[POM Daily Review] Factory Prices Adjusted Downward, Quotation Focus Declines

1. Today's Summary

Some POM manufacturers have reduced their ex-factory prices by 500 yuan per ton.

Market sentiment is becoming more cautious, and traders are offering discounts to operate.

2Spot Overview

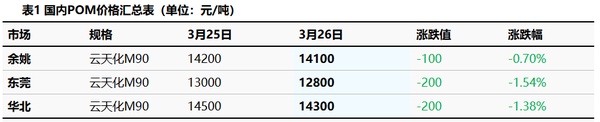

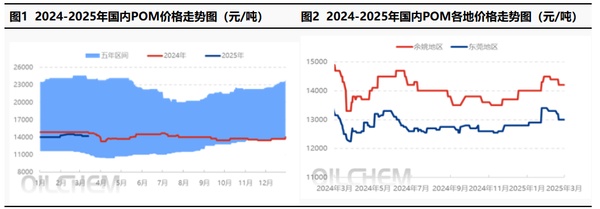

Based on the Yuyao area, today's price for Yun Tianhua M90 is 14,100 yuan/ton, with a decrease of 100 yuan/ton.Today, the POM market is showing a downward trend. Some POM manufacturers have reduced their ex-factory prices by 500 yuan/ton, which has put pressure on market sentiment. Traders continue to offer discounts, with mainstream quotations dropping by 100-400 yuan/ton. Downstream buyers are adopting a cautious wait-and-see attitude, leading to a lackluster purchasing atmosphere. The main quotation range is running between 10,500 and 14,400 yuan/ton.

3Production dynamics

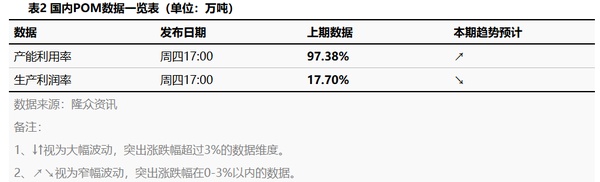

This week, the domestic POM capacity utilization rate remained at 96.99%. All manufacturers' POM facilities are operating at full capacity. With the decline in methanol prices and stable POM prices, the gross profit margin of the product has increased, with a profit increase of about 9 yuan per ton.

4. Price Prediction

The POM petrochemical plant is facing significant shipping pressure, and there is little short-term fundamental support. Additionally, there is no noticeable improvement in demand orders, and the market inquiry atmosphere is relatively weak. Traders are lacking in operational motivation, and some quoted prices may continue to decline. Downstream purchasing enthusiasm is low, with sporadic real transactions. Longzhong Information predicts that the domestic POM market will experience a slight downward trend in the short term.

5Related product information

:Today, the methanol spot price index is 2363.69, down 14.34. The spot price in Taicang is 2670, down 7, and the price in Inner Mongolia's North Line is 2215, down 20. According to Longzhong's monitoring of prices in 20 major cities, 12 cities have experienced varying degrees of decline, with a drop of 2.5 to 30 yuan per ton. Today, the northwest...The market is slightly lower, with futures continuing to show weakness and the atmosphere for spot trading turning muted. Some inventory-pressured companies are offering discounts to sell, and there is decent buying interest for replenishing stocks at lower prices, but traders' holding mentality has weakened, leading to further price reductions. In the afternoon, some inquiries for external procurement of olefins spurred slight price increases in certain companies' auctions, but the overall market boost is limited. Currently, although there is support from maintenance on the supply side, inventory pressure varies among different companies, while the demand side mainly focuses on just-in-time procurement, still lacking supportive momentum.

6Data Calendar

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track