Polypropylene | Regional price spread narrows, industry competition intensifies

Changes in supply and demand patterns have narrowed regional price differences.

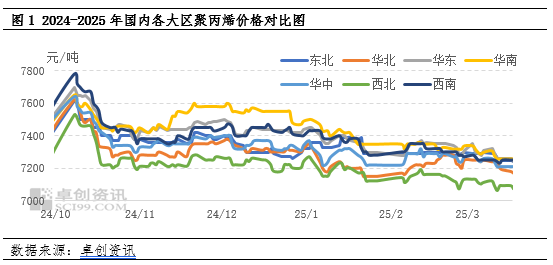

In March, the domestic PP market has shown weakness, with the price center moving downward and regional price spreads narrowing. According to data from Zhucu Information, apart from Northwest and North China regions where low-priced PP granular material still has a significant advantage, the price gap of low-priced PP granular material in other regions has narrowed. As of now, the price of low-priced PP granular material in the Northwest region is around 7,070 yuan per ton, while in the North China region it is around 7,170 yuan per ton. Other regions' low-priced PP granular material mostly ranges between 7,210-7,260 yuan per ton. The domestic PP prices are gradually becoming more consistent, which further increases the resistance to the outflow of resources within the region and intensifies the competitive landscape within the region.

Capacity base expands, regional production increases.

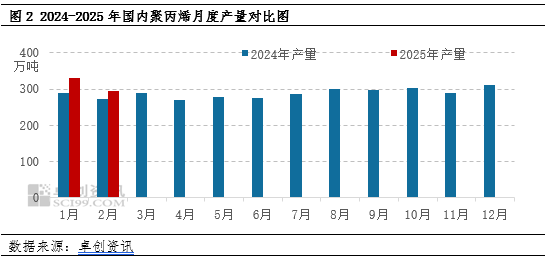

Against the backdrop of continuously increasing PP capacity at home, the supply volumes in various regions have all seen different degrees of increase, further intensifying the competitive landscape among regions. According to data from ZhuCE Info, in recent years, apart from the Southwest region, the production capacities in other domestic regions have all experienced varying degrees of growth. Among these, the North China, South China, and East China regions have seen particularly significant increases in production capacity. The expansion of production capacities across various regions has laid the groundwork for an increase in supply (the Southwest region mainly relies on nearby supplies from the Northwest region). As of now, China's total PP capacity has reached 44.32 million tons, with a notable increase in supply volume across various regions. In January and February 2025, the cumulative production of PP was 6.2376 million tons, an increase of 11.34% compared to the same period last year, with production in all regions being higher than the previous year. The relatively rapid increase in regional supply has also become a major factor driving downward pressure on regional prices.

Demand performance is weak, and regional competition is intensifying.

The poor demand performance has become a key factor driving the convergence of prices across different regions in the country. Entering March, which is traditionally the peak season for demand, the overall performance of PP (polypropylene) demand this year has fallen short of expectations. Affected by fluctuations in the international environment and domestic consumption downgrade, new orders from downstream sectors since the beginning of 2025 have been less than in previous years, with a slower procurement pace and weaker demand performance. Additionally, pre-sale货源提前点价导致需求被前置消耗,使得各大区现货资源消耗放缓。与此同时,各地区供应量呈现增长态势,在供需压力下,企业优先消化区域内需求,进一步加剧了区域内的竞争格局,这也是各大区拉丝价格趋向一致的关键因素。

Gross margins vary, and future supply will still face pressure.

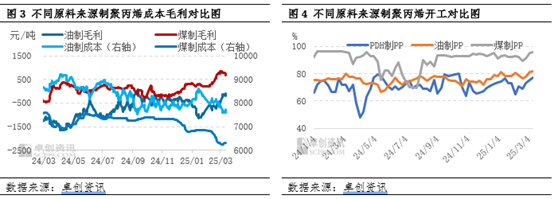

In the later stage, despite the basic fundamentals putting pressure on PP prices and leading to negative industry profit levels, some companies, especially those using coal-based production, still maintain relatively substantial profits and are actively producing. According to data from Zhushuang Information, as of now, most domestic PP enterprises across different raw material sources are experiencing gross profit losses. Specifically, oil-based PP is experiencing a loss of around 200 yuan per ton, PDH-based PP is facing a loss of approximately 400 yuan per ton, and both externally purchased propylene and externally purchased methanol-based PP are also suffering from losses. However, coal-based PP enterprises continue to maintain a gross profit margin of around 700 yuan per ton, which further boosts their production enthusiasm.

The operating load of coal-based PP has remained at a high level above 85%. Compared to this, the operating loads of PDH and oil-based PP are relatively lower. Especially for PDH-based PP producers, affected by the high prices of propane and low valuations of PP, some companies have reduced production loads, and there are also plans for some companies to undergo planned shutdowns for maintenance, resulting in generally lower operating loads for these facilities.

Overall, the short-term supply of PP is relatively limited due to maintenance of production units, and the supply in various regions is leaning towards abundance. However, April is a concentrated maintenance season for PP units, with several plants such as Qingdao Jineng Phase II, Jinan Refinery, and China National Chemical Corporation Tianjin planning to undergo lengthy maintenance. This is expected to further alleviate the pressure on the supply side.

Looking ahead, as the expectations for supply pressures gradually decrease, demand becomes the key influencing factor. In the short term, downstream recovery is relatively slow, but with the efforts of a large demand group, there are still positive expectations for downstream sectors such as daily necessities, packaging, and milk tea cups. Additionally, the domestic "old-for-new" policy will further boost domestic PP demand, along with the continued strength of PP exports. It is expected that the overall supply-demand pattern in the market will improve, gradually strengthening market support. The differences in supply and demand among various regions will once again lead to varying fluctuations in South China, North China, and East China, causing the price differences among these regions to widen again.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track