Polypropylene (PP) Faces Downward Pressure as Peak Season Demand Falls Short of Expectations

Summary

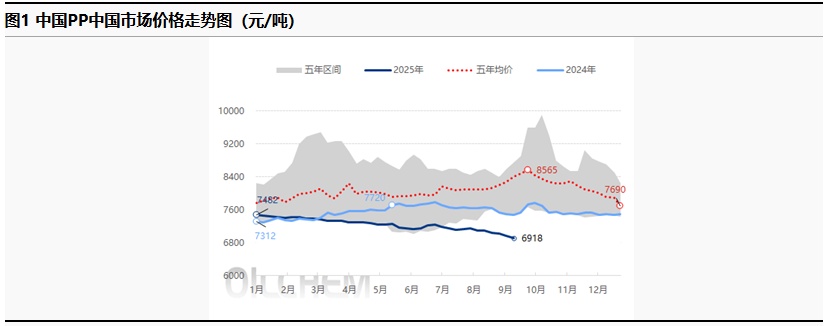

This week, the polypropylene market continued to fluctuate at low levels. The weak reality of the near-term situation remains unchanged, and downstream demand is slowly resuming operations. The peak season expectations are limiting the extent of the decline, with the market average price dropping by 44 yuan/ton. On the spot market, rumors on Friday suggested that anti-overcompetition policies for nine major industries would be introduced over the weekend, leading to a rebound in commodity prices. The polypropylene market saw a slight increase, but with crude oil prices falling again, the spot market continued to decline under pressure from the supply side. Recent downstream orders have not improved as expected, limiting the overall rebound of PP. In the short term, the market lacks upward momentum and is expected to maintain a weakening trend.

Recent focus points in the polypropylene market:

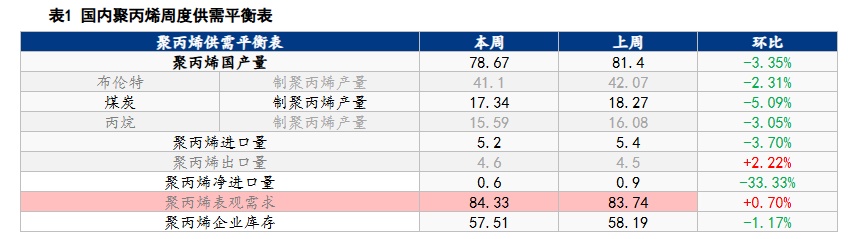

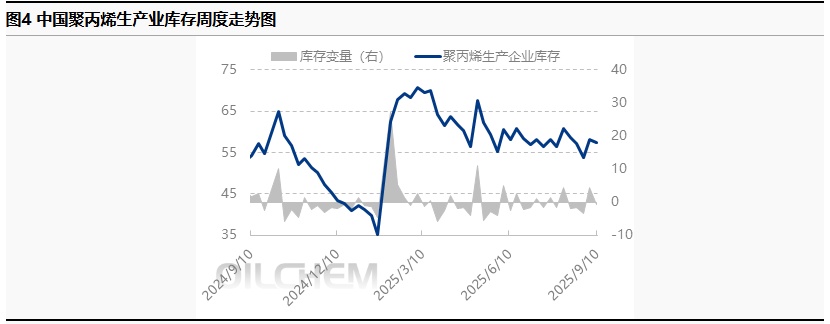

As of 2025 Year 9 Month 10 On [date], the total commercial inventory of polypropylene in China was 83.66 10,000 tons, increased compared to the previous period. 0.32 Ten thousand tons, a month-on-month increase. 0.39% Total inventory of manufacturing enterprises month-on-month -1.17% Sample trader inventory month-on-month +4.99% Sample port warehouse inventory month-on-month +0.68% In terms of inventory by variety, the inventory of wire drawing grade is expected to increase month-on-month. +4.98% Fiber-grade inventory month-on-month +8.31% 。

This week's domestic polypropylene production is 786,700 tons, a decrease of 27,300 tons compared to last week's 814,000 tons, a decline of 3.35%. Compared to the same period last year, which was 692,700 tons, there is an increase of 94,000 tons, a rise of 13.57%. During the week, the shutdown of facilities such as Huizhou Lituo, Daqing Refining & Chemical, and Donghua Energy (Zhangjiagang) led to an unexpectedly high loss in polypropylene production, resulting in a pullback from high production levels.

