[pp daily review] slow redemption of peak season demand, polypropylene market fluctuates weakly

1. Today's Summary

①. Sinopec South China Guangzhou 4220 decreased by 100 to 8300, PPR-200P decreased by 100 to 8500.

②. Today, the domestic polypropylene shutdown impact decreased by 0.51% compared to yesterday to 19.28%. Guoneng Xinjiang's 450,000-ton/year unit is operational, with an expected daily production increase of 1,350 tons. The daily production proportion of raffia increased by 1.16% compared to yesterday, reaching 29.34%.Jingmen Petrochemical120,000 tons per yearMaoming PetrochemicalThree lines with an annual capacity of 200,000 tons.Guoneng Ningxia Coal Line 4The production capacity is 300,000 tons per year, with an expected increase in wire drawing output of 1,800 tons per day.

In section ③, (from September 5, 2025, to September 11, 2025), the current supply-demand balance maintains a pattern of supply being less than demand. The supply-demand gap has shifted from a positive to a negative value, which positively impacts market sentiment. The supply-demand balance gap is expected to remain negative and slightly widen in the next period, which is anticipated to continue having a favorable impact on prices.

2. Spot Overview

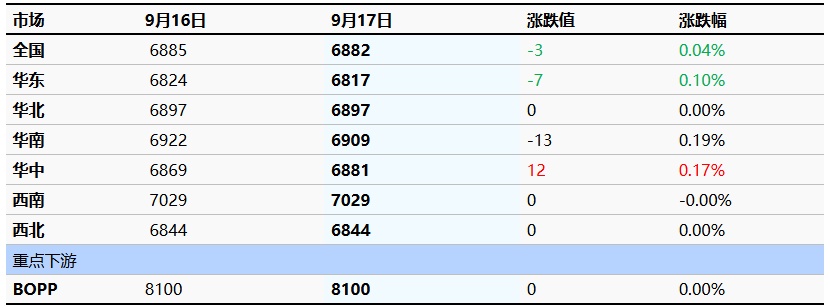

Table 1 Summary of Domestic Polypropylene Prices (Unit: Yuan/Ton)

Based on the East China region as a benchmark, today's polypropylene filament closed at 6817 yuan/ton, down 7 yuan/ton compared to yesterday. The national average filament price fell by 3 yuan/ton compared to yesterday, a decrease of 0.04%, in line with the morning forecast.

Today, the futures market fluctuated within a range, with morning market quotations maintaining a fluctuation amplitude of -10/10 yuan/ton. The potential interest rate cut by the Federal Reserve has activated capital enthusiasm, and maintenance benefits have alleviated some supply pressure. However, market demand is still recovering slowly. In the short term, the market is still under supply and demand pressure, and cautious selling at a discount is the primary focus. In the short term, there is a tug-of-war between supply-demand and cost. The market is expected to remain weak and volatile in the near term. As of midday, the mainstream price of East China wire drawing is between 6,780-6,950 yuan/ton.

|

Figure 1 Domestic Polypropylene Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic Polypropylene Prices in Various Regions (Unit: RMB/ton) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/62d81c87d09b4b9181547e179a7fb7b2.png) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/ff3aa8041fe949edb3ef2166fa34a911.png) |

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

3. Basis between spot and futures

In terms of basis, the polypropylene basis in East China today is -165 yuan/ton, down 3 yuan/ton from last week; the basis in North China is -85 yuan/ton, up 10 yuan/ton from yesterday.

|

Figure 3 Basis Trend in North China (Unit: Yuan/Ton) |

Figure 4 Basis Trend in East China (Unit: Yuan/Ton) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/2faea56cf7da4b708f56eead05923931.png) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/580564bd4a6c4bcf8b743f641c31330e.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4. Production Dynamics

The polypropylene capacity utilization rate increased from 74.96% yesterday to 75.43%, up by 0.47% compared to yesterday.The startup of Guoneng Xinjiang's 450,000-ton/year plant is expected to increase daily production supply by 1,350 tons.The profit from oil refining decreased by 79.49 yuan/ton compared to yesterday, reaching -523.78 yuan/ton.

|

Figure 5: Domestic Polypropylene Capacity Utilization Rate Trend Chart |

Figure 6 Domestic Polypropylene Profit Price Trend Chart (Unit: Yuan/Ton) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/8283ced4ac554328969a0d2f93c962ac.png) |

![[PP日评]:旺季需求兑换缓慢 聚丙烯市场弱势震荡(20250917)](https://oss.plastmatch.com/zx/image/62ef61c41bea4b4e8ed94028f4559f83.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

5. Market Sentiment

Although crude oil prices have increased, cost support has strengthened.But Market demand follow-up remains insufficient.The market prices are primarily experiencing weak fluctuations. Intermediaries face transaction pressure and are cautiously offering discounts to sell goods. Downstream factories have limited order follow-up, and merchants are prudently purchasing as needed.

6. Price Forecast

In the short term, despite strong maintenance efforts for installations, supply-side pressure remains significant. The growth rate in downstream consumption sectors is slower than expected, exacerbating supply-demand conflicts in the market. Factory order growth is limited, and there is insufficient willingness to stockpile. Participants hold a cautious attitude towards the future market, with prices lacking upward momentum. It is expected that the polypropylene market will fluctuate within the range of 6700-6900 yuan/ton in the short term.

7. Related Product Information

Table 2 Summary of Prices for Polypropylene-related Products (Unit: Yuan/Ton)

|

Market |

9 16th of the month |

9 16th of the month |

Change in value |

Percentage Change |

|

Shandong Propylene |

6550 |

6615 |

+65 |

+0.99% |

|

Shandong Methanol |

2430 |

2450 |

+20 |

0.82% |

|

Linyi PP powder |

6770 |

6770 |

0 |

0.00% |

Data source: Longzhong Information

8. Data Calendar

Table 3 Overview of Domestic Polypropylene Data (Unit: 10,000 tons)

|

Data Project |

Publication Date |

Previous Data |

The trend for this period is expected |

Unit |

|

PP Total Inventory |

Wednesday 4:30 PM |

83.66 |

↑ |

10,000 tons |

|

PP manufacturing enterprises capacity utilization rate |

Thursday 4:30 PM |

76.83% |

↓ |

% |

|

PP weekly maintenance impact== |

Thursday 4:30 PM |

16.64 |

↑ |

10,000 tons |

|

Total Domestic PP Production |

Thursday 4:30 PM |

78.67 |

↓ |

10,000 tons |

|

Oil-based PP company profit |

Thursday 4:30 PM |

-415.41 |

↓ |

CNY/ton |

|

Coal-to-PP enterprise profit |

Thursday 4:30 PM |

489.2 |

↑ |

Yuan/ton |

|

PDH-based PP enterprise profit |

Thursday 4:30 PM |

-882.14 |

↓ |

Yuan/ton |

|

PP import profit |

Thursday 4:30 PM |

-488.4 |

↓ |

CNY/ton |

|

PP export profit |

Thursday 4:30 PM |

-5.58 |

↑ |

USD/ton |

|

1. ↓↑ are considered significant fluctuations, highlighting data dimensions with a change exceeding 3%. 2. ↗↘ are considered narrow fluctuations, highlighting data with a rise and fall within 0-3%. |

||||

Data Source: Longzhong Information

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track