[PP Daily Review] End Of Month Supply And Demand Marginal Improvement, Polypropylene Supply And Demand Game Cautiously Seeks Increase

1. Today's Summary

①, Sinopec Southwest PP Price Adjustment: Raffia decreased by 150 RMB/ton, Ningxia NX40S decreased by 150 RMB/ton, set at 7100 RMB/ton; Lanzhou 9018 decreased by 200 RMB/ton, set at 6950 RMB/ton; Sichuan Chemical 36D decreased by 70 RMB/ton, set at 6800 RMB/ton.

Today, the domestic polypropylene shutdown impact has increased by 0.60% compared to last week, reaching 19.62%. Zhejiang Petrochemical’s four-line 450,000 tons/year facility started over the weekend, with an expected increase in daily supply by 1,350 tons. The daily production proportion of yarn-grade polypropylene has increased by 1.62% compared to last week, reaching 25.52%. The main reason is the switch to yarn production at Donghua Maoming's 400,000 tons/year, Zhejiang Petrochemical's first line of 450,000 tons/year, and Donghua Ningbo's first line of 400,000 tons/year, with an expected decrease in yarn production by 3,750 tons/day.

③、(20251017-1023) The supply-demand balance in this period continues to show a tight balance, which has boosted market sentiment. In the next period, the supply-demand imbalance is expected to expand due to supply growth not meeting expectations and increased demand, which is anticipated to have a positive impact on prices.

Spot Overview

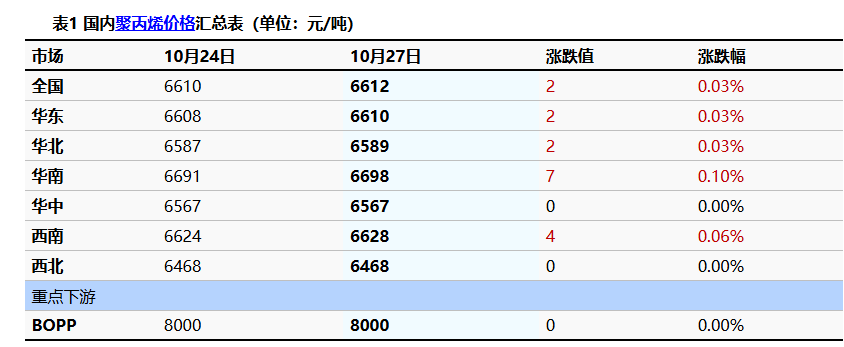

East China Sea Based on the region as a benchmark, today's polypropylene raffia closed at 6,610 yuan/ton, up 2 yuan/ton from last week. The national average price of raffia also increased by 2 yuan/ton from last week, representing a 0.03% increase, in line with the morning forecast.

Futures opened higher today and fluctuated slightly lower. In the morning, most market quotations fluctuated and consolidated, with a slight increase of 10 yuan/ton in low prices in East China. At the end of the month, market resource consumption and sellers' sales pressure eased. Intensive maintenance alleviated market supply and demand pressure. The tug-of-war between supply-demand and cost is ongoing, and the market is expected to experience weak fluctuations in the near future, with opportunities for low prices to rise. As of midday, the mainstream price of raffia in East China was between 6560-6650 yuan/ton.

|

Figure 1 Domestic Polypropylene Price Trend (Unit: Yuan/Ton) |

Figure 2 Domestic Polypropylene Prices in Various Regions (Unit: Yuan/Ton) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/1bca322d8b904a158b4bbd1ce3fe9e56.png) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/e08ee1da7aaa442b9ea3c6bec220d0ba.png) |

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3. Futures-Spot Basis

Based on the basis, today's polypropylene basis in East China is -72 yuan/ton, down 1 yuan/ton from last week; in North China, the basis is -93 yuan/ton, an increase of 8 yuan/ton from last week.

