[POM Daily Review] Insufficient Fundamental Support, Market Under Pressure to Sell

1. Today's Summary

①、 Kaifeng Longyu POM unit will undergo maintenance shutdown on October 9, and Hebi Longyu POM unit will undergo maintenance shutdown on October 20. 。

The Tianjin Bohua POM unit was shut down for maintenance on July 7, and the start-up time is not yet determined.

2 Spot Overview

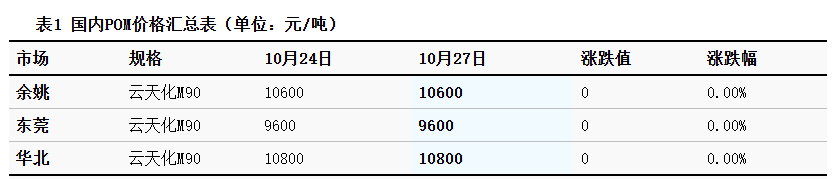

Based on the Yuyao area, the price of Yuntianhua M90 is 10,600 RMB/ton today, stable compared to the previous period. Today, the POM market remains stable with no clear guidance from the fundamentals. The shipment speed in various regions is slow, and there are no clear signs of improvement in the market. Traders' sentiment is relatively weak, and transactions are unsatisfactory. As of the close, the domestic POM price in the Yuyao market is 8,100-11,100 RMB/ton (including tax), while the cash price in the Dongguan market is 7,300-10,400 RMB/ton.

|

Figure 1: Domestic POM Price Trend Chart for 2024-2025 (Yuan/Ton) |

Figure 2 Price Trend Chart of Domestic POM by Region for 2024-2025 (Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data source: Longzhong Information |

3 Production dynamics

This week, the domestic POM capacity utilization rate is 82.00%, a decrease of 5.21% compared to last week. Tianjin Bohua's 40,000 tons/year POM unit was shut down for maintenance on July 7th, Kaifeng Longyu 4 The POM unit with a capacity of 10,000 tons/year will be shut down for maintenance on October 9. The Hebi Longyu 60,000 tons/year POM unit will be shut down for maintenance on October 20, and the loss of production due to maintenance has increased this week. This week's POM production cost adjustment. The product's gross profit margin slightly increased, with the profit margin rising by 12 yuan per ton.

|

Figure 3 Trend of Domestic POM Capacity Utilization Rate from 2024 to 2025 |

Figure 4 Comparison of Domestic POM Profit and Price for 2024-2025 (CNY/ton) |

![[POM日评]:基本面支撑不足 市场承压出货(20251027)](https://oss.plastmatch.com/zx/image/2ffd6970602f4224853d31a97c550339.png) |

![[POM日评]:基本面支撑不足 市场承压出货(20251027)](https://oss.plastmatch.com/zx/image/e60a8ff11fb548318fd764c6949435ef.png)

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

4. Price Prediction

At the beginning of the week, shipments in various regions showed no significant improvement, with the supply side remaining weak. Some petrochemical plants have low inventory levels, suggesting no immediate downward trend. However, market inquiries are relatively inactive, increasing the pressure on traders to sell. Some offers have room for negotiation, as end-user factories are operating below capacity and have little intention to restock, with actual transactions being negotiated based on quantity. Longzhong predicts that the domestic POM market will be weak in the short term.

5 Relevant product information:

MethanolToday's methanol spot price index is 2124.67, down 5.29. The spot price in Taicang is 2230, down 10, while the price in Inner Mongolia's northern line is 2037.5, down 2.5. According to Longzhong's monitoring of prices in 20 major cities, 13 cities have experienced varying degrees of decline, with price drops ranging from 2.5 to 30 yuan/ton. On Monday, the domestic methanol market showed an overall weak and fluctuating performance. In addition to the weak transmission from the futures market, recent rapid declines in downstream related product prices have significantly squeezed the economics of MTO, and some projects face the risk of shutdown in November. Coupled with the expectation of relatively ample domestic and imported supplies, the supply-demand situation for methanol is weakening, which may suppress the overall market's willingness to hold inventory. Today's methanol port focus has slightly declined, and the basis has weakened significantly; some auctions in domestic production areas have faced failures. Close attention should be paid to the overall shipping rhythm in domestic production areas.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: Ten Thousand Tons)

|

Data |

Release date |

Previous Data |

The trend forecast for this period |

|

Capacity Utilization Rate |

Thursday 17:00 |

82.00% |

↘ |

|

Production profit margin |

Thursday 17:00 |

1.09% |

↘ |

|

Data Source: Longzhong Information Note: 1. ↓↑ is regarded as significant fluctuation, highlighting data dimensions with a change exceeding 3%. 2. Consider narrow fluctuations as those with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[POM日评]:基本面支撑不足 市场承压出货(20251027)](https://oss.plastmatch.com/zx/image/4b5b30374d5948969215bec8e3cfb061.png)

![[POM日评]:基本面支撑不足 市场承压出货(20251027)](https://oss.plastmatch.com/zx/image/8a3c577d6b01429f8306611c2fec134b.png)