Pop mart's half-year net profit soars by 363%! from pla to faux fur fiber, these core suppliers and material technologies are worth noting

In the landscape of the trendy toy market, Pop Mart undoubtedly holds a pivotal position. Since its establishment, it has become a leader in the industry by relying on a unique business model and keen market insight, overcoming obstacles along the way.

Image of POP MART products, Image source: pexels

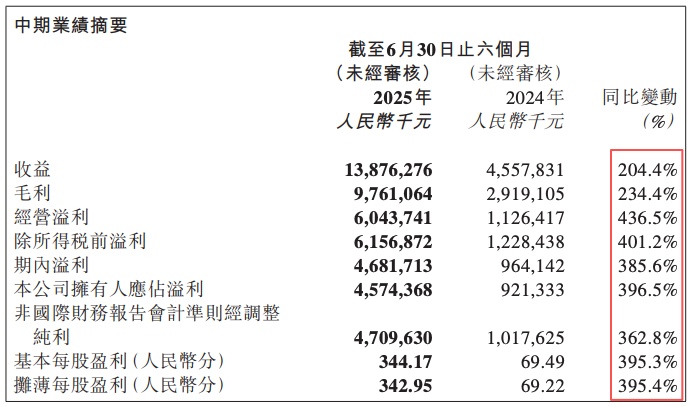

In the first half of 2025, Pop Mart delivered an impressive report card, with all key indicators achieving leapfrog growth, and both growth rates and profitability reaching new stage highs. According to Pop Mart International Group's 2025 semi-annual report, Pop Mart's revenue in the first half of the year was 13.88 billion yuan, a year-on-year increase of 204.4%; the gross profit margin increased from 64.0% in the first half of 2024 to 70.3% in the first half of 2025; and the adjusted net profit was 4.71 billion yuan, a year-on-year increase of 362.8%, surpassing the entire year of 2024!

1. Core Competence: IPComprehensive breakthrough in three dimensions: industry, product, and region.

Pop Mart's growth is not driven by a single factor, but is the result of the collaborative efforts of three core areas: IP operations, product categories, and regional markets. This has formed a development pattern of "IP as the core, diversified products, and global expansion."

1、“"One superpower, many strong powers"Stable structure, emerging IPRapid growth

IP incubation and operation have always been the core competitiveness of Pop Mart. In the first half of 2025, their IPs showcased a flourishing scenario of "one strong and many strong." The LABUBU from THE MONSTERS series shone brightly, achieving a revenue of 4.81 billion yuan, accounting for 34.7% of the total revenue, and quickly becoming one of the popular global IPs. Its unique image and design style have attracted the attention of numerous consumers worldwide, leading to a buying frenzy not only in the domestic market but also in overseas markets.

In addition to LABUBU, classic IPs such as MOLLY, SKULLPANDA, CRYBABY, and DIMOO also performed well. During the reporting period, MOLLY, SKULLPANDA, CRYBABY, and DIMOO achieved revenues of RMB 1.3572 billion, RMB 1.2205 billion, RMB 1.2182 billion, and RMB 1.1051 billion, respectively. These IPs each have unique characteristics that meet the aesthetic and emotional needs of different consumers, collectively forming a solid IP matrix for Pop Mart.

At the same time, emerging IPs like HIRONO and Xingxingren are also growing rapidly. HIRONO achieved a revenue of 730 million yuan in the first half of the year, representing a year-on-year increase of 197.0%. Xingxingren achieved a revenue of 390 million yuan, becoming one of the fastest-growing emerging IPs under its brand.

2Plush products are emerging prominently, with the category structure becoming more diverse.

In terms of product categories, there was a significant change in the first half of 2025, as the revenue share of plush products surpassed that of figurines for the first time.

In the first half of 2025, plush products achieved a revenue of 6.1392 billion RMB, representing a year-on-year increase of 1276.2% and accounting for 44.2% of total revenue. POP MART launched nearly 20 plush products for 10 IPs, covering both soft-face and hard-face designs and utilizing various sizes and materials. The upgrade of plush fabrics enriched the soft texture of the products, and different techniques were used to achieve interactive functions, transforming the singular companionship attribute of plush products and adding more playability. Meanwhile, drawing on the product experience of LABUBU vinyl plush, it used vinyl craftsmanship as a foundation, combined with spray painting techniques and fashion fabrics to showcase the characteristics of different IPs, giving them stronger vitality and recognition, thereby enhancing product competitiveness.

