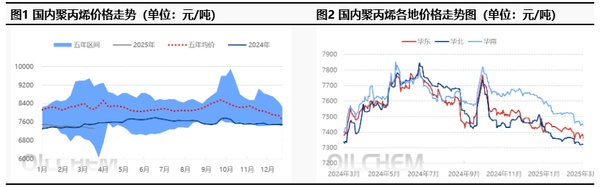

[PP Daily Review] Support from the cost side boosts the polypropylene market, shifting its focus upwards

today's summary

Petrochemical East China PP pricing, Zhongan PPH-T03 up 100 to 7300 yuan/ton, An PPH-T03 up 100 to 7400 yuan/ton, Yang 1215C down 50 to 7800 yuan/ton, Shang GM1600E down 50 to 8650 yuan/ton.

②、The impact of domestic polypropylene shutdowns today decreased by 1.03% to 16.51% compared to last week, mainly due to the startup of a 70,000 tons/year line at Dushanzi Petrochemical and a 300,000 tons/year PP unit at Hainan Ethylene, which is expected to increase daily production by 2,220 tons. The daily production ratio of fiber increased by 4.43% to 28.02% compared to last week, mainly due to the startup of the 300,000 tons/year unit at Hainan Ethylene producing fiber, which is expected to reduce daily fiber production by about 1,800 tons.

③、This week (20250307-0314), the supply-demand gap narrowed significantly to 40,000 tons, mainly due to a noticeable decrease in supply caused by increased facility maintenance, coupled with a slow recovery in demand, leading to an improvement in the supply-demand gap.

2, Spot Overview

Table 1 Domestic Polypropylene Price Summary (Unit: Yuan/Ton)

Data source: Longzhong Information

Using the East China region as a benchmark, today's polypropylene fiber closed at 7351 yuan/ton, an increase of 8 yuan/ton from last week, in line with early expectations.

Futures opened higher and fluctuated today, with the market reporting a shift in focus to 10-50 yuan/ton in the morning. The increase in cost supports the market sentiment, and as demand gradually recovers, low-price offers have risen accordingly. However, due to the impact on export orders, the growth of new downstream orders has slowed, limiting the overall circulation of goods. By midday, the mainstream price for wire drawing in East China was 7280-7430 yuan/ton.

3, futures-spot basis

In terms of basis, the polypropylene basis in East China today is 50 yuan/ton, a decrease of 44 yuan/ton from last Friday; the basis in North China is -18 yuan/ton, a decrease of 49 yuan/ton from last week.

4, Production Dynamics

Polypropylene capacity utilization rate increased from 76.53% to 77.14%, up 0.61% from last Friday. The main reason is the start-up of a 70,000 tons/year unit at Dushanzi Petrochemical and a 300,000 tons/year ethylene unit in Hainan, resulting in an increase of 2,220 tons in daily production. Oil-based profit margin decreased by -69 yuan/ton to -368 yuan/ton.

5, market sentiment

Downstream factories have insufficient follow-up on new orders, leading to a weak intention to replenish raw materials. Upstream factories face increased pressure to ship, with clear signs of reduced production and load reduction, and rising pressure to reduce inventory. Intermediaries, due to weak demand follow-up, experience increased pressure to ship, resulting in more cautious profit concessions.

6, price prediction

Demand-side weakness continues, with increased tariffs overseas leading to a reduction in export orders for manufactured goods. Supply-side expectations for recent increases remain unchanged, with future market valuation expectations being weak. Frequent short-term maintenance and rising costs are beneficial to market sentiment, as merchants who have been holding low prices for a long time are testing higher offers to confirm transactions. Recently, the market has been in a tug-of-war between supply and demand and costs. It is expected that the short-term polypropylene market will see transaction verification around 7300-7430 yuan/ton, with close attention to the impact of tariff adjustments on downstream product exports, inventory across the industrial chain, and changes in the demand side.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track