As of September 11, 2025, the domestic polypropylene plant's weekly loss amounted to 230,980 tons, an increase of 12.61% compared to the previous week. Among this, the maintenance loss was 166,440 tons, up by 19.49% from the previous week, while the reduced load loss was 64,540 tons, down by 1.95% from the previous week. This week, as the traditional peak season arrives, the downstream demand did not materialize as expected. The willingness of petrochemical production enterprises to conduct maintenance has increased, with equipment maintenance losses rising significantly due to a combination of unscheduled and planned maintenance.

1. Weak performance on the demand side puts downward pressure on polypropylene prices during the peak season.

This week, the polypropylene market continued to fluctuate at low levels, with the near-term weak reality difficult to change. Downstream demand is slowly recovering, and expectations for the peak season are limiting the extent of the decline, resulting in an average market price drop of 44 yuan/ton. On the spot market, news on Friday indicated that nine major industries would introduce policies related to anti-involution over the weekend, leading to a rebound in commodity futures, with a slight increase in polypropylene futures. However, the decline in crude oil prices has weakened the market again, and spot prices continue to decline under pressure from supply. Recently, downstream orders have not improved as expected, limiting the overall rebound of PP, and in the short term, the futures market lacks upward drivers, maintaining a weak trend.

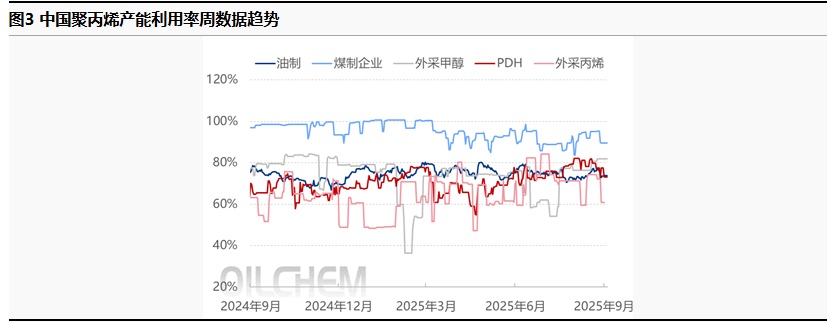

2. SubtractionRepair losses surged, and capacity utilization rate declined month-on-month.

Forecast: The average polypropylene capacity utilization rate for this period (September 5, 2025 - September 11, 2025) is expected to decrease by 3.08 percentage points week-on-week to 76.83%. Sinopec's capacity utilization rate is expected to increase by 1.21% week-on-week to 84.86%. There are no shutdown or startup fluctuations in Sinopec's facilities during the week, resulting in a slight increase in capacity utilization. Shutdowns at facilities such as Daqing Refining & Chemical and Donghua Energy (Zhangjiagang) have caused a decline in the average polypropylene capacity utilization rate.

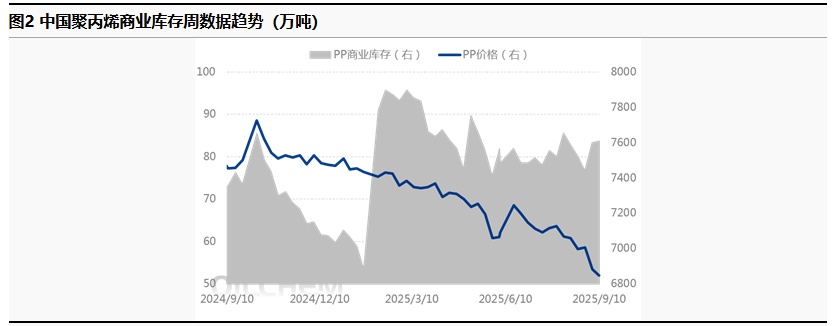

As of September 10, 2025, the total commercial inventory of polypropylene in China stands at 836,600 tons, an increase of 3,200 tons from the previous period, representing a 0.39% rise. The new facility from the second phase of CNOOC Daxie has been introduced to the market, increasing supply pressure. Upstream petrochemical inventories are actively being transferred to intermediaries, leading to a slight decrease in inventories at production enterprises within the week. The anticipated peak season has yet to materialize, causing slow digestion of inventories by traders, resulting in accumulation. Overseas market demand remains weak, with little willingness to take over, leading to sluggish export transactions during the period. Coupled with the arrival of some imported resources, the port inventory showed an accumulation trend this cycle. Overall, the total commercial inventory increased this week.

