PP Basis Weak and Volatile: Reasons Behind and Future Trends

1. Recent Performance Overview of PP Basis

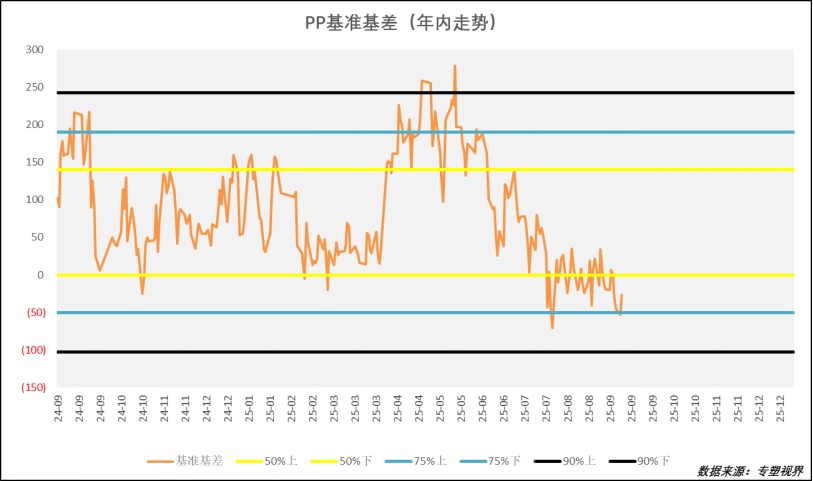

Since July 2025 to early September, the domestic polypropylene (PP) market has shown a clear pattern of weak basis. Specifically, in July, the PP basis was in a continuous narrowing trend, with the spot prices in the East China region having a larger discount compared to futures prices. Entering August, this phenomenon did not see effective improvement, and the basis remained at historically low levels, with the market's expectations for future supply-demand improvement clearly insufficient. Until early September, the PP basis showed no significant signs of strengthening, spot prices changed little, the basis slightly weakened, and the transaction situation was neutral to weak (as shown in the figure below).

This persistently weak basis pattern reflectsThe PP market is experiencing a structural contradiction of "weak reality, strong expectations." Although futures prices fluctuate significantly due to macro sentiment and future expectations, the spot market is constrained by fundamental pressures and shows a clear lack of willingness to follow the rise, resulting in the spot market consistently underperforming the futures market and the basis remaining at a low level.

Let’s summarize the above content in a table:

Characteristics of PP Basis in Early July to September 2025

2. Analysis of the Reasons for Basis Weakness

The fundamental reason for the continuous weakening of the PP basis lies in the severe imbalance between supply and demand fundamentals. On the supply side, PP is still in a capacity expansion cycle in 2025, with a total new capacity of as much as 7.1 million tons (according to Longzhong statistics). Among them, the 900,000-ton unit of CNOOC Ningbo Daxie Phase II was successfully put into operation at the end of August and early September, resulting in sustained pressure on supply.

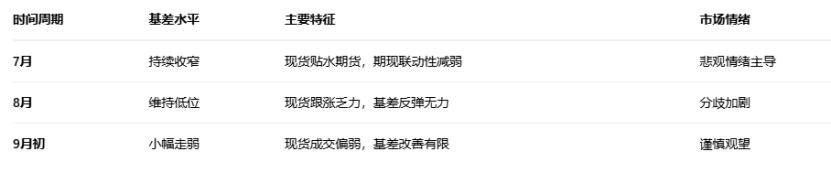

And in terms of demand,The PP market is facing the dual impact of the seasonal demand off-season in July and August and the overall weakness in traditional sectors. Specifically:

Plastics weaving industry: The operating rate dropped from 43.2% in July-August to 41.1%, mainly due to the decline in demand for cement bags and bulk bags.

BOPP Industry: The operating rate remained around 60-70% in July and August. Although there was no significant decline, orders for packaging films were noticeably low.

- PP nonwoven fabric industry: The operating rate decreased from 36.2% in July-August to 35.2%, a month-on-month decline of about 1 percentage point.

• CPP industry: The operating rate decreased from 56.38% to 54.13% between July and August.