|

Figure 3 Basis Trend in North China (Unit: Yuan/Ton) |

Figure 4: Basis Trend in East China (Unit: Yuan/Ton) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/9e34843ddac2401cbc587d4b076199c1.png) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/146ecfb2ab3f4a9cb6e271b52f233214.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

4. Production Dynamics

The polypropylene capacity utilization rate increased from 76.83% yesterday to 77.05% today, an increase of 0.22%. Zhejiang Petrochemical's four-line 450,000-ton per year unit started over the weekend, with an expected daily production increase of 1,350 tons. PP profits decreased by 3.18 yuan/ton from last week to -655.1 yuan/ton.

|

Figure 5 Trend Chart of Domestic Polypropylene Production Capacity Utilization Rate |

Figure 6 Domestic Polypropylene Profit and Price Trend Chart (Unit: Yuan/Ton) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/999001c9752c4ae4b76f0fe5739e9959.png) |

![[PP日评]:月底供需边际好转 供需博弈谨慎探涨(20251027)](https://oss.plastmatch.com/zx/image/0c05a0c60b2144df9ec449dea404ce87.png) |

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

5. Market Sentiment

At the end of the month, market inventory is basically depleted, and businesses have certain expectations for the future market. However, due to the weak economic conditions this year, market supply transactions are being suppressed. As a result, businesses and factories mainly maintain a cautious approach, keeping low inventory and a fast-paced shipping strategy.

6. Price Prediction

Supply and demand marginal improvements, macro policy direction established by the Fourth Plenary Session to set economic goals, and market sentiment uplift. However, the mismatch between supply and demand in the polypropylene industry is difficult to resolve quickly. Although short-term maintenance may provide some positive momentum, it has minimal impact given the vast capacity base. Additionally, on the export front, international trade barriers restrict downstream product shipping orders, creating a bearish pressure on the domestic market. Under the intense short-term supply-demand game, the market is expected to fluctuate around 6560-6700 yuan/ton with potential upward movement opportunities.

7. Relevant Product Information

Table 2 Summary of Prices for Polypropylene Related Products (Unit: Yuan/Ton)

|

Market |

10 The 24th of the month |

10 27th of the month |

Change Value |

Change in rate |

|

Shandong Propylene |

6025 |

6025 |

0 |

0.00% |

|

Shandong Methanol |

2310 |

2330 |

20 |

0.87% |

|

Linyi PP Powder |

6510 |

6490 |

-20 |

-0.31% |

Data source: Longzhong Information

8. Data Calendar

Table 3 Overview of Domestic Polypropylene Data (Unit: 10,000 tons)

|

Data Project |

Release Date |

Previous Data |

Current trend forecast |

Unit |

|

PP Total Inventory |

Wednesday 4:30 PM |

92.53 |

↓ |

ten thousand tons |

|

PP production enterprises capacity utilization rate |

Thursday 4:30 PM |

75.94% |

↓ |

% |

|

PP Weekly Maintenance Impact Quantity |

Thursday 4:30 PM |

18.276 |

↑ |

ten thousand tons |

|

Total Production of Domestic PP Enterprises |

Thursday 4:30 PM |

77.76 |

↓ |

Ten thousand tons |

|

Profit of Oil-based PP Enterprises |

Thursday 4:30 PM |

-372 |

↓ |

CNY/ton |

|

Coal-to-PP Enterprise Profit |

Thursday 4:30 PM |

-307.87 |

↓ |

Yuan/ton |

|

PDH-based PP enterprise profits |

Thursday 4:30 PM |

-538.59 |

↑ |

Yuan/ton |

|

PP Import Profit |

Thursday 4:30 PM |

-416.01 |

↑ |

CNY/ton |

|

PP Export Profit |

Thursday 4:30 PM |

-23.38 |

↓ |

USD/ton |

|

1. Consider a significant fluctuation as a large change, highlighting data dimensions with a change exceeding 3%. 2. Consider narrow fluctuations, highlighting data with price changes within 0-3%. |

||||

Data source: Longzhong Information

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track