[POM Daily Review] Demand Performance Flat, Industry Players Cautiously Bearish

1. Today's Summary

①、 Kaifeng Longyu POM unit shut down for maintenance on October 9th. 。

②. Tianjin Bohua's POM plant was shut down for maintenance on July 7, and the restart date is yet to be determined.

2 Spot Overview

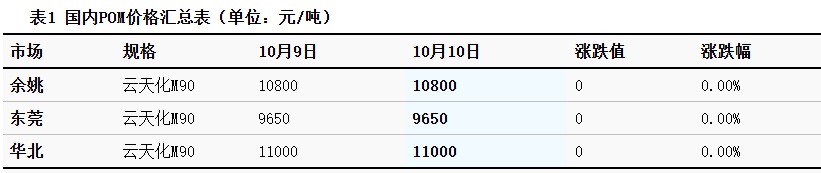

Based on the Yuyao region, today's price for Yuntianhua M90 is 10,800 yuan/ton, stable compared to the previous period. Today, the POM market is narrowly consolidating. The spot circulation is slow, and the pressure on petrochemical plants to sell is difficult to alleviate, leading some manufacturers to reduce their ex-factory prices. , Market inquiry behavior is relatively low. Traders' bearish sentiment increases. , The market was sluggish. By the close, the tax-inclusive price of domestic POM in the Yuyao market was 8,100-11,100 yuan/ton, and the cash price of POM in the Dongguan market was 7,300-10,400 yuan/ton.

|

Figure 1: Domestic POM Price Trend Chart for 2024-2025 (Yuan/ton) |

Figure 2: 2024-2025 Domestic POM Regional Price Trend Chart (Yuan/Ton) |

|

|

|

|

Data source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

This week, the domestic POM capacity utilization rate is 94.06%, an increase of 7.31% compared to last week. Tianjin Bohua's 40,000 tons/year POM unit will be shut down for maintenance on July 7, and Kaifeng Longyu. The POM unit with a capacity of 10,000 tons/year will be shut down for maintenance on October 9th. This week's maintenance loss has decreased. Methanol prices are declining, while POM prices remain stable. As a result, the product's gross profit margin increased, and the profit margin increased by 27 yuan per ton.

|

Figure 3 Trend of Domestic POM Capacity Utilization Rate for 2024-2025 |

Figure 4 Comparison of Domestic POM Profits and Prices for 2024-2025 (Yuan/Ton) |

![[POM日评]:下游复工缓慢 购销气氛平平(20251009)](https://oss.plastmatch.com/zx/image/67ba3175d55245fca8fae96ca2351a12.png) |

![[POM日评]:市场走货缓慢 商谈空间灵活(20250922)](https://oss.plastmatch.com/zx/image/2d83599574ee4cb1ba83c32b191c455f.png)

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

4. Price Forecast

After the holiday, there is no favorable support for the fundamentals. Due to high inventory accumulation, some manufacturers are reportedly considering price reductions, increasing market pressure for sales. Traders are gradually lowering their quoted prices, while end-user demand is recovering slowly. Factory operating rates remain low, and given the ample pre-holiday stockpiling, user purchasing enthusiasm is lacking. Actual transactions are negotiated on a case-by-case basis.Longzhong expects that the domestic POM market will undergo weak adjustments in the short term.

5 Relevant product information:

Methanol:Today's methanol spot price index is 2155.07, down by 3.64. The Taicang spot price is 2225, up by 12, while the Inner Mongolia northern line price is 2077.5, down by 5. According to Longzhong's monitoring of prices in 20 large and medium-sized cities, 6 cities experienced varying degrees of decline, with a drop ranging from 2 to 40 yuan/ton. Today's domestic methanol market showed differentiated performance. The port prices slightly increased in the afternoon following the market rebound, and the buying interest improved slightly due to the sanctioned ship incident, with a slightly stronger basis. The impact and duration of this incident should be closely watched. The inland market was relatively weak; although some olefins in Inner Mongolia still have external procurement incentives, the overall decline in the eastern market was significant. Downstream buyers in northern Shandong continued to press prices for procurement, and overall market sentiment was weak. Most upstream factories focused on actively reducing prices to sell goods. Attention should be paid to how the restoration of low freight rates will impact the upstream and downstream markets.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: 10,000 tons)

|

Data |

Release date |

Last period data |

Current Trend Forecast |

|

Capacity utilization rate |

Thursday 17:00 |

94.06% |

↘ |

|

Production Profit Margin |

Thursday 17:00 |

0.54% |

↗ |

|

Source of Data: Longzhong Information Remarks: 1. Significant fluctuations are considered when there is a large increase or decrease, highlighting data dimensions with a change exceeding 3%. 2. Consider narrow fluctuations as those with price changes within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[POM日评]:下游复工缓慢 购销气氛平平(20251009)](https://oss.plastmatch.com/zx/image/06ceba0904fa4c2e8f0d286e16fdd3a6.png)

![[POM日评]:下游复工缓慢 购销气氛平平(20251009)](https://oss.plastmatch.com/zx/image/7ccf08fda34d4fbeb481f1c75a4074cd.png)