This situation of increasing supply and decreasing demand makes it so thatThe supply and demand imbalance in the PP market is prominent, and spot prices are under significant pressure, leading to a continuous weakening of the basis.

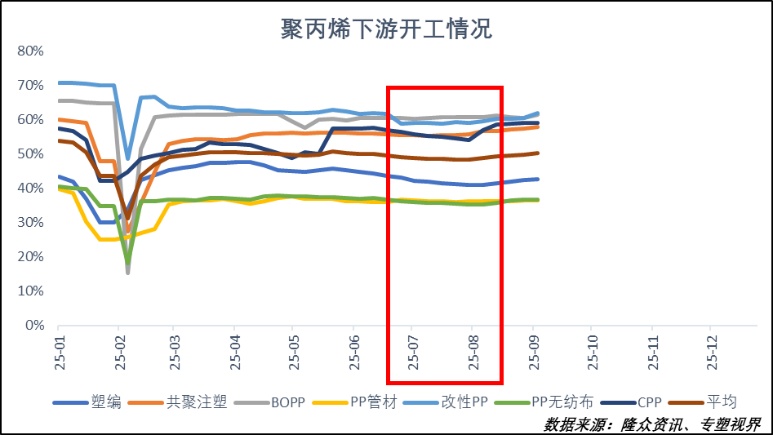

The weakening of cost-side support has further intensified.The weak pattern of the PP basis. In July and August, the crude oil center moved downward, and the coal price remained stable, leading to an overall decline in the cost line. The production profit performance of various process routes also showed differentiation. Although the profit of some routes has rebounded, the overall profitability is still poor, especially for the oil-based routes, which account for a large proportion and are still in a state of deep loss. The downward shift in the cost end has caused spot prices to lose support, and downstream acceptance of price increases is extremely low. The cost transmission mechanism has failed, further exacerbating the weak basis pattern (see the figure below).

Moreover, the macro level and market sentiment also affectThe PP basis was significantly affected. In July, macro disturbances intensified, leading to increased volatility in PP futures prices. In mid-July, driven by expectations of the "anti-involution" policy, macro sentiment propelled a rapid rise in futures prices, but spot prices did not increase correspondingly. Market sentiment was highly volatile, with futures prices strongly rising while spot prices lagged, resulting in a noticeable weakening of the basis.

This phenomenon of divergent sentiment between the futures and spot markets reflects the market's relatively optimistic expectations for the future, while being generally pessimistic about the current spot situation. This divergence between long and short positions leads to increased volatility in futures prices, while the spot market continues to be suppressed by fundamentals. As a result, the futures and spot price trends are not synchronized, and the basis remains at a low level.

3. Outlook on Future Basis Trends

In the short term,The PP basis is unlikely to show a significant strengthening. In early September, polyolefins remained in a fluctuating range, but with the arrival of the traditional "Golden September and Silver October" peak season, demand may see marginal improvement. Additionally, the recent continuous decline in propane prices and the profit recovery of PDH units provide some support to the PP cost side. In the short term, the basis is expected to stop falling and stabilize, but the upside for a rebound is limited.

In the medium term, the fourth quarter isThe traditional peak season for PP consumption is expected to gradually strengthen the basis. At the same time, the intensity of macroeconomic policy stimulus may increase, and the impact of domestic and international macroeconomic policies will gradually become apparent. These factors will all provide support for the market and promote the repair of the basis.

In the long run,By 2026, the PP market will gradually move towards a supply-demand rebalance, but it will take time for the capacity to clear. It is expected that after the supply-demand rebalance, the PP price center will be between 6800-7200 yuan/ton, and the basis level will also tend to stabilize.

For plasticizing enterprises, we recommend:

- Flexible sales planning: during periods of weak basis, appropriately reduce the proportion of spot sales and increase forward sales.

- Optimize inventory management: reduce intermediate inventory levels to avoid passive sales during periods of high stock.

- Focus on hedging opportunities: use the futures market to lock in sales prices and avoid the risk of spot price declines.

Finally, it is important to note that market risks always exist, especially with the uncertainties such as changes in global trade policies and fluctuations in oil prices potentially impacting.It may have a significant impact on the PP market. Any decisions should be based on the latest market trends and data, with risks carefully assessed.

Author: Gao Xing, Senior Market Analyst

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track