2 、 The number of parking devices is increasing. The capacity utilization rate of polypropylene has decreased.

The average polypropylene capacity utilization rate for this period decreased by 3.08 percentage points week-on-week to 76.83%. Sinopec’s capacity utilization rate increased by 1.21% week-on-week to 84.86%. There were no shutdowns or startups of Sinopec units during the week, resulting in a slight increase in capacity utilization. Shutdowns at units such as Daqing Refining & Chemical and Donghua Energy (Zhangjiagang) led to the decline in the average polypropylene capacity utilization rate.

Table 2 Weekly Production of Polypropylene in Domestic Regions

3 The peak season boosts market sentiment, leading to a decrease in inventory for production enterprises.

As of September 10, 2025, the inventory of polypropylene producers in China stood at 575,100 tons, down by 6,800 tons from the previous period, a decrease of 1.17% on a week-on-week basis. After entering September, downstream demand has slowly recovered, leading to some rigid consumption of resources. The launch of the new CNOOC Daxie Phase II facility has increased supply pressure. Upstream petrochemical inventories are actively being transferred to intermediaries, resulting in a slight decline in producers' inventories during the week.

Sure! Please provide the content you would like me to translate. Downstream operations are recovering slowly. Mainstream order follow-up is limited.

Prediction:During this period, the average operating rate of downstream polypropylene industries showed an overall upward trend, with significant increases observed in CPP and PP non-woven fabrics.

Boosted by the Mid-Autumn Festival and National Day holidays, orders for terminal food packaging such as mooncakes and rice have increased, leading to a rise in demand for CPP and BOPP. In the PP non-woven fabric sector, with the weather cooling down, there is a significant increase in demand for medical and hygiene fabrics like diapers and surgical packs, providing clear support for industry operations. As the hot and rainy weather has passed, construction projects are gradually resuming, leading to a slight increase in demand for PP pipes and cement bags. Coupled with a rebound in industrial and agricultural activities, the consumption of bulk bags and fertilizer bags has also increased, causing a slight rebound in the operations of industries such as PP pipes and woven plastic. With the accelerated promotion of green, smart, and healthy home appliances, along with the "trade-in" policy, market demand in the home appliance industry is further unleashed, driving up operations in the daily injection molding and modified PP industries. Supported by the traditional peak demand season, it is expected that the operational trend of the polypropylene products industry will continue to rise next week.

Downstream mainstream order follow-up is limited, and market prices are steadily declining.

