[POM Daily Review] Limited Fundamental Support, Flexible Operations by Industry Players

1. Today's Summary

①、 Kaifeng Longyu POM plant will be shut down for maintenance on October 9, with a planned duration of about 20 days. 。

The Tianjin Bohua POM unit will be shut down for maintenance on July 7, and the startup time is not yet determined.

2 Spot Overview

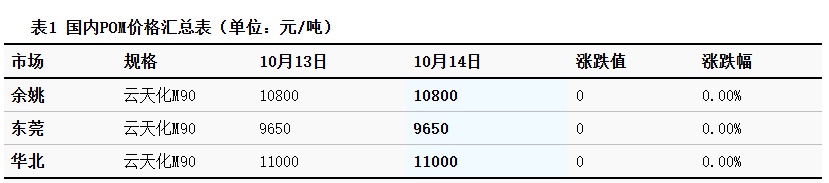

Based on the Yuyao area, today's price of Yuntianhua M90 is 10,800 yuan/ton, which is stable compared to the previous period. Today's POM market is weakly consolidating. The fundamentals are weak, market sentiment is cautious, and there are no significant fluctuations in mainstream quotations. , End-users are cautious in procurement follow-up, and buying and selling are hard to be optimistic. As of the closing, the domestic POM price in the Yuyao market is 8,100-11,100 yuan/ton including tax, and the POM cash price in the Dongguan market is 7,300-10,400 yuan/ton.

|

Figure 1 Domestic POM Price Trend Chart for 2024-2025 (Yuan/Ton) |

Figure 2 Price Trend Chart of Domestic POM by Region for 2024-2025 (Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Dynamics

This week's domestic POM capacity utilization rate is 93.09%, a decrease of 0.98% compared to last week. Tianjin Bohua's 40,000-ton/year POM plant was shut down for maintenance on July 7, Kaifeng Longyu 4 The POM unit with a capacity of 10,000 tons/year will undergo maintenance shutdown on October 9. This week's maintenance loss has increased. Methanol prices are falling, POM prices remain stable. The gross profit margin of the product continues to rise, increasing the profit space by 15 yuan per ton.

|

Figure 3: Trends in Domestic POM Capacity Utilization Rate for 2024-2025 |

Figure 4 Comparison of Domestic POM Profits and Prices for 2024-2025 (Yuan/Ton) |

![[POM日评]:现货流通承压 让利商谈(20251013)](https://oss.plastmatch.com/zx/image/1362a7eea01d4f969d8bd51cfcd410f9.png) |

![[POM日评]:现货流通承压 让利商谈(20251013)](https://oss.plastmatch.com/zx/image/7e12723d629c41d595cede35e2ca2131.png)

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

4. Price Forecast

During the week, the shipping situation in various regions was unsatisfactory, with limited guidance from petrochemical plants. Ex-factory prices remained stable, market inquiries were weak, and traders were not very motivated. There was a continued bearish sentiment in the short term, with some offers open to negotiation. End-user factories operated at low capacity, and users made sporadic restocking purchases, with transactions negotiated on a case-by-case basis.Longzhong expects the domestic POM market to stabilize in the short term.

5 Related product information:

MethanolToday, the methanol spot price index is 2170.19, up 3.02. The spot price in Taicang is 2285, down 15, and the price in Inner Mongolia's North Line is 2082.5, up 12.5. According to Longzhong's monitoring of prices in 20 major cities, four cities have experienced varying degrees of increase, with price rises ranging from 5 to 20 yuan/ton. The overall atmosphere in the domestic methanol market has weakened somewhat today, as the macro sanction situation has slightly eased. During the day, methanol futures experienced a significant drop, which has impacted the port market, leading to a noticeable shift in price focus. The basis showed strong performance initially and then weakened later in the day. Continued attention is required on the main storage areas' response plans for sanctioned vessels. The inland trading atmosphere also weakened during the day, with some enterprise auctions in production areas failing to attract bids in the afternoon, and trade turnover slightly loosening. Close monitoring of upstream inventory changes is essential.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: 10,000 tons)

|

Data |

Release Date |

Previous Data |

Current trend forecast |

|

Capacity utilization rate |

Thursday 17:00 |

93.09% |

↘ |

|

Production Profit Margin |

Thursday 17:00 |

0.90% |

↗ |

|

Data Source: Longzhong Information Note: 1. ↓↑ is regarded as significant fluctuation, highlighting data dimensions where the increase or decrease exceeds 3%. 2. ↗↘ are considered as narrow fluctuations, highlighting data with changes within the range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[POM日评]:下游复工缓慢 购销气氛平平(20251009)](https://oss.plastmatch.com/zx/image/2c8cc29969fb489dac821e92d8910251.png)

![[POM日评]:下游复工缓慢 购销气氛平平(20251009)](https://oss.plastmatch.com/zx/image/0685ade4a9b04d059730f7d157612b9f.png)