For example: Translate the above content into English and directly output the translation result without any explanation.

- The combination of roto-cast vinyl plush and tie-dye craftsmanship successfully creates the LABUBU "High Energy Ahead," which offers both visual appeal and tactile experience.

- SKULLPANDA "Light Weaving Garden" vividly depicts facial makeup through PVC injection molding, with movable eyes adding a more exquisite and lively touch.

- BABY MOLLY transforms into a palm-sized cat, becoming fans' "pocket friend."

- The CRYBABY "Leopard Cat" vinyl plush uses long strip small-sized plush, becoming a popular fashion item.

- PUCKY "Bean Bubbles" series plush pendant has a built-in airbag that can blow out colorful bubbles.

- The HACIPUPU "Gummy Bear" series of vinyl plush pendants combines the sweet aroma of gummy candies.

Figurine products: continue to maintain high growth, with revenue of 5.18 billion yuan (a year-on-year increase of 94.8%), accounting for 37.3% of total revenue, and remain one of the core categories.

Other categories: MEGA series revenue reached 1.01 billion yuan (a year-on-year increase of 71.8%, accounting for 7.3%), derivative products and other revenue reached 1.55 billion yuan (a year-on-year increase of 78.9%, accounting for 11.2%). A diversified layout reduces reliance on a single category.

3The implementation of the globalization strategy has been effective, and the overseas market has become a new growth engine.

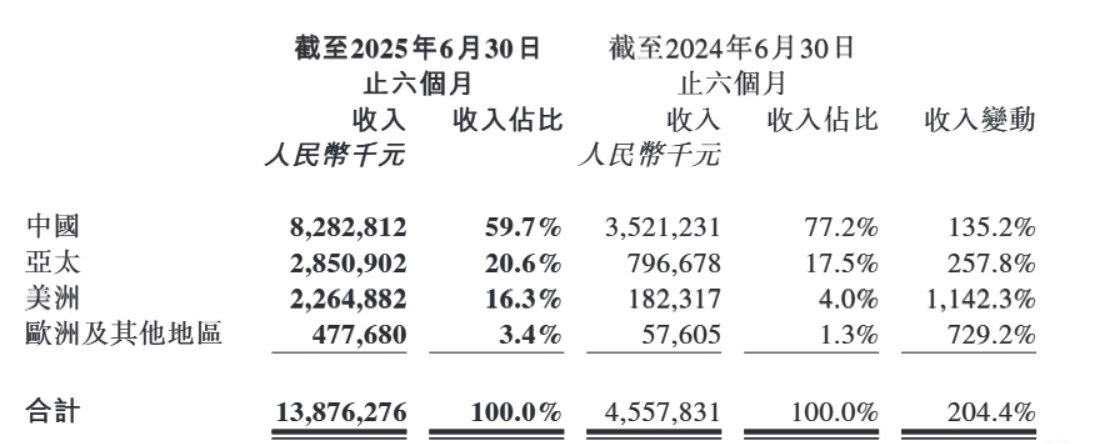

In April 2025, Pop Mart announced the launch of a global organizational restructuring, setting up regional headquarters in four major regions for the first time. According to the regional performance disclosed in the semi-annual report, this strategic adjustment has proven to be significantly effective.

Source: Pop Mart Semi-Annual Report

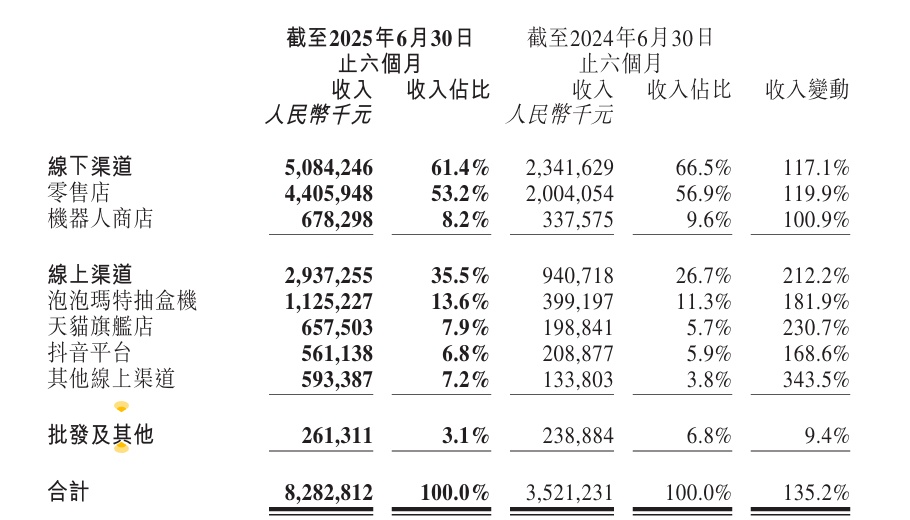

The Chinese market, as the home base of Pop Mart, continues to maintain a steady growth trend. Revenue reached 8.28 billion yuan, a year-on-year increase of 135.2%. The number of offline stores increased by 12, reaching 443 stores, with offline revenue at 5.08 billion yuan, a year-on-year increase of 117.1%. Online channels achieved revenue of 2.94 billion yuan, a year-on-year increase of 212.2%. Among them, Pop Mart's blind box machines, content e-commerce channels, and flagship stores on e-commerce platforms all achieved remarkable results. During this year's 618 shopping festival, the sales rankings on Tmall, Douyin, and JD platforms all ranked first in the industry.

Figure: Detailed breakdown of revenue by channel in the Chinese market (Source: Pop Mart Semi-Annual Report)

In the overseas market, Pop Mart has demonstrated strong expansion capabilities. Revenue in the Asia-Pacific region reached 2.85 billion yuan, a year-on-year increase of 257.8%; revenue in the Americas was 2.26 billion yuan, a year-on-year increase of 1142.3%. Focusing on the United States market, the number of offline stores increased by 19 in the first half of the year, reaching a total of 41, with offline revenue of 840 million yuan, a year-on-year increase of 744.3%. Revenue in Europe and other regions was 480 million yuan, a year-on-year increase of 729.2%. In the European market, the number of offline stores increased by 4 in the first half of the year, reaching a total of 18, with offline revenue of 280 million yuan, a year-on-year increase of 569.6%.

As of June 30, 2025, Pop Mart has opened 571 stores in 18 countries worldwide (an increase of 40 stores) and added 105 robot stores. Their official website covers 37 countries, and their self-developed app is available in 34 countries. The app once topped the shopping chart on the US App Store, and their business reaches nearly 100 countries and regions.

2. Supply Chain Analysis: Predominantly OEM Model, Core Suppliers Concentrated in the Pearl River Delta and Yangtze River Delta

Pop Mart does not have its own factories; its products are manufactured through outsourcing, with the supply chain widely distributed across multiple cities. Dongguan in Guangdong is particularly crucial, accounting for about 70% of the production capacity. In 2023, Dongguan was awarded the title of "China's Capital of Trendy Toys," with over 4,000 toy companies and nearly 1,500 supporting enterprises forming a powerful industrial cluster. Nearly a quarter of the world's anime derivatives and more than half of the trendy toys are produced here. Besides Dongguan, cities like Beijing, Hong Kong, Guangzhou, Shenzhen, Suzhou, Ningbo, Shanghai, and Shantou also play important roles in Pop Mart's supply chain.

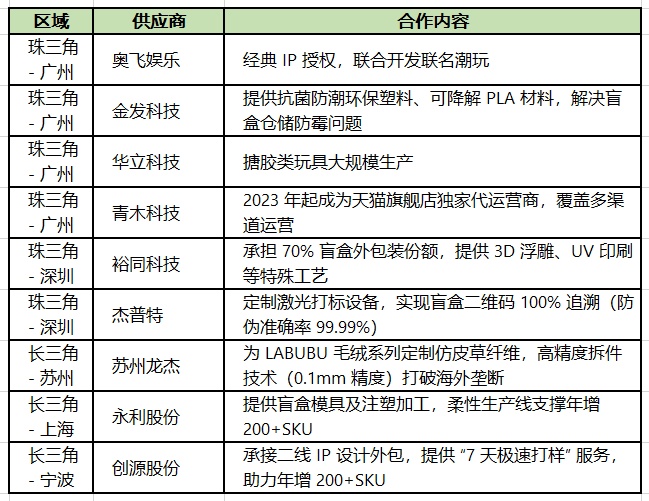

Table of Some Key Suppliers of Pop Mart (Compiled by Specialized Vision)

In the Pearl River Delta, Guangzhou has at least five core suppliers. Alpha Entertainment has authorized classic IP to Pop Mart for developing co-branded trendy toys; Kingfa Sci. & Tech. Co., Ltd, as a green supply chain partner, provides antibacterial, moisture-proof, eco-friendly plastics, and biodegradable PLA materials to solve the mold prevention issue in blind box storage; Huali Technology is responsible for large-scale production of vinyl toys; Aomu Technology has become the exclusive online operator for Pop Mart's Tmall flagship store since 2023, covering multi-channel operations. In Shenzhen, Yuto Technology holds a 70% share of Pop Mart's blind box outer packaging, providing special processes such as 3D embossing and UV printing; Jept provides customized laser marking equipment for them, achieving 100% traceability of blind box QR codes with an anti-counterfeiting accuracy rate of 99.99%.

The Yangtze River Delta region also contributes a number of core suppliers. Suzhou Longjie customizes faux fur fibers for the LABUBU plush series, breaking overseas monopolies with its high-precision dismantling technology (accuracy up to 0.1mm) and faux fur fiber production process. Shanghai Yongli Co., Ltd. provides molds and injection processing for blind box development, with flexible production lines that can quickly switch between different IP productions, supporting Pop Mart in adding over 200 SKUs annually. Ningbo Chuangyuan Co., Ltd. undertakes the outsourcing of second-tier IP design for Pop Mart, offering a "7-day rapid prototyping" service, aiding in the annual addition of over 200 SKUs.

Three, New Opportunities in the Plastic Industry: Four Key Areas Benefiting from the Growth of the Trendy Toys Industry

1. Growth in demand for eco-friendly plastics

With the rise of environmental awareness and stricter policies, the market prospects for biodegradable and eco-friendly plastics are broad. As a leading company in the designer toy industry, Pop Mart actively practices environmental concepts. Its green supply chain partner, Kingfa Sci & Tech, provides antibacterial, moisture-proof, eco-friendly plastics, and degradable PLA materials that have been applied in blind box production. As Pop Mart expands its business, the demand for such eco-friendly plastics will continue to grow. Furthermore, the entire designer toy industry and even more consumer product categories will be influenced, driving the expansion of the eco-friendly plastics market. According to Bloomberg data, the global biodegradable plastics market size is expected to grow from $10.7 billion in 2021 to $29.8 billion in 2026, with a compound annual growth rate of 22.7%.

The demand for high-end customized plastic products is prominent.

Pop Mart's products are rich and diverse, requiring diverse demands for plastic material properties and appearance effects. For instance, the LABUBU plush series demands faux fur fibers with high requirements for the realism, texture, and durability of plastic materials; blind box packaging printing requires plastic films with good printability and gloss. This prompts plastic companies to increase R&D investment to develop high-performance, customized plastic products. For example, Yutong Technology provides 3D embossing, UV printing, and other special process packaging for Pop Mart, which relies on specific plastic materials. This high-end customization trend will drive the upgrade of product structures in the plastic industry, offering opportunities for companies with strong R&D capabilities.

3. Expansion of Plastic Application Scenarios

The success of Pop Mart has significantly driven the development of the trendy toy industry and opened up new application scenarios for plastics. Beyond traditional figures and blind boxes, the rise of categories such as plush toys and derivatives has diversified the use of plastics in toy stuffing, accessory making, and packaging. As trendy toys cross over with other fields such as theme parks and catering, the application of plastics in these emerging scenarios will further expand, creating new growth opportunities for the plastics industry.

4. Opportunities for Plastic Recycling and Circular Economy

The EU Regulation on Packaging and Packaging Waste will take effect in 2025, requiring that plastic packaging products within the region contain more than 30% recycled materials by 2030. As a global enterprise, Pop Mart must comply with the relevant regulation, which will prompt it to collaborate with plastic recycling companies to promote the recycling and reuse of plastic in product packaging and components. For plastic recycling companies and plastic manufacturers involved in the circular economy, partnering with enterprises like Pop Mart will provide a competitive advantage in the market.

Pop Mart's growth has a significant driving effect on the plastics industry. Its demand for eco-friendly plastics and high-end customized plastics, along with global recycling compliance requirements, will open up four major opportunities for the plastics industry: "environmentalization, customization, scenarization, and circularization." This will propel the industry to transition from traditional manufacturing to high value-added and green transformation. Are you ready?

Editor: Lily

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track