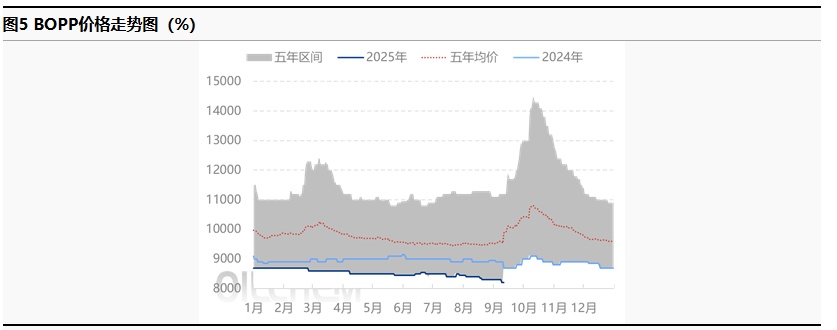

This week's BOPP prices have remained stable with a slight downward trend. As of September 11, the mainstream ex-factory prices for thick light film in East China are between 8200-8450 yuan/ton, a decrease of 1.20% compared to the previous period. With a slight increase in crude oil prices and PP futures experiencing fluctuations across various ranges, the spot market has mostly seen stable adjustments of 10-50 yuan/ton, while petrochemical ex-factory prices have largely remained stable. The cost support is weak, leading to a partial decrease in film company ex-factory prices by 50-100 yuan/ton, with mainstream market prices also falling by 50-100 yuan/ton. As the BOPP demand side enters its traditional peak season, despite the weak trend in costs and film prices, downstream sectors, driven by upcoming traditional holidays and e-commerce, are moderately following up with orders and restocking. However, overall restocking is limited due to the anticipated new supply in the market. The prices of raw materials and films are also trending weakly, mostly maintained by small orders, while downstream cooperation in receiving goods is improving, resulting in a slight decrease in film company finished product inventories. Traders are mostly offering discounts to promote orders, with high prices being difficult to negotiate, affecting transaction conditions. In the future, with the release of new production capacities in the market and potential increases in overseas demand, the short-term film price trend may remain stable with adjustments.

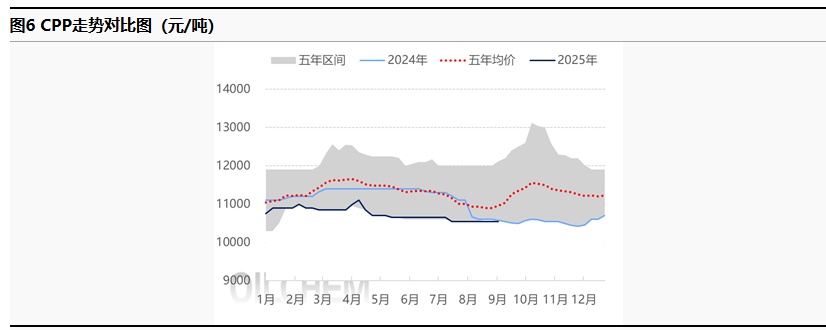

In this period, the price of low-temperature composite film in East China remained stable, and market sentiment was still cautious. PP futures saw a narrow decline, and the polypropylene raw material market was mainly quoted at an organized level, with overall price changes being minimal, providing limited support for CPP. According to research, the dual festivals of Mid-Autumn and National Day boosted demand, with terminal food packaging orders, such as for mooncakes and rice, increasing, thereby raising demand for CPP. Medium and large enterprises have orders for about 8-15 days, while small enterprises mostly take sporadic orders. Film enterprises' operating loads have steadily increased, and inventory within the market is being actively digested, with the overall supply-demand pattern still in a phase of gradual adjustment. It is expected that the peak season atmosphere will become increasingly strong in the future, with a continued positive outlook for the CPP market, and prices are likely to mainly fluctuate and consolidate.

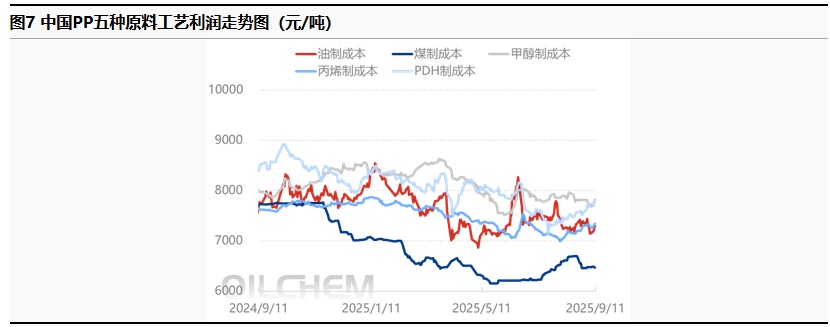

4. Weak downstream order performance puts pressure on market profitability.

In this period, the production margin of coal-based PP showed a profit, while the production margins of PP from other sources were all in a loss state.Looking ahead to the next period, the crude oil market sees OPEC+ maintaining its production increase stance in October, heightening the risk of oversupply. With the traditional peak season for fuel ending, the supply-demand balance is currently skewed towards oversupply. Coupled with the geopolitical situation being unlikely to intensify, international oil prices are expected to decline next week, and oil-based PP profits are anticipated to recover. As for the thermal coal market, traders currently have expectations for winter storage coal, with some firm price quotes. However, terminal demand has not significantly increased, suggesting that coal prices may experience narrow fluctuations in the short term, and coal-based PP profits are expected to narrow slightly next week.

