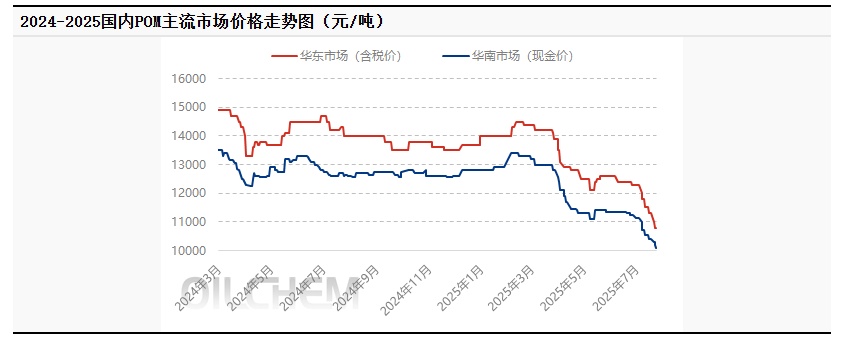

[POM Weekly Review] Domestic Material Prices Concentratedly Lowered, Market Focus Declines

1. Market Focus This Week

The ex-factory price of domestic materials has been reduced by 200-500 RMB/ton.

2) Increase in market low-price replenishment activities ;

3) Import offers continue to decline. 。

2. This Week's Market Analysis

Weekly Price Change Table of Domestic POM Market

Units: Yuan/ton

|

Market |

This week |

Last week |

Rise and Fall |

|

East China |

10800 |

11300 |

-500 |

|

Southern China |

10100 |

10400 |

-300 |

Data Source: Longzhong Information

The POM market was under pressure and declined this period. During the week, the decline in POM prices intensified across various regions. The Tianjin Bohua POM plant was shut down for maintenance. In the first half of the week, the ex-factory prices of domestic materials were collectively reduced by 200-500 yuan/ton, which dampened the sentiment of market participants. The bearish atmosphere in the market intensified, and the focus of domestic material quotations continued to decline, with mainstream grades dropping by 200-700 yuan/ton. In the latter half of the week, as POM prices fell to around the cost line, traders' willingness to restock at low prices increased, and the atmosphere for inquiries in the market became relatively active. Downstream users made small orders based on demand, and real transactions were negotiated according to quantity.

3. Market Impact Factor Analysis

1)This week, the POM market is under pressure and has declined, with mainstream grades falling by 500 yuan/ton compared to last week.

2)This week, the operating rate of China's POM industry was 92.04%, an increase of 2.15% compared to last week.

3)The average gross profit of domestic POM this week is 247 yuan/ton, down by 337 yuan/ton compared to last week.

4. Market Forecast for Next Week

The POM price is expected to rebound slightly in the next period. Key points to watch: 1. Supply side: The Tianjin Bohai Chemical POM unit will undergo a shutdown for maintenance next period. Due to the concentrated digestion of Petrochemical plant inventories, short-term support will be strengthened. 2. Demand side: During the traditional off-season demand period next time, end-user factories will maintain low operating rates. However, stimulated by market speculative buying, downstream users are likely to replenish stocks, with actual transactions following demand. 3. Cost side: Upstream raw material methanol prices have slightly rebounded, and profit margins will continue to shrink. 4. Macro aspect: It is reported that Korea Kolon has the intention to lower POM ex-factory prices, and import offers will gradually decline. Market price competition remains intense, with flexible negotiations on transactions.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track