For this period, looking at the profit by polypropylene product category in China: the average weekly profit for raffia-grade PP was -322.17 yuan/ton, up 67.84 yuan/ton from the previous period, an increase of 17.39%; the average weekly profit for impact copolymer PP was -106.05 yuan/ton, a week-on-week increase of 53.89%; and the average weekly profit for transparent PP was 37 yuan/ton, a week-on-week increase of 37.04%.

V. Translate the above content into English, and output the translation directly without any explanation. Intensified supply-demand cost competition Polypropylene Deadlock Seeks New Solution

Supply: Maintenance loss volume increases, supply pressure eases.

This week, the shutdown of facilities such as Huizhou Litop, Daqing Refining & Chemical, and Donghua Energy (Zhangjiagang) led to an unexpected increase in the loss of polypropylene production, causing a decline from high production levels. This week's domestic polypropylene production is 786,700 tons, a decrease of 27,300 tons from last week's 814,000 tons, a drop of 3.35%. Compared to the same period last year, which was 692,700 tons, there is an increase of 94,000 tons, a rise of 13.57%.

Demand: Downstream demand is recovering slowly, and operating rates are rising gradually.

Demand recovery is slow, but it is the traditional peak season of September and October. The demand side is gradually recovering, and orders are showing signs of warming. Plastic weaving companies have a fair level of purchasing enthusiasm.

Cost: There is room for flexibility on the cost side.

The cost side continues to show a loosening trend. In terms of crude oil, OPEC+10 maintains its production increase policy, and the seasonal favorable factors supporting oil prices are weakening, leading to an increased risk of oversupply.

Conclusion (Short-term) : The polypropylene market is expected to have a slight rebound opportunity from low levels in the next period, as demand continues to recover during the peak season.Key Focus: 1. Some maintenance units will be shut down this weekend, with maintenance losses likely to impact next week, leading to a potential increase in losses next week. The increase in supply has pushed PP production capacity to a new high, and supply pressure remains. 2. Demand is slowly recovering during the traditional peak season of September and October, with demand gradually rebounding and orders showing signs of improvement. The purchasing enthusiasm of plastic weaving enterprises is relatively positive. 3. The cost side continues to ease, with OPEC+10 maintaining a production increase policy, coupled with seasonal favorable factors weakening support for oil prices, increasing the risk of oversupply. The main market in East China is at 6750-7000 yuan/ton for wire drawing.

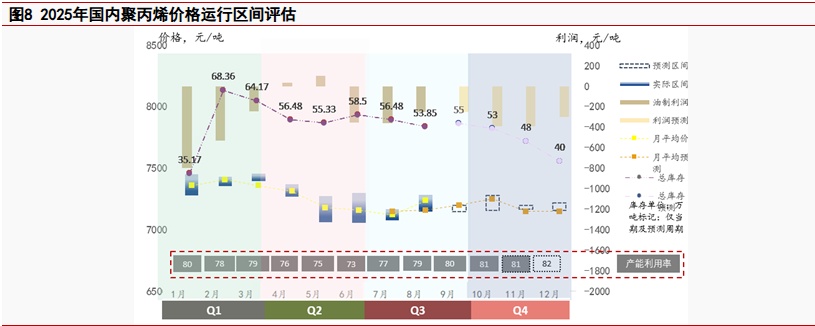

Conclusion (Medium to Long Term):The incremental increase on the supply side is becoming increasingly apparent, with production releases concentrated in early to mid-September. On the demand side, mainstream order follow-ups are not obvious; although there is some weak recovery in certain areas, both domestic demand and foreign trade are under pressure due to the sluggish global economy. The market is seeking more guidance from external macro factors. Market expectations are for the Federal Reserve to cut interest rates twice in September, which may enhance market liquidity. However, with the pressure of RMB appreciation becoming evident, export pressure will intensify. This presents mixed implications for polypropylene. The intense struggle and competition between supply and demand suggest that the market will show a trend of initial weakness followed by a gradual recovery in September. East China drawn yarn prices are expected to trade around 6,800-7,100 RMB/ton. Key focus should be on variables in foreign trade export orders, changes in cost factors, and the situation of new capacity expansion and